'Safety, security and strong rule of law' to support Australian hotel recovery - CBRE

Contact

'Safety, security and strong rule of law' to support Australian hotel recovery - CBRE

CBRE's latest report, COVID-19: Implications for Asia Pacific Hotels indicates investors are still in a "wait and see" mode following the pandemic but CBRE Hotels Asia Pacific Executive Director Robert McIntosh believes competition for good assets in the Australian market is likely to become stronger as the year progresses.

The ability of Australian hoteliers to redirect their marketing toward domestic demand should enable a relatively good performance from the country's accommodation sector, in comparison with other Asia markets, CBRE Hotels says.

The firm's latest Asia Pacific Hotel Update discusses the implications of COVID-19 for countries in the region while outlining what challenges lie ahead from an investment perspective.

CBRE Implications of COVID-19 on Asia Pacific Hotels report - At a glance:

- Regional travel remains at a standstill owing to tight restrictions by authorities, significantly reduced air traffic and risk aversion by travellers.

- Until regional and international travel becomes easily available, growth will be confined to domestic and drive-leisure markets.

- There has been a substantial uplift in interest in easily accessible resorts.

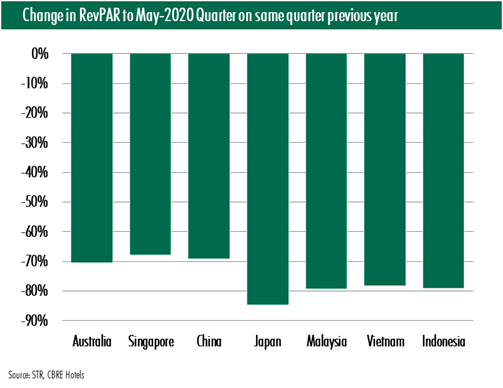

- Overall occupancy in Asia Pacific remains low at less than 30 per cent.

- Room rates are close to 50 per cent of what they were a year ago.

CBRE retains its forecast of a global recession in 2020, noting Asia Pacific GDP growth forecasts were revised down to -1.4 per cent from the previous forecast of 4.2 per cent made in January.

But CBRE Hotels Asia Pacific Executive Director Robert McIntosh told WILLIAMS MEDIA that while the Australian tourism market had been badly impacted by COVID-19, the country had a number of advantages over many of its Asian neighbours.

"Most importantly there is a very low rate of infection," he said.

"In addition there is a strong level of domestic demand which can partly offset the fall in that of international visitors.

"Australia has always had a good reputation for safety, security and a strong rule of law, all of which will support a recovery.

"The real challenge will be the economy which is forecast to be hard hit in comparison with Asian countries.

"Nevertheless the ability of hoteliers to redirect their marketing to domestic demand should enable a relatively good performance for Australian hotels."

According to the report, regional travel in the Asia Pacific region remains at a standstill owing to tight restrictions by authorities, significantly reduced air traffic and risk aversion by travellers.

Source: CBRE Research

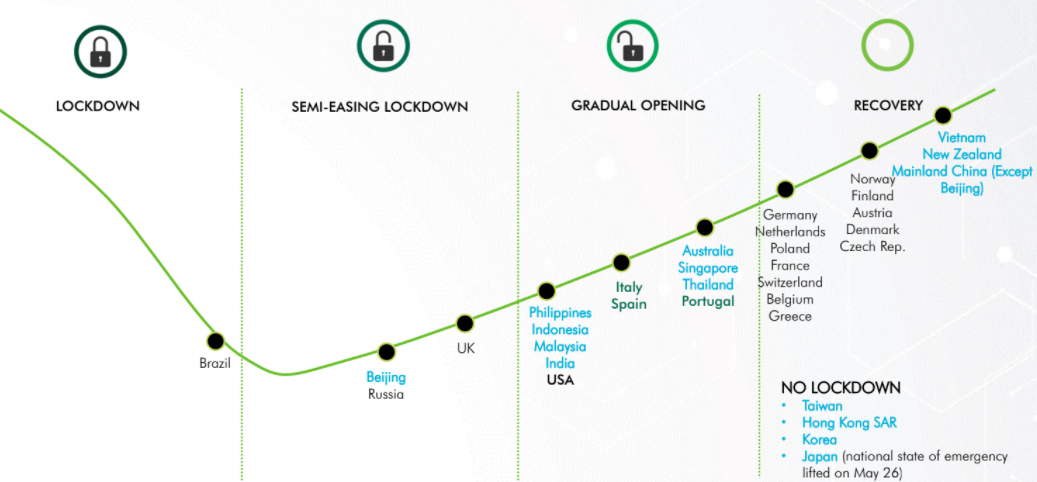

The research indicates while lockdown restrictions across the region gradually began lifting in mid-May, Until regional and international travel becomes easily available, growth will be confined to domestic and drive-leisure markets.

CBRE reports it has not yet seen any significant transactions that that indicate where prices now sit, with hotel investors still in "wait and see" mode.

Mr McIntosh said investors were looking for discounts that were not available, causing a slowing of sales activity.

"Until there is more clarity and reduced uncertainty as to the outlook buyers will be careful," he said.

"However the overweight of capital continues.

"As this year progresses there are likely to be vendors who choose to, or are forced to, sell, which will create more activity in the market.

"Poorer quality properties are likely to be more difficult to sell but the competition for good assets is likely to be strong."

Click here to download the report.

Similar to this:

CBRE to host hotel market webinar, Hotels in the New World: Navigating the Road to Recovery

'When people can move, they'll go holidaying' - Hotel experts look to the future