Gaming in New South Wales has achieved pre-COVID levels since doors have reopened and Queensland is seeing an uplift in gaming revenue growth compared to 2019 over the July to August period.

The report, entitled Thirsty For Business, provides a current overview of the national pubs market and also compares key state markets and addresses the challenges facing the sector over the next 12 to 18 months.

Paul Fraser, CBRE Hotels Director and report co-author, said that the northern state was expected to see a two-speed economy between metro and regional pub markets, with gaming continuing to perform strongly under challenging conditions.

“Pubs in metro Brisbane are experiencing softer trading conditions as CBD worker numbers remain low, with office occupancy levels sitting between 35% to 45% of pre-COVID levels,” he continued.

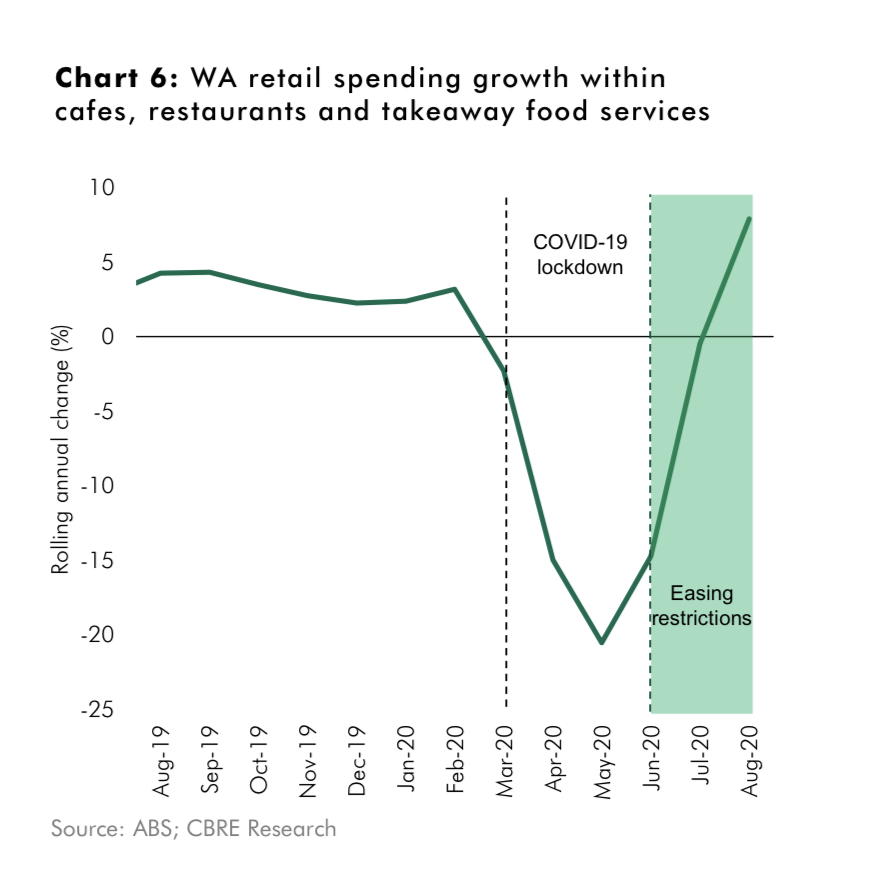

Paul Fraser told WILLIAMS MEDIA “We have seen a resilient pub industry pushed to the brink by Covid-19. Whilst many challenges lie ahead in 2021 onwards the positive signs from WA, NSW and QLD are reassuring to Melbournians who have clearly suffered the most Nationally”.

“Conversely, there has been a resurgence across key regional tourism markets such as Airlie Beach, the Gold Coast and the Sunshine Coast, with venue operators benefitting from a captive state market and displaced interstate travel.”

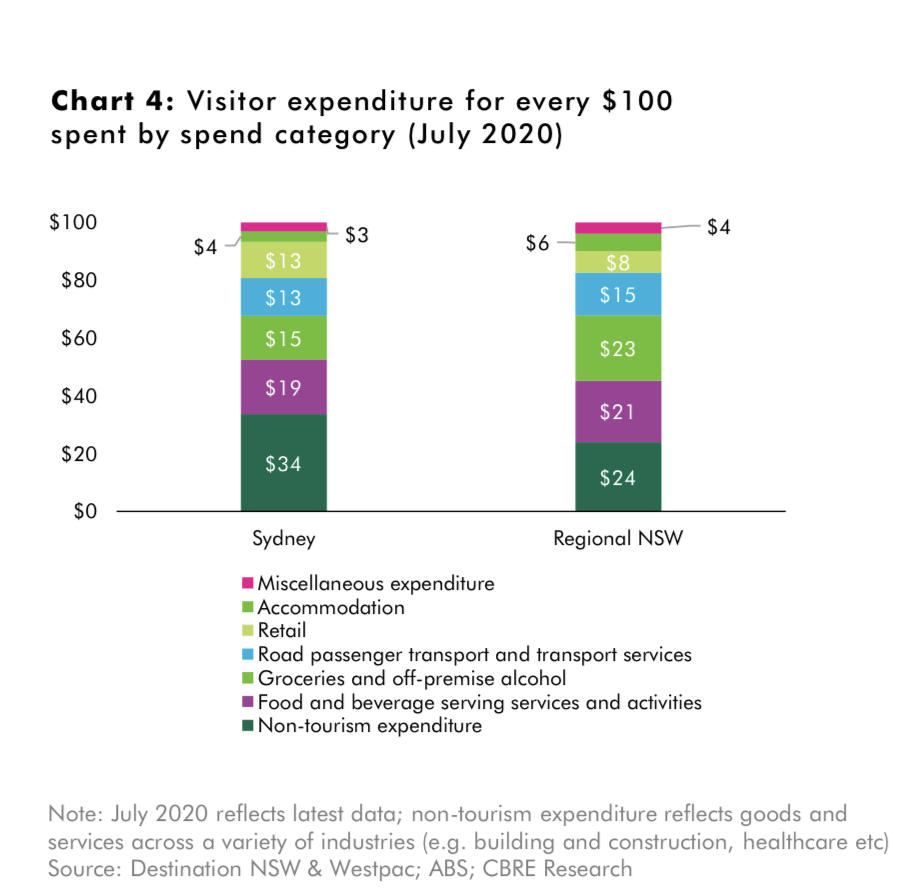

“In New South Wales, non-gaming venues and traditional food and beverage outlets across Sydney and regional NSW will have to rely more so on tourists to spur future performance.”

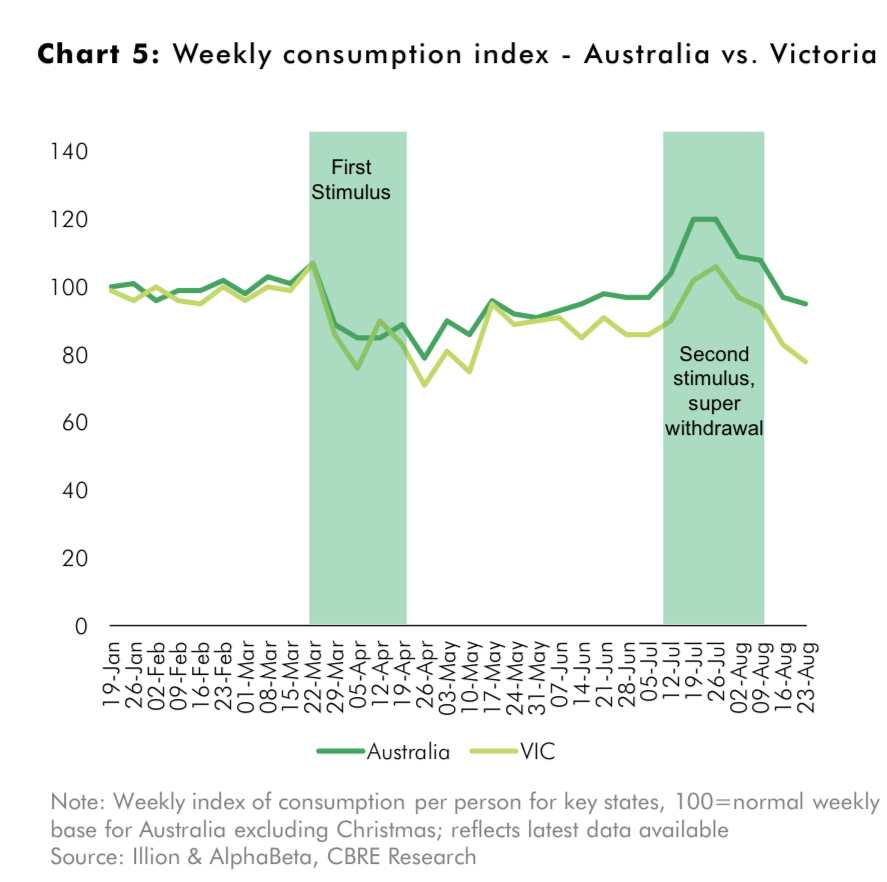

Mr Fraser further explained that Victorian operators, which had clearly been the hardest hit, were beginning to pivot from business continuity towards business reopening as the state government sets out a roadmap to reopen food and beverage and gaming venues.

“Recent times have been some of the most challenging for the pub industry nationally. We believe that this will continue into 2021, putting added pressure on operators in all states,” Mr Fraser said.

“Economic stimulus in the industry will be required to ensure a bounce back, initiatives like Fringe Benefit Tax exemption for business lunches etc could be one of several initiatives a progressive federal government might look to employ. At state level the obvious payroll tax should firmly be in the firing line as publicans and restauranteurs look to climb out of one of the most challenging years in over a century” said Paul Fraser, National Director Hotels CBRE Australia.

Paul Fraser, National Director, CBRE Hotels“Over the past year, operators have been able to conduct a full top-to-bottom review of their business and overwhelmingly adapt to the challenges they’ve faced and we’ve seen a trading performance bounce back in states where restrictions have been lifted or less onerous.”

“If COVID-19 cases in Australia remain contained, the industry faces a litmus test over the next 12 to 18 months but is expect to bounce back; however, there is concern for pubs that were struggling pre-pandemic, those that do not have the balance sheet or the cash flow to remain sustainable over the short to medium.”

“Pubs must therefore be leaner, smarter and, more importantly, create a unique place for human connection in order to succeed in this environment.”

Click here to download a copy of the report.

Similar to this:

CBRE release their 2019 hotel market outlook research report

Port Melbourne London Hotel leasehold for sale - CBRE Hotels

Eden Fisherman's Recreation Club for sale on NSW South Coast - CBRE