Reducing fit-out costs when refurbishing your hotel function centre - BMT Tax Depreciation

Contact

Reducing fit-out costs when refurbishing your hotel function centre - BMT Tax Depreciation

With the end of year approaching, hoteliers might be considering upgrading or renovating a function centre - it’s important to be aware of their tax entitlements, including property depreciation.

As the end of the year approaches, hotel function centres will soon be fully booked with corporate events, formals and festive celebrations.

If hoteliers are considering upgrading or renovating a function centre before the busy period, it’s important for them to be aware of their tax entitlements, including property depreciation.

Depreciation is generally the second biggest tax deduction after interest, though it’s often missed by commercial property owners and tenants. This is because it’s a non-cash deduction, meaning you don’t have to spend money to be eligible to claim it.

As a building gets older and items within it wear out, they depreciate in value. The Australian Taxation Office (ATO) allows owners of income producing property, including hotels, to claim deductions related to the building’s structure as well as the plant and equipment items contained within the property.

When depreciation is being applied to plant and equipment items it can become complicated as both owners and tenants are entitled to claim deductions simultaneously.

In any commercial property, the owner of the building can claim capital works, the plant and equipment items they own and any fit-out they purchase or install. Tenants can also claim any fit-out they install within the building once their lease has commenced.

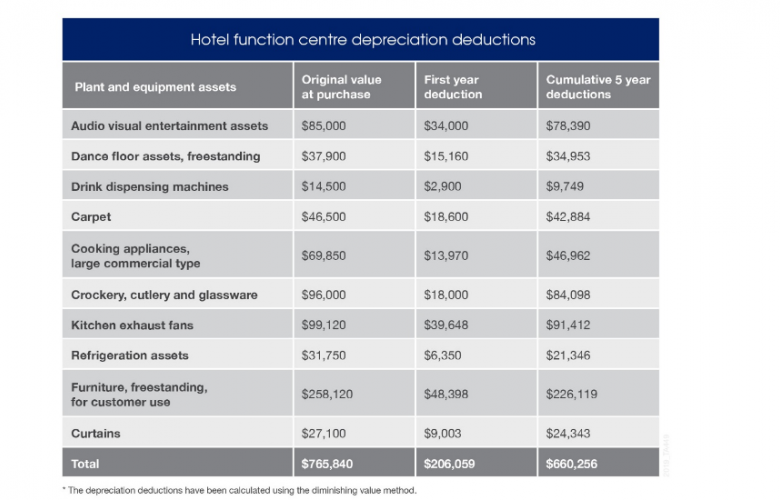

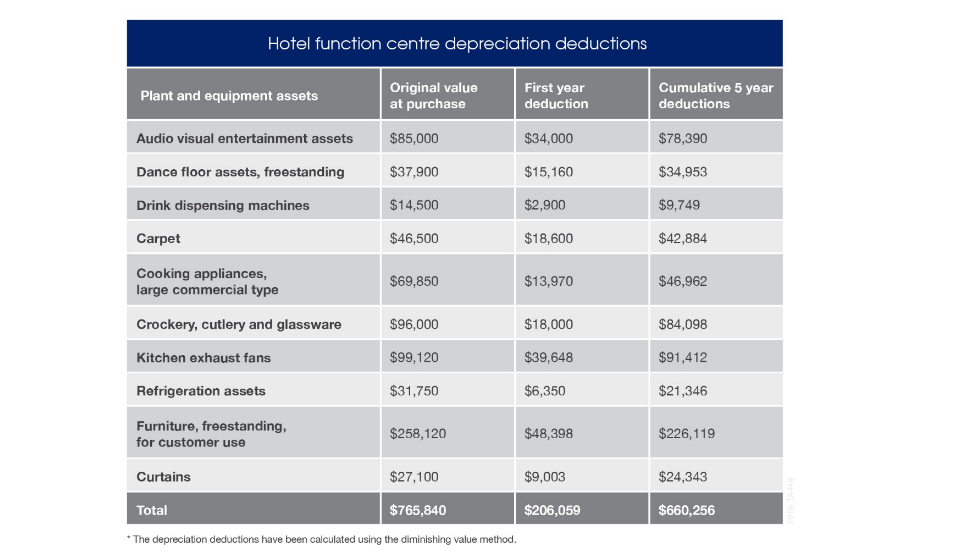

Let’s take a look at an example of how plant and equipment deductions can boost an owner’s cashflow. The table below outlines ten plant and equipment assets commonly found within hotel function centres. The table highlights each asset’s value at the time of purchase, the first year deductions and the cumulative five year deductions available to the investor.

Supplied: BMT - Click the table to enlarge

As the table shows, the investor could claim $206,059 worth of depreciation deductions for their function centre in the first year alone. In the cumulative five years this figure could rise to more than $660,000. There are likely to be several more eligible plant and equipment assets within the function centre, which means the investor could be entitled to hundreds of thousands of dollars more.

On top of this, if the investor decides to upgrade or refurbish the function centre, they could be eligible to claim additional deductions through a process known as scrapping.

Scrapping can be applied when removed assets and structural elements within a building have a remaining un-deducted value. At the time of removal, the owner of the asset can claim the residual value as an immediate deduction in that financial year. These deductions can reduce the cost of an upgrade and make the task more worthwhile.

To learn more about depreciation or to find out how much you can claim, simply Request A Quote or contact the team at BMT Tax Depreciation on 1300 728 726.

Click here to view the BMT Tax Depreciation website.

This is a Sponsored Article.

Related reading:

Scrapping can boost a hotel’s cash flow - BMT Tax Depreciation