Holiday parks offer plenty of activities and depreciation deductions

Contact

Holiday parks offer plenty of activities and depreciation deductions

Holiday Parks can potentially carry thousands, and even millions, of dollars in depreciation deductions available over their lifetime, according to BMT Tax Depreciation.

Tourism Australia officially launched the ‘Holiday Here This Year’ campaign in January.

The campaign aims to get Australians holidaying in their own backyard this year to support the local community.

It’s no secret that we love being in the great outdoors, and holiday parks are a popular destination.

From swimming pools to golf courses and first-class cabins, holiday parks continue to prove themselves as somewhere that the whole family can enjoy. As free camping sites grow across Australia, holiday park owners must continue to upgrade their facilities to remain competitive.

A holiday park’s operation costs can be very high as they hold a diverse range of assets.

Click here to request a tax depreciation schedule quote

The upgrades and general upkeep can quickly stack up. However, owners can also benefit from the many depreciation deductions available.

Depreciation is the natural wear and tear of assets over time and is a non-cash deduction.

This means that the owner of the investment doesn’t need to spend anything to be able to claim it.

Depreciation deductions can be claimed under two categories.

The first is capital works, which is the depreciation of the building’s structure and permanently fixed assets.

The second category is plant and equipment, which is the depreciation of easily removable fixtures and fittings.

Let’s look at an example of the type of plant and equipment deductions a holiday park owner would be eligible to claim.

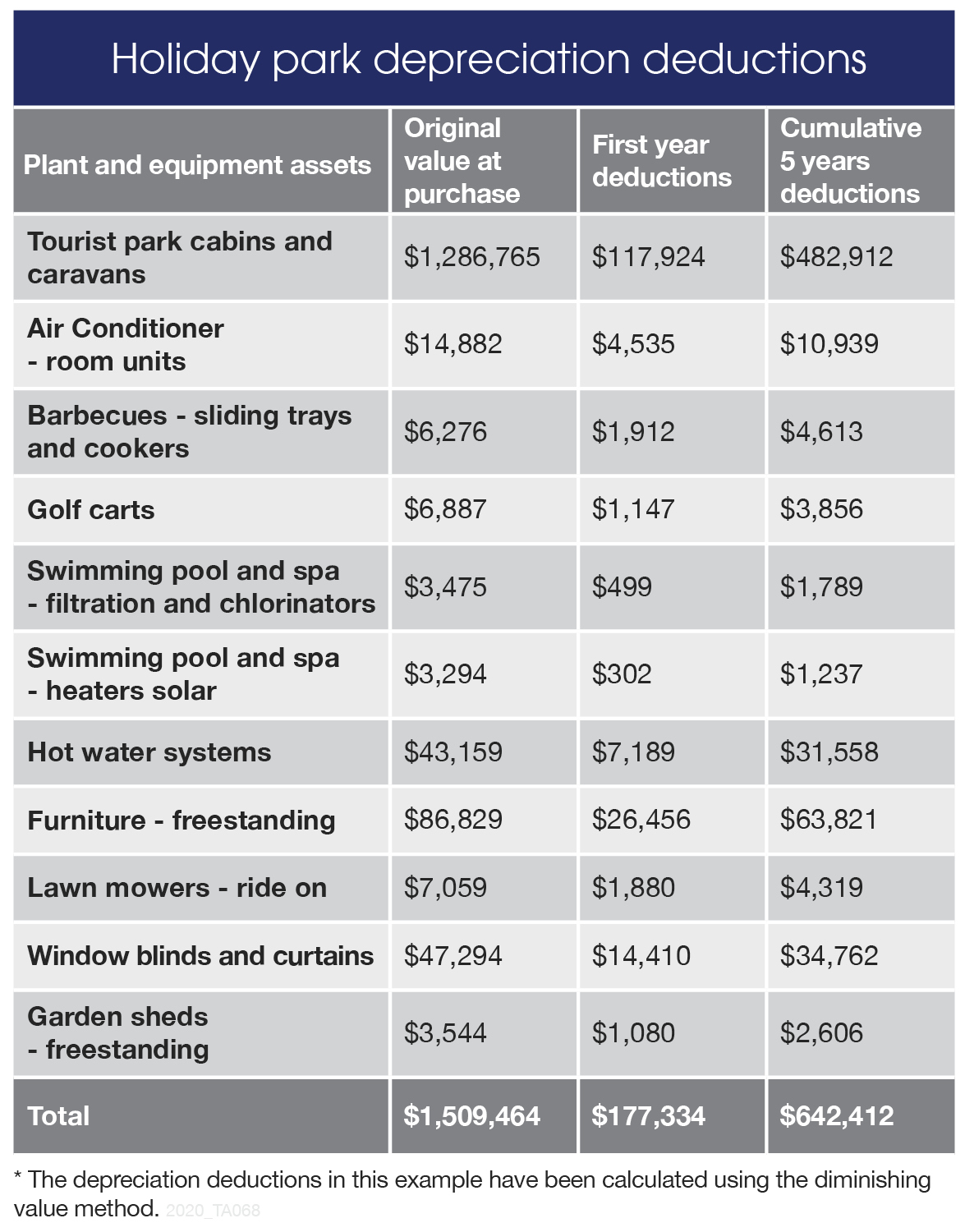

The following table includes examples of the type of plant and equipment assets found in a holiday park such as cabins and caravans, golf carts, furniture and swimming pool accessories.

The table highlights each asset’s original value, the first year and cumulative five year deductions available.

In this scenario, the owner can claim $177,334 in depreciation deductions in the first financial year alone. In the cumulative five years of owning the investment, the depreciation claims total $642,412.

This scenario only includes some of the assets found at a holiday park, with thousands, and even millions, of dollars in depreciation deductions likely to be available over the lifetime of the property.

To learn more about the depreciation deductions you can claim from your holiday park, Request a Quote or speak with one of the expert team at BMT Tax Deprecation on 1300 728 726.

This is a sponsored article.

More from BMT Tax Depreciation:

Scrapping can boost a hotel’s cash flow - BMT Tax Depreciation

See the deductions available in a hotel lobby - BMT Tax Depreciation