Previous market disruptors give glimpse into hotel sector recovery - Colliers report

Contact

Previous market disruptors give glimpse into hotel sector recovery - Colliers report

Previous market disruptors can provide insights into the timeline anticipated for the recovery of Australia’s Hotel sector, according to Colliers International’s Valuation in a COVID-19 Climate report.

Members of Australia's hotel industry believe it may be three years before revenue from the sector returns to 2019 levels, new research has found.

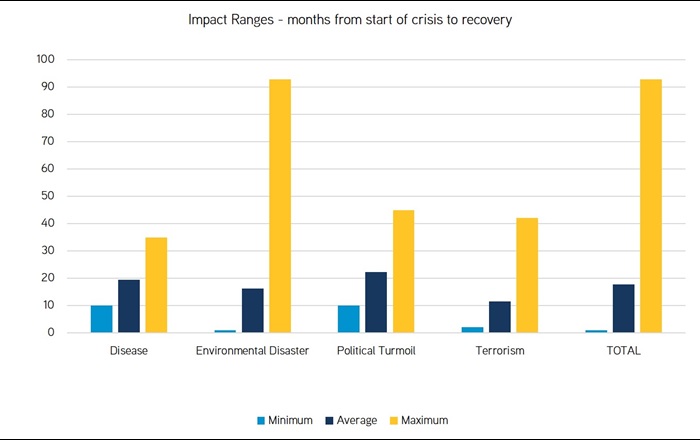

As part of its Valuation in a COVID-19 Climate, Colliers International used data from the World Travel and Tourism Council Report on Crisis Readiness (WTTC), released in November 2019, which measured the length of time markets took to recover from major crises.

After analysing the impact of 90 crises between 2001 and 2018, at a national and city level, and examining the time of recovery, WTTC came to the conclusion that the average recovery times for disease outbreaks, such as MERS, Zika and Ebola, was 19.4 months.

At a glance:

- Colliers' latest report, Valuation in a COVID-19 Climate, draws on data World Travel and Tourism Council Report on Crisis Readiness (WTTC), released in November 2019, to provide insights into the length of time markets take to recover from major crises.

- Colliers International Hotel Valuations National Director Michael Thomson says "nothing comes close" to COVID-19 in terms of disruptors to the market.

- Mr Thomson says there are both quantitative and qualitative tools which can be used to ensure hotel valuations remain accurate during the pandemic period.

Source: World Travel and Tourism Council Report on Crisis Readiness, November 2019

But Colliers International Hotel Valuations National Director Michael Thomson said the current pandemic presented a different challenge to markets.

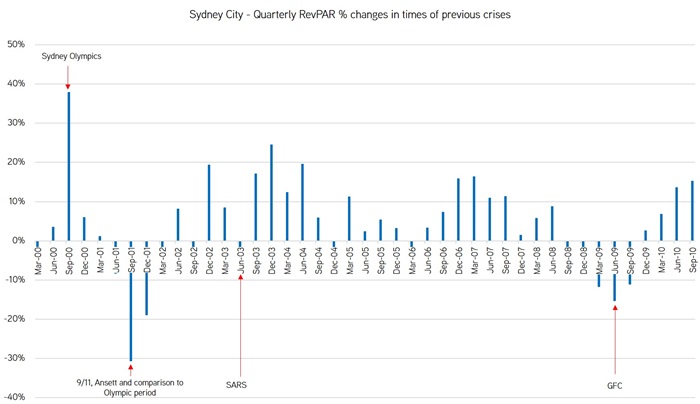

“We have been monitoring previous disruptors to the market including the SARS coronavirus but nothing comes close to the scale of the impact of COVID-19,” he said.

“There are many variables which will impact on the time scale on recovery from COVID not least the discovery of a vaccine with approximately 30 at trial stage around the world.

“However current thinking from various industry participants is a likely three year period until we see a return to 2019 revenue levels.

"This model assumes the opening up of all State and International borders in 2021.”

Source: ABS, Small Area Data/ Colliers International

Mr Thomson told WILLIAMS MEDIA Colliers’ report acknowledged the difficulty in valuing hotels in a fair and objective manner when trading was so heavily impacted.

“We believe there are both quantitative and qualitative tools which we can use to ensure hotel valuations remain accurate in this uncertain time,” he said.

“Quantitative sources include statistical data, our internal benchmarking model, clients trading accounts, and tracking of other statistical sources such as passenger numbers entering state capital airports and tracking transactional activity.

"In a market where it is so difficult to predict where cashflows are likely to go over the next two years at least, we believe the most appropriate valuation approach is the discounted cash flow, where the future income is projected ideally over a ten year period and based on longer term benchmarks, which will help to smooth out the likely volatility over the short term."

Christopher Milou, Head of Hotel Valuations at Colliers International, said the research had allowed for a more informed approach the valuation process, while at the same time acknowledging the market was having to operate in a climate with significant restrictions such as state and International border closures and social distancing restrictions.

“It is our opinion that any decline in values is likely from the market’s acceptance of a diminution in earnings due to COVID rather than any evidence that the market is significantly rerating the risk attached to hotel investments," he said.

“This clearly needs to be continually monitored but with finance costs still at all-time lows and predicted to continue to be so for some time, there are currently limited signs of upwards pressure on capitalisation rates.”

Click here to view the full report.

Similar to this:

New Zealand hotels well positioned but recovery will be protracted, says Colliers International

Australian hotels 'on the road to recovery' - Colliers International

'Revenge spending' to assist with Australian hotel recovery - Colliers International