Hotel investors still on the lookout amid COVID-19 - CBRE Survey

Contact

Hotel investors still on the lookout amid COVID-19 - CBRE Survey

The Australian hotel industry remains cautiously optimistic about medium-term investor appetite amid the COVID-19 pandemic, according to CBRE Research’s latest Hotel Market Survey.

A new survey has shown more than half of hoteliers have not changed their medium-term investment intentions despite the impact of COVID-19.

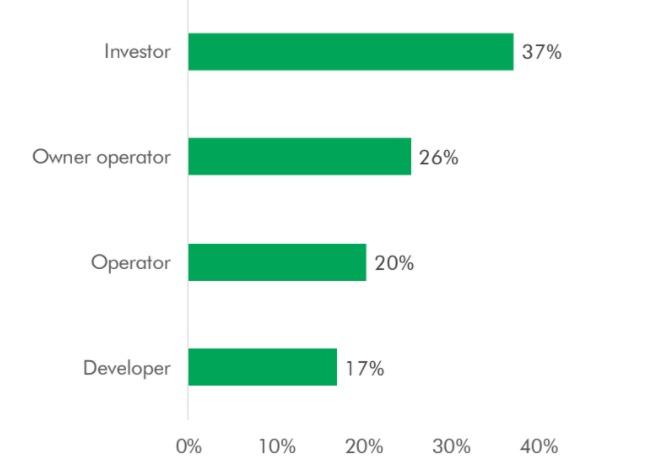

Investors, owner-operators, operators and developers took part in the CBRE online survey, the results of which were designed to capture market sentiment within a sector that is facing significant short-term pressure.

While acknowledging the considerable challenges ahead, with tourism brought to a virtual standstill, many investors indicated they were looking forward, eyeing potential buying opportunities.

CBRE Hotels Regional Director, Valuation & Advisory Services, Troy Craig said the bulk of the hoteliers surveyed indicated their medium-term investment intentions had not declined significantly compared to December 2019.

Who took the survey?

Source: CBRE

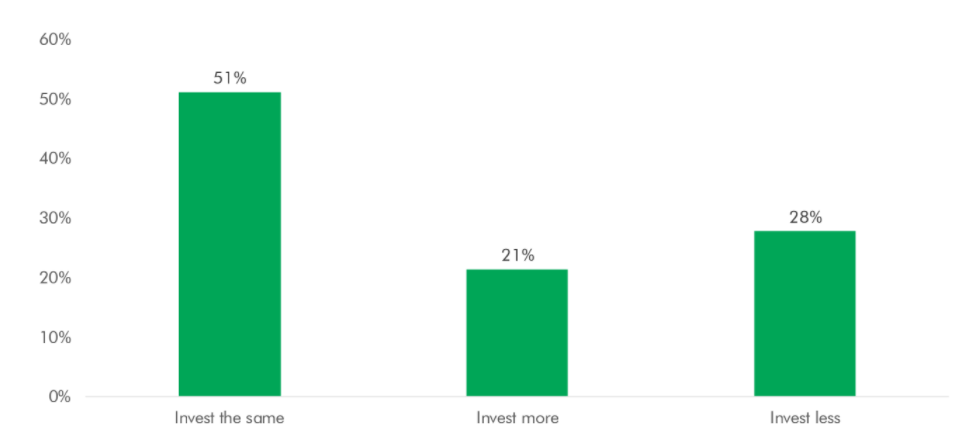

A total of 51 per cent answered that their level of investment would be unchanged and a further 21 per cent indicated they would invest more, while 28 per cent indicated they would invest less.

When asked about the most-likely outcome of the crisis, 46 per cent predicted buying opportunities for less-geared investors.

Shared concerns within the industry were reflected by 38 per cent answering that they expected ‘significant’ financial stress and only 16 per cent of the view the sector would emerge with ‘minimal’ implications.

Almost all of the survey participants expect hotel values in Australia’s major cities to decline over the next six months, including 54 per cent who believe that will be by more than 10 per cent.

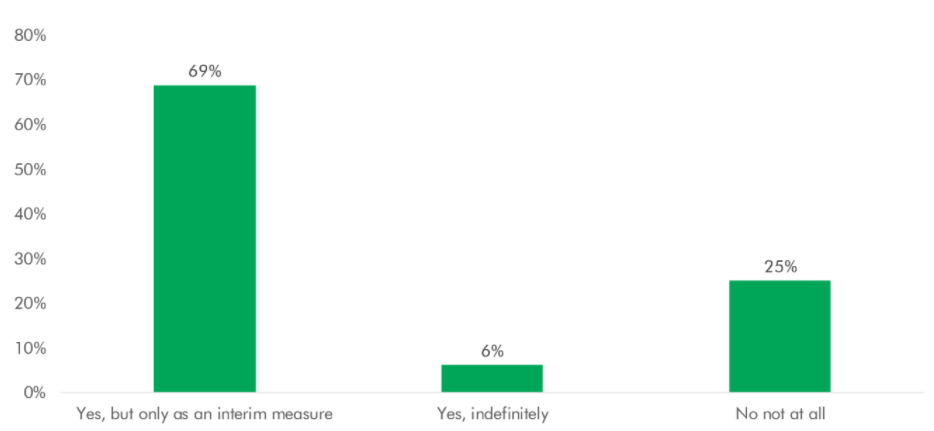

Has the crisis led to your company putting new development plans on hold?

Source: CBRE

“Our survey found that investor appetite has not deteriorated by as much as may have been expected under the current circumstances with 72% of respondents still prepared to invest the same or more in the sector relative to December 2019,” Mr Craig said.

“The other 28 per cent indicated a likelihood to invest less, which is not surprising given the impact the crisis has had on the sector.

“A significant proportion of respondents believe there will be substantial financial stress with implications to play out over the short-to-medium term, including a notable drop in RevPAR this year across all major markets.

“However, with widely held expectations that capital values will decline by 10 per cent or more, the current climate could lead to buying opportunities for some investors moving forward.”

The financial challenges are headlined by expectations of a substantial fall in revenue per available room (RevPAR) in major cities across 2020.

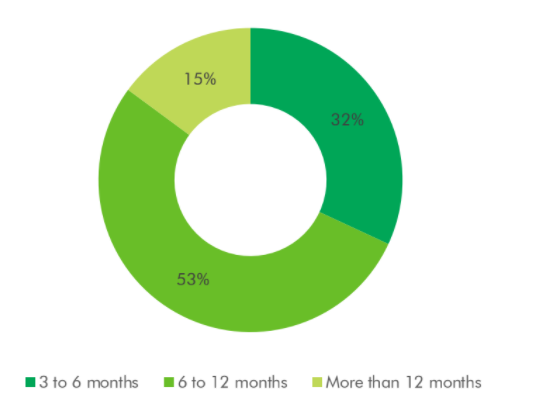

How long do you expect this crisis to continue?

Source: CBRE

A total of 71 per cent of respondents believe RevPAR will decline by 30 per cent or more this year, averaged across Sydney, Melbourne, Brisbane and Perth.

Just over half of respondents, 53 per cent, expect the current crisis to last between six and 12 months, and only 15 per cent foresee it stretching out beyond 12 months.

Of the recovery period that would then follow, 54 per cent predict that is likely to last longer than six months.

A re-rating of the sector over the medium term is anticipated by 85 per cent of respondents, but the majority of those foresee only a slight re-rating.

“We are confident the Australian hotel market will fare better than most other countries, and that there will be a strong recovery once the government reopens the economy,” CBRE Hotels National Director Wayne Bunz said.

“Once again, this will highlight the resilience of our hotel economy with a larger amount of capital sitting on the sidelines ready to be invested.

“The challenge will be the adjustment period and managing the disparity between vendor and buyer expectations of hotel values.”

The survey also highlighted that short-term priorities for the industry include the preservation of cash flow, which was identified by 33 per cent of participants as the primary action that should be taken.

How has your medium-term investment outlook for the hotel real estate sector changed since December last year?

That was followed by 22 per cent who suggested seeking other sources of income and 17 per cent flagging closing rooms or floors, while reducing room rates (3 per cent) and closing altogether (1 per cent) were the least popular answers.

“Operators are largely focusing on preserving cash flow in the short-term,” Mr Bunz added.

“Development and capital expenditure plans are being put on hold, and their cash position is being reviewed regularly.

“At the same time, hotel operators know the importance of maintaining business continuity; having a good continuity plan in place will ensure they are well-placed to take advantage of the market recovery in the months ahead, after the crisis is contained.

“Our strong recommendation to our clients has been to proactively look at their hotel portfolio and factor in a worst-case scenario on valuations, and then understand the impact of this on their loan to value ratio (LVR).

“This will then allow them to manage and work to resolve any potential LVR breach while still in their control.”

Click here to view the full report.

Similar to this:

CBRE release their 2019 hotel market outlook research report

Adelaide hotel market benefitting from corporate growth: CBRE report

Brisbane and Perth 'absorbing' increase in hotel supply: CBRE report