Deloitte's latest Tourism and Hotel Market Outlook reports that hotels across the country performed well during 2017, recording positive gains across key indicators.

"Trend room occupancies showed a smaller gain than both average daily room rates (ADR) and revenue per available room (RevPAR), adding one percentage point over the year to reach 68.5%. This figure represents the circa 7000 commercial accommodation properties from Hobart to the top end."

"Occupancy rates in Sydney and Melbourne are 20 percentage points greater than this national score, highlighting the different trading conditions in regional areas."

"Melbourne, Hobart and the Gold Coast experienced softer occupancy rates over the year, losing at least a percentage point each, Perth saw a decline of 4.6%, while Darwin’s occupancy grew the fastest of any capital city by 8.8%. Darwin’s future prospects are expected to be more subdued as the market adjusts to demand changes later this year. "

"A number of new hotels and serviced apartments opened their doors last year, with 5,500 new rooms coming onto the market – an addition of 2.3% to the national room stock."

Looking ahead, the report notes that the nation will see a significant number of new properties being completed which will have a strong impact on the market.

"The majority of this supply is concentrated in capital cities, with Melbourne having over 50 active projects alone. 2019 and 2020 are expected to see the largest number of new rooms becoming available, with an increase of 3.4% to total supply each year."

"Several of the new hotels are positioned at the high end of the market, with brands such as the Ritz Carlton, W and Mandarin Oriental making their debut appearances in Australia. These luxury class properties will help push average rates upward over the three-year forecast period, growing at 2.8% per annum."

Click here to view and download the Executive Summary of the Deloitte Tourism and Hotel Market Outlook, Edition one 2018.

Key takes outs from the report include:

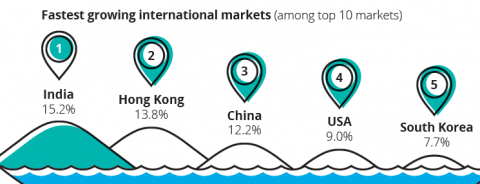

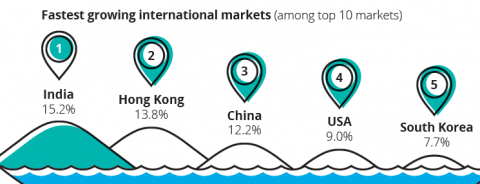

- International visitor arrivals continued to grow strongly, up 6.5% to over 8.8 million visitors in 2017

- Domestic trips continue to outperform real GDP with consistent growth over the last seven years

- At the same time that domestic tourism has strengthened, the number of overseas trips by Australians has increased, up 5.2% over the year to 10.5 million trips

- Across both international and domestic markets, the leisure segment was outperformed by other segments. Among international visitors, business and education focused travel grew most strongly while for the domestic market, it was business travel and travel to see friends and relatives that showed the strongest growth

- Global economic conditions remain favourably orientated for Australian tourism with international tourist arrivals outpacing global economic growth over the last three years

- Domestically, conditions are expected to strengthen with domestic trips forecast to grow by 3.7% p.a. and visitor nights by 3.4% p.a. over the next three years

- Hotels across the country performed well during 2017, recording gains across key indicators. Room occupancy added one percentage point over the year to reach 68.5%

- Looking ahead, Australia will see a significant number of new hotel properties come online over the forecast period which will have a strong impact on trading conditions, and limit the opportunity to grow occupancy rates any further in the near term across a number of city hotel markets.

See also:

Melbourne's charm pips Sydney as top Australian city for investment

First Marriott hotel to be built in Australia in 20 years

Australia's hotel renaissance