Australia among the hotel markets to watch in Asia-Pacific COVID recovery - JLL Hotels and Hospitality

Contact

Australia among the hotel markets to watch in Asia-Pacific COVID recovery - JLL Hotels and Hospitality

Australia has been identified as one of five Asia Pacific markets to watch during the COVID-19 by JLL Hotels and Hospitality in an industry webinar.

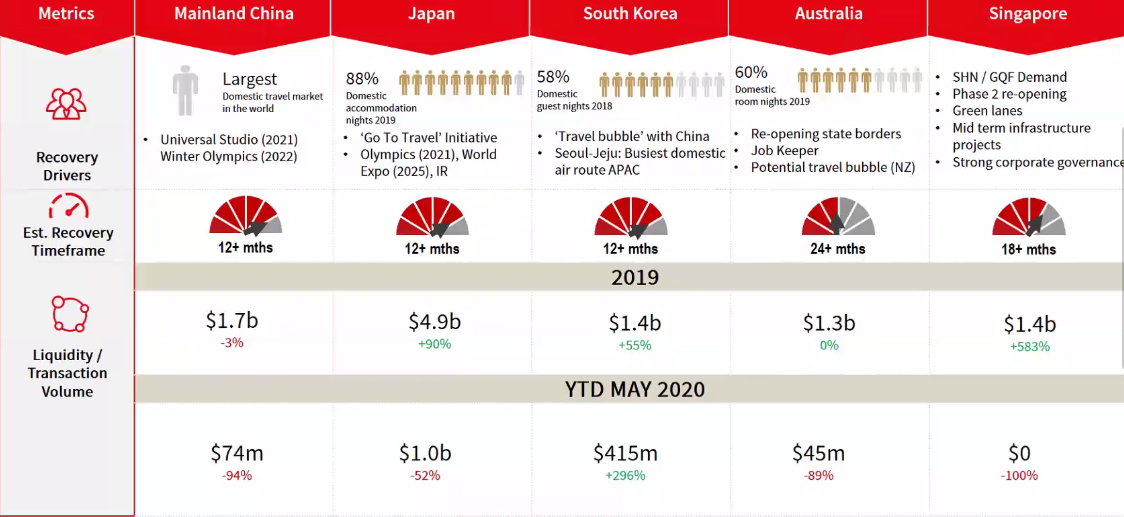

Australia joins mainland China, Japan, South Korea, and Singapore as one of the key Asia Pacific hotel markets to watch during the Covid-19 recovery, according to JLL Hotels and Hospitality Group.

The group outlined the markets within the region that had the strongest recovery prospects based on their fundamentals as part of its Hotel Transactions in the New Normal - What to Expect webinar on Monday.

At a glance:

- On Monday, June 29, JLL Hotels and Hospitality Group conducted webinar entitled Hotel Transactions in the New Normal - What to Expect.

- The Group identified Australia as one of the markets to watch during the Covid recovery, along with mainland China, Japan, South Korea, and Singapore.

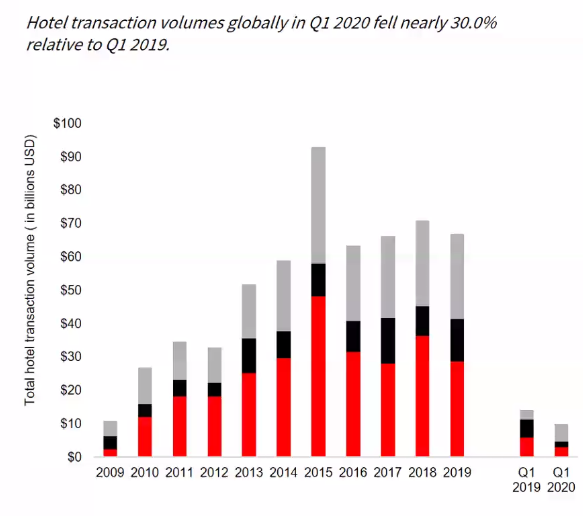

- According to JLL Hotels and Hospitality Group, Asia Pacific transaction volumes were down approximately 60 per cent across the region in 2020, following a record year in 2019.

JLL Hotels & Hospitality Senior Associate for Investment Sales in Asia, Alison Li, said the destinations were chosen for reasons other than liquidity.

"Government policy as economic stimulus are going to be key recovery drivers," she said.

"Programs such as JobKeeper in Australia are likely to support recovery in the short term.

"Markets with strong domestic demand are also likely to rebound first."

Source: JLL Hotels and Hospitality

According to JLL, Asia Pacific transaction volumes were down approximately 60 per cent across the region in 2020, following a record year in 2019.

Ms Li said while the Australian hotel market had historically proven to be a flight to quality investment destination, especially in times on global uncertainty, there had been few investment-grade assets that had come to market in recent years.

"If we were to see high-quality core assets come to market, we believe these will continue to attract strong investor appetite and competitive tension will likely push pricing closer to pre 2019 levels," she said.

"However, we may see repricing for secondary assets in non-core, non-cbd locations."

Source: JLL Hotels and Hospitality

Speaking about the region as a whole, JLL Hotels and Hospitality Head of Investment Sales for the Asia Pacific, Nihat Ercan, said there was currently little market evidence to suggest a correction has taken place from a pricing perspective.

"From a market perspective, I would say that would be buyers and sellers are still very much in the discovery phase," he said.

"Based on our analysis of recovery periods and likely cap rate movements, we see potential price corrections of anywhere between 10 and 30 per cent that are likely to take place from around the region."

"Overall, the recovery scenario looks a lot more prolonged than our initial anticipation, and could take anywhere from 12 to 24 plus months to return to the 2019 peak."

Similar to this:

Hotel owners and operators examining ways to reinvent themselves after COVID-19, says JLL

JLL announces APAC leadership changes to Hotels and Hospitality Group