Business pool lucrative for small hotel owners - BMT Tax Depreciation

Contact

Business pool lucrative for small hotel owners - BMT Tax Depreciation

Small hotel owners should make sure they have a general understanding of the available depreciation incentives that can boost their cash flow, according to BMT Tax Depreciation.

Property depreciation is one of the most reliable sources of cash flow for business owners.

Depreciation doesn’t discriminate and all hotel owners, no matter how small or unique their hotel is, can claim it each financial year.

A specialist quantity surveyor like BMT Tax Depreciation knows all the technical intricacies of depreciation.

However, it’s key that business owners also have a general understanding of the available incentives that can boost their cash flow.

What is property depreciation?

Depreciation is the natural wear and tear of a building’s structure and assets over time.

Owners of income-producing properties and business owners can claim depreciation as a tax deduction each financial year.

There are two categories of depreciation.

The first is capital works, which refers to the structural component of a building.

Some common capital works deductions that BMT find for hotel owners are on the walls, doors, elevators and windows.

The second category of depreciation is plant and equipment.

These are the easily removeable fixtures and fittings an in income-producing property holds.

Some common examples include furniture, kitchen equipment, carpets and hot water systems.

Click here to request a commercial tax depreciation schedule

Understanding the general small business pool

While the underlying principles of how depreciation works apply to everyone, there are same incentives in place for small business owners.

One of the most lucrative is the general small business pool.

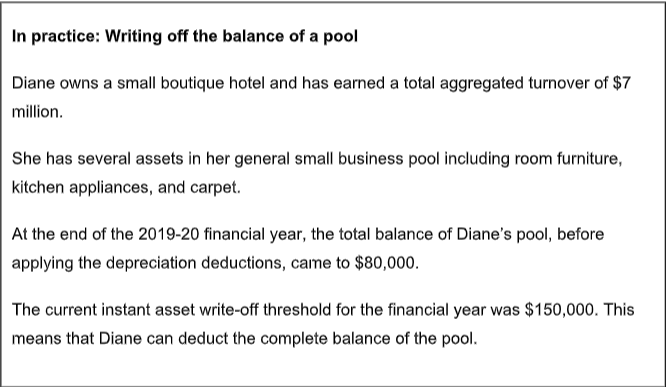

The pool is only available for business that meet the Australian Taxation Office classification of a small business.

Generally, a small business is one that has an aggregated turnover of $10 million dollars.

What can be depreciation in the general small business pool

Only plant and equipment items that are equal or above the current instant asset write-off threshold can be placed in the pool.

Once assets are pooled together, they are depreciated at an accelerated rate.

In the first year of being pooled, the assets depreciate at a rate of 15 per cent.

For following years, depreciation is further accelerated to a rate of 30 per cent.

How small hotel owners can instantly write off their pool

The instant asset write-off threshold is currently $150,000 and is in place until December 2020.

Before the increase, the threshold was $30,000.

This means that many general small business pool’s balances are below the new threshold.

In this scenario, the business can instantly write-off the entire depreciable balance of their pool, boosting their cash flow by tens of thousands in the single year.

BMT Tax Depreciation is the commercial specialist

For over twenty years, BMT Tax Depreciation has helped thousands of hotel owners maximise their cash flow with depreciation deductions.

BMT leave no stone unturned and ensure that owners claim everything they can.

To learn more about depreciation and how it can help your cash flow, contact BMT on 1300 728 276 or Request a Quote.

Similar to this:

Reducing fit-out costs when refurbishing your hotel function centre - BMT Tax Depreciation

Scrapping can boost a hotel’s cash flow - BMT Tax Depreciation