CBRE release their 2019 hotel market outlook research report

Contact

CBRE release their 2019 hotel market outlook research report

CBRE's latest research report has found that Australian hotels on average recorded 1.2% RevPAR growth in 2018, a positive result but lower than the 2.8% growth recorded in 2017.

CBRE have reported that Hotels in 2019 will benefit from a weaker Australian currency, which will help entice international visitors and encourage locals to stay at home.

The report states, "The Australian hotels on average recorded 1.2% RevPAR growth in 2018, a positive result but lower than the 2.8% recorded in 2017. Between states there was a degree of convergence in performance, with those outperforming in 2017 experiencing lower growth in 2018, while most weaker performing markets improved. The Gold Coast was the top performing market, underpinned by hosting the Commonwealth Games in April 2018."

"The slightly weaker level of national growth recorded in 2018 was partly driven by a modest decline (~1%) in hotel nights occupied by international visitors; 2018 marked the first year since 2012 that hotel nights occupied by international visitors declined. The 2018 result bucked the trend of strong growth (7% p.a.) over the three preceding years. The impact was felt most in Cairns and Melbourne, with occupancy declining in both cities."

CBRE don’t expect this decline in international visitors to persist in 2019. The Australian currency is ~10% weaker against the US dollar and ~5% against the Chinese yuan than this time last year.

"Given our economic forecasts, we expect bias towards further AUD depreciation in 2019. Over the past decade, any year with AUD/USD currency depreciation of 10% or more was typically followed by a year of (on average) 5% growth in hotel nights occupied by international visitors; thus we expect more international visitors in 2019.

"International visitor nights are forecast to grow by 6.2% p.a. over the next three years according to Tourism Research Australia."

"Growth in visitors from China over the past decade has been phenomenal and China has displaced the U.K. as Australia’s most valuable market for leisure exports since 2013. China is also Australia’s largest market for education exports, and a lower AUD will strengthen Australia as a choice destination for university studies. There is a positive relationship between leisure tourism and education exports given that overseas’ students also travel domestically during their studies."

"A weaker currency will provide the additional benefit to local hoteliers insomuch that a greater number of Australians will travel nationally rather than internationally. In the past ten years, hotel nights occupied by domestic tourists grew by 5% when the AUD fell 15% against the USD. While we expect this relationship will remain in 2019, the impact will be diluted due to household cost pressures."

Some markets will be at a greater risk of lower RevPar growth

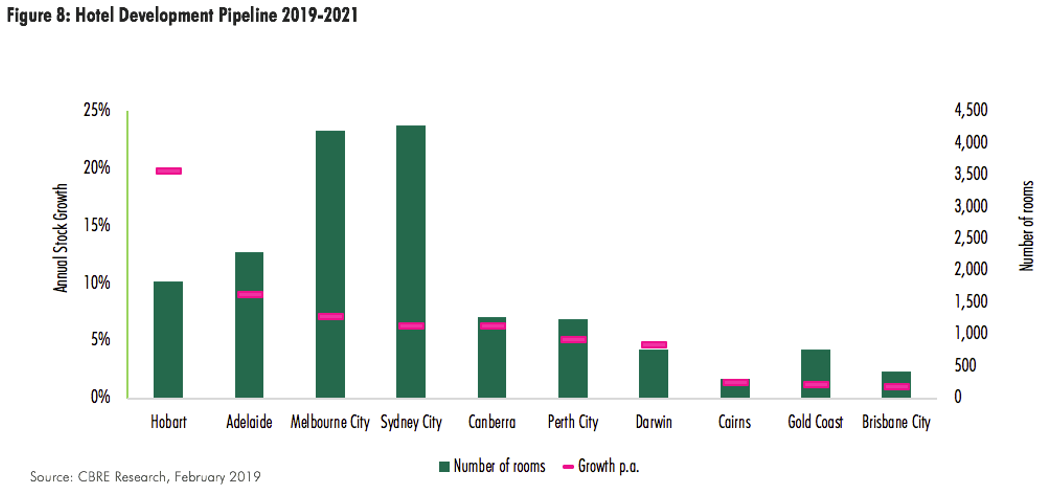

"New supply over the next few years will influence RevPAR growth over the medium-term outlook period. The Hobart hotel market will grow in size by 20% annually over the next three years (figure 8). Higher levels of international visitors in 2019 should benefit the Hobart market; nevertheless, on account of new supply we expect further declines in RevPAR this year."

"Adelaide and Melbourne are also expecting sizable increases in supply (as a proportion of existing stock) from 2019-21, meaning these markets risk recording lower RevPAR growth in 2019 as occupancy is expected to fall and operators feel pressure to reduce room rates."

"In Sydney occupancy rates ended the year trending lower and growth in room rates stalled. Pipeline over coming years will likely have limited impact on overall hotel performance because most developments are high-end products and should be well absorbed by the market given there has been limited new supply of such product over the past decade."

"Perth has experienced ongoing RevPAR decline since 2012 but the rate of decline moderated in Q4 to the extent it was almost stable. Any further falls will be moderate and we’re expecting stabilisation in 2019."

"Queensland markets will experience the least supply growth over coming years which augurs well for RevPAR. Brisbane recorded a 7.2% increase in hotel rooms in 2018; the detrimental effect to RevPAR from this massive increase in supply was partly mitigated by growth in international visitor nights that eclipsed all other capital cities except Hobart. Brisbane’s new hotels will act as a further draw to the city, for tourists and investors."

Click here to download the full CBRE Property Market Outlook for 2019 report.

To discuss the Australian hotel market in further detail, phone or email CBRE Hotels National Director, Wayne Bunz.

See also:

Australian hotel sales total $1.8 billion in 2018 - Colliers International Report

Wellness Tourism is big business in Asia Pacific

New Zealand records most popular international visitor numbers ever throughout Spring