Canberra and Brisbane will lead recovery of Australian hotel sector - Colliers survey

Contact

Canberra and Brisbane will lead recovery of Australian hotel sector - Colliers survey

Colliers International has launched their inaugural Australian Hotel Investor Sentiment survey in response to the COVID-19 health pandemic, with the results showing investors expect Canberra and Brisbane to lead the sector's recovery.

Green shoots of recovery for the hotel sector are expected to emerge in early 2021, underpinned by growth in domestic leisure travel, a new survey has found.

Colliers International has released the results of its inaugural Australian Hotel Investor Sentiment survey, which was conducted in response to the COVID-19 pandemic and reflects the sentiment of a range of investors.

According to the data, investors have identified Canberra and Brisbane as the markets best placed to lead the recovery, with trial return of Federal Parliament expected to lift room demand in the nation's capital later this year, while more than a quarter of respondents believe Brisbane will return to positive trading in the first half of 2021.

Colliers International Australian Hotel Investor Sentiment survey - At a glance:

- Canberra and Brisbane expected to lead recovery which is expected to begin in H1 2021.

- Investors expect Q3 2020 to be the weakest quarter for hotel trading in Australia.

- Majority of investors expect it to take between 18 months and 2 years before the Australian hotel investment market reaches stabilisation.

- More than one third of investors expect to see city hotel capital values decline by 0-10 per cent by the end of 2020.

- Investors have cited future room night demand as the biggest challenge currently facing the industry.

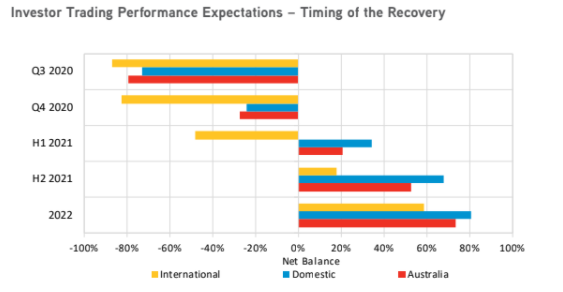

Colliers International Head of Hotels Gus Moors said as some Australian states and territories began to cautiously relax social distancing measures, investors remained optimistic that 2022 would see strong performance across all geographies and segments.

"International tourism is expected to rebound but driven by the international corporate segment given the strong and salient relationships offshore," he said.

“Investors expect Q3 2020 to be the weakest quarter for hotel trading in Australia with sentiment for negative trading averaging -79.4 per cent.

"Whilst considerably improved, investor sentiment for trading in Q4 2020 is still negative at -27.2 per cent, which highlights the slow road to recovery which owners, operators, financiers and governments must navigate.”

Source: Colliers International

Colliers report found that the overwhelming majority of investors expect it to take between 18 months and 2 years before the Australian hotel investment market reaches stabilisation with more than one third of investors expecting to see city hotel capital values decline by 0-10 per cent by the end of 2020.

Investor expectations for hotel cap rates in Australia averaged 6.75 per cent across all ten hotel markets but are lowest for Sydney (5.6 per cent), Melbourne (6.05 per cent) and Brisbane (6.4 per cent) as the three largest and most liquid hotel investment markets in Australia.

Colliers hotel specialists expect these three markets to remain the focus of investor activity over the coming year as many investors adopt a ‘flight to quality’ investment strategy in response to dislocation in the global hotel trading markets.

Source: Colliers International

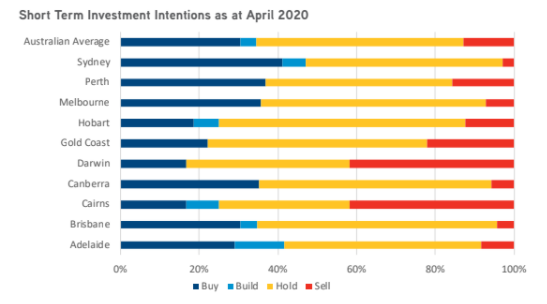

Colliers International Hotels Director Karen Wales said although the majority of investors were adopting a "wait and see approach" to hotel investments over the next six months, almost one third of investors say their primary investment activity will be to ‘buy’, indicating that the Australian hotel transaction market is expected to heat up towards the end of 2020.

“While Australia’s hotel development cycle has been in full swing over the past couple of years, investors have signalled a significant change in strategy with ‘build’ intentions the lowest across all Australian markets averaging only 3.9 per cent," she said.

“Uncertainty about the quantum of future room night demand – which investors have cited as the biggest challenge currently facing the industry - has undermined hotel development feasibilities and investors have refocussed activities further down the risk curve.

“Whilst the reconvening of the National Cabinet to consider the baseline restrictions will likely provide some guidance to the hotel industry for the stepped timing of the recovery, the Australian Government may need to consider targeted incentives for hotel owners if Australian hotels are to remain open for business once the current stimulus falls away.”

Click here to download the report.

Similar to this:

Investment demand for New Zealand hotel assets remain high - Colliers International

Radisson Hotel Darling Harbour for sale for $40 million - Colliers International