Record tourists ensure healthy growth for New Zealand hotel industry

Contact

Record tourists ensure healthy growth for New Zealand hotel industry

The New Zealand tourism sector continues to grow with international visitors reaching a record 3.9m to July 2019, according to Colliers International.

The tourism sector in New Zealand is seeing continued growth as the number of international visitors reach a record 3.9 million to the year end July 2019, according to the Colliers International New Zealand Hotel Market Snapshop Report 2019.

Using statistics sourced from Tourism Industry Aotearoa (TIA) Colliers reports a growth of 2.8 per cent and has helped maintain robust volumes in the business industry across the country.

Wellington is currently the market leader for growth in revenue per available room (RevPAR), recording a 6.8 per cent annual increase, followed by Rotorua (3.3 per cent) and Queenstown (2.8 per cent).

wellingotn_new_zealand.jpg

<p>Wellington, New Zealand has seen the highest growth of tourists over the past year.</p>

Wellington New Zealand has seen the highest growth in RevPAR over the past year. Photo: Deposit Photos

At a glance:

- New Zealand has seen a record number of international visitors (3.9 million) in the last financial year.

- Wellington, Rotorua and Queenstown are achieving record high RevPAR.

- Auckland has had a decline in RevPar.

The result is that these three regions are achieving RevPAR at or near record highs.

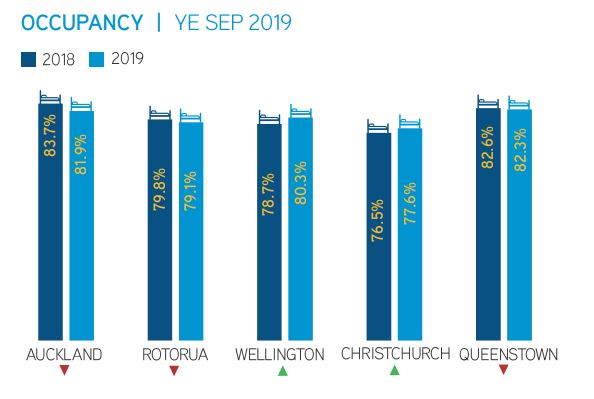

Auckland has seen a decline in RevPAR of 7.9 per cent despite maintaining a healthy occupancy rate of 81.9 per cent. A lack of major events compared to 2017/18 and the postponement of opening of the NZICC have limited compression nights in Auckland, precluding hotels from holding ADR at historic highs.

Hoteliers are looking forward to an increasing number of major events throughout 2020/21 to counter increasing new supply entering the market over the sort/medium term.

Christchurch RevPAR has remained stable at 0.4 per cent with the opening of their new convention centre in 2020 likely to assist in helping absorb new supply.

The NZ Super Fund's $300 million investment in a hotel venture in July this year, represents the single largest off market hotel transaction in New Zealand's history.

New Zealand's $42 billion sovereign wealth fund announced it was investing in a portfolio of hotels established by one of the country's largest hotel owners, the Russell Group and Lockwood Property Group.

The venture will create a platform for NZ Super Fund to invest further in New Zealand's tourism sector. The phased investment includes the 255 room Four Points by Sherato, the 160 unit Adina Auckland Britomart in Auckland, and the 263 room BreakFree on Cashel in Christchurch, as well as an intention to acquire and develop additional sites.

Colliers International has played an instrumental role in this strategic off market joint venture with these entities.

Similar to this:

Investment demand for New Zealand hotel assets remain high - Colliers International

"Australia’s investment-grade hotel rooms now worth $56 billion" - Colliers International