Australian hotel expectations to be revised as COVID-19 'casts a shadow' over Asia Pacific markets - CBRE

Contact

Australian hotel expectations to be revised as COVID-19 'casts a shadow' over Asia Pacific markets - CBRE

A relatively strong performance by the Asia Pacific hotel market in the second half of 2019 has been overshadowed by the ongoing impact of COVID-19 at the beginning of this year, CBRE says.

Any momentum the Asia Pacific hotel market gained from the second half of last year has been lost in the impact of the COVID-19 pandemic, CBRE says.

The research firm released its Asia Pacific Hotels MarketView for the second half of 2019 last week, revealing that while the major hotel markets recorded relatively solid performance towards the end of last year, the COVID-19 outbreak had "cast a shadow over the Asia Pacific economy" in the opening months of 2020, posing a downside risk to global growth.

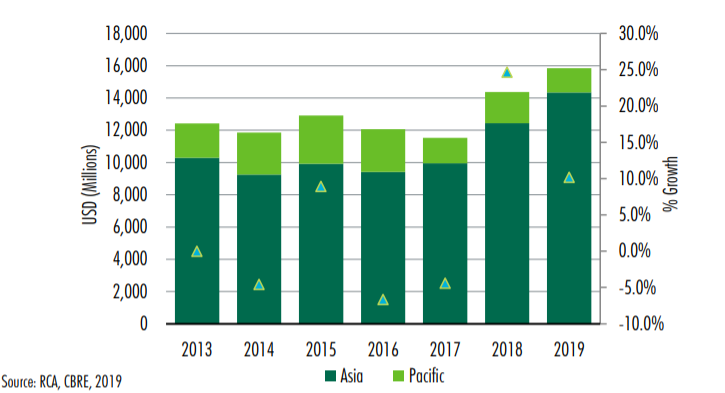

According to the report, Asia Pacific hotel transaction volume registered approximately US$15.8 billion last year, signalling a 10 per cent increase from 2018.

But CBRE also noted that the COVID-19 outbreak was expected to have a considerable impact on purchasing activity in the short term, including a sharp decline in visitor arrivals resulting from travel restrictions is already impacting the hospitality sector.

"The short term impacts on the regional hotel market have been significant and continue to evolve along with the development of the disease," CBRE says.

"As of mid-March, occupancy in many hotels is in the single digits, leading owners to implement cost-saving initiatives or close temporarily for refurbishment. Some hotels have reportedly closed completely while others will struggle to ride out this challenging period."

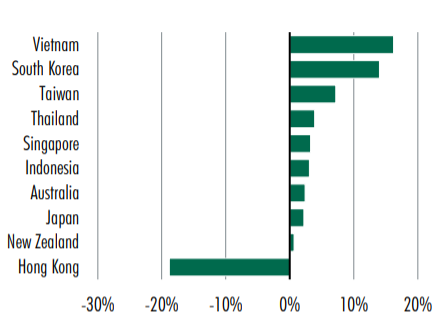

Australia is among the markets where expectations are set to be revised, with predictions from last year to be heavily affected by COVId-19 restriction.

Source: CBRE Hotels

Research from CBRE indicates hotel investment volume registered AUD 360 million in Australia for the fourth quarter of last year, with domestic investors accounting for 46 per cent of all transaction volume.

The largest transaction of the quarter, according to CBRE, was Icon Oceania's sale of Vibe Sydney to a Thai investor for AUD 108 million.

CBRE says while a combination of limited availability and easier access to capital had been likely to underpin asset values for 2020, COVID-19 was "set to prompt a revision of these expectations.

Click here to download a full copy of the report.

More hotel research from CBRE:

Adelaide hotel market benefitting from corporate growth: CBRE report

Sydney hotel performance experiences softening despite tourist increase - CBRE

Brisbane and Perth 'absorbing' increase in hotel supply: CBRE report