"Sydney accommodation market performs well in 2018" - HTL Property

Contact

"Sydney accommodation market performs well in 2018" - HTL Property

It has been an exciting year for the Sydney accommodation market, heavily spurred on by favourable tourism numbers that translated into a positive 2018 performance, according to HTL Property's latest ‘Spotlight On’ report.

The research showed new highs in visitor arrivals both internationally and domestically had a large impact on occupancy levels and RevPAR rates across the city.

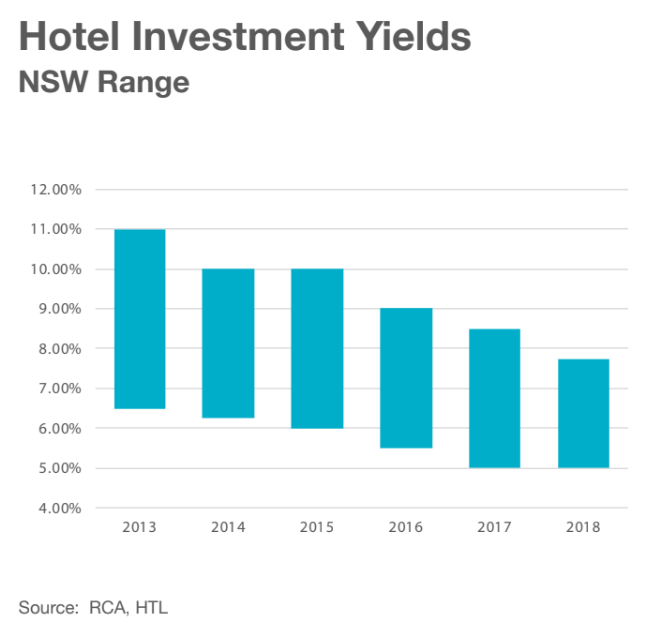

HTL Property Director of Asia Pacific Region Andrew Jolliffe said this had not gone unnoticed by investors, who had actively pursued the limited assets which had entered the market, placing further downward pressure on investment yields.

Andrew Jolliffe, HTL Property Director of Asia Pacific Region

“With the reduction in investment activity, the mismatch between buyers and sellers has aided in the contradiction of yields,” Mr Jolliffe said.

“Accommodation hotels continues to be a hotly contested asset class, both by domestic and international buyers. With limited quality stock coming to market, we’ve seen both a compression in yield, and a narrowing in average yield range.

“Currently, NSW yields range from five per cent to 7.75 per cent, with an average of sub-six per cent which has compressed by 215 basis points in the last five years.

“The gap between yields has contracted by over 100 basis points over this same time frame, highlighting competition to purchase quality assets.

Click here to view and download HTL Property Spotlight On – Sydney Hotel Market – February 2019.

“Average yields in regional locations maintain at the upper end of the yield range, with an average of 7.25 per cent recorded in 2018.

“Offshore activity is high for this asset class, with Singaporean investors the most active buyers and sellers.

“The limited supply of investment stock has seen yields compress in both metropolitan and regional locations, with the rumoured ADIA portfolio transaction likely to set a new benchmark for investment yields in 2019.”

HTL Property Head of Research Vanessa Rader said limited stock availability had resulted in 2018 yielding record lows in sales volumes.

“The absence of many large trophy asset sales in the last few years has seen volumes dwindle to just over $281.84M for the state,” Ms Rader said.

“However, there's a further $350M portfolio transaction which has yet to be confirmed.

“This portfolio, owned by UAE based ADIA, includes all four major hotel assets in Sydney Olympic Park. The completion of this transaction would see 2018 in line with 2017 volumes.

“Despite the confirmed limited volume of sales in metropolitan areas, the regional area market continues to be active, recording $58.75M in sales in 2018.

“Regional sales represent 20.85 per cent of total confirmed sales, up from the average proportion of 11.55 per cent.

“Limited CBD transactions sees Park Regis City Centre being the largest transaction in 2018, at $54.18M.

“This property yielded $444,098 per room, selling to Yeh’s Family Holdings, a local investor/developer.”

Click here to view and download HTL Property Spotlight On – Sydney Hotel Market – February 2019.