Resort depreciation – case study by BMT

Contact

Resort depreciation – case study by BMT

With borders reopening and international flights now available, travelers are making up for lost time and booking their ‘bucket list’ holidays – so much so that Expedia has labelled 2022 the ‘GOAT’ (Greatest of All Trips).

With borders reopening and international flights now available, travelers are making up for lost time and booking their ‘bucket list’ holidays – so much so that Expedia has labelled 2022 the ‘GOAT’ (Greatest of All Trips).

Australia is an overwhelmingly popular tourist destination with over nine million international visitors welcomed each year. March 2022 saw 374,360 international arrivals, an increase of 103,370 arrivals from the previous month.

Australia is not only a favourite with international travelers, but many locals are choosing to travel domestically. We can already see domestic travel growth this year, with 7.1 million interstate overnight trips in February 2022 alone.

Resort operators should be poised to take advantage of this growth, and to improve cash flow using depreciation deductions.

What is property depreciation?

Property depreciation is the natural wear and tear of a building and its assets over time. The Australian Taxation Office (ATO) allows owners of income-producing properties to claim this depreciation as a tax deduction.

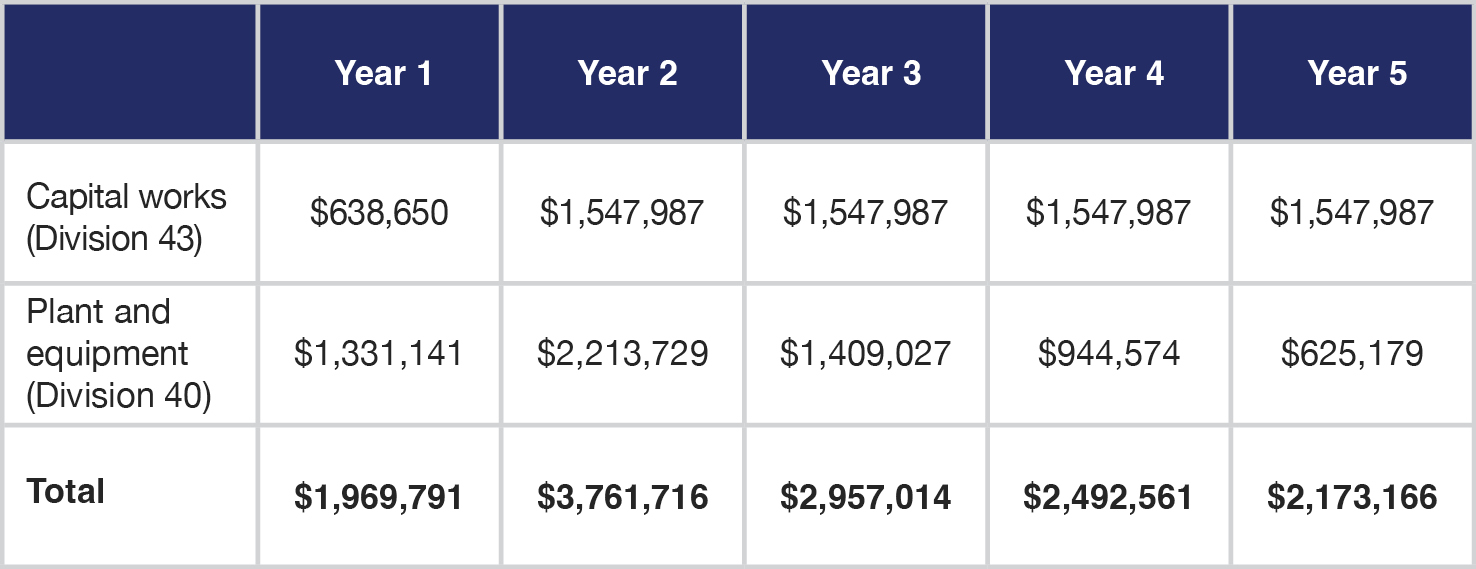

There are two types of depreciation deductions that can be claimed. Capital works deductions (Division 43) are claimable on the building and assets permanently fixed to the property. Some commonly found capital works in resorts include pools, car parks and ducting for air conditioning.

Plant and equipment depreciation (Division 40) can be claimed on assets which are easily removable from the property or mechanical in nature. Some commonly found plant and equipment deductions in resorts include carpet and flooring, light fittings and blinds.

The following hypothetical case study shows the lucrative depreciation deductions that could be available in a Queensland resort.

Case study: Depreciation on resort

‘Sunshine Resort’ is a resort located on the Sunshine Coast in Queensland. The resort was purchased in 2018 and is owner operated. Sunshine Resort has 100 rooms, a restaurant and bar, function room, pool and outdoor bar.

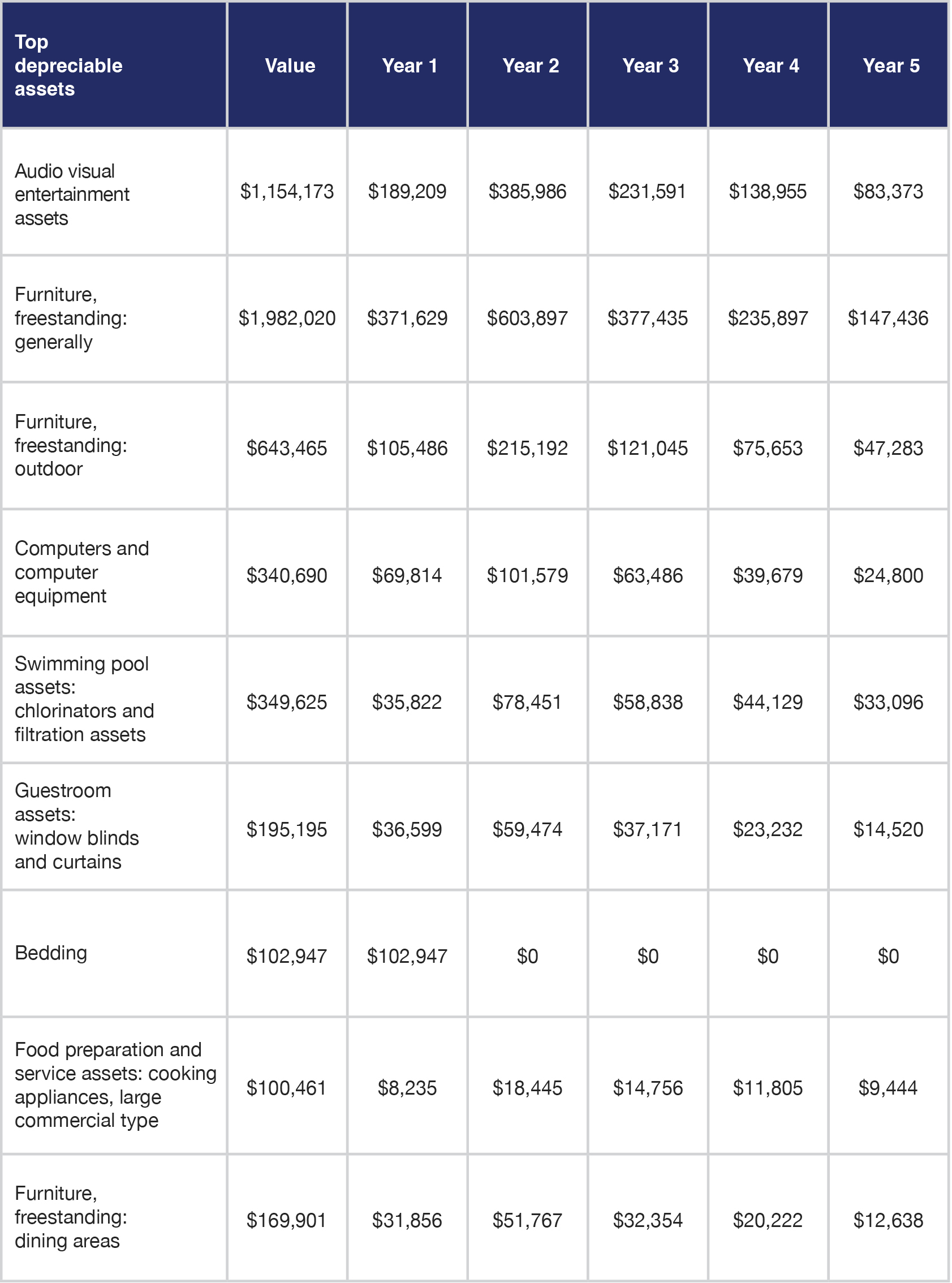

This table indicates the top depreciable assets claimed by Sunshine Resort.

By claiming depreciation Sunshine Resort boosted cash flow and was able to renovate and expand to accommodate business growth. If they didn’t claim these deductions they would have missed out on over $13 million dollars in missed depreciation deductions in the first full five years.

A BMT Tax Depreciation Schedule ensures commercial depreciation deductions are claimed to their full potential and compliantly by applying all industry-specific legislation.

To learn more about the depreciation deductions available in resorts call BMT on 1300 728 726 or Request a Quote.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

More from BMT:

Top tips for hoteliers in 2022 - BMT Tax

Hoteliers can claim more this tax time - BMT

Frequently asked hotel depreciation questions answered - BMT