Discovering the most reliable source of cash flow for hotels - BMT Tax Depreciation

Contact

Discovering the most reliable source of cash flow for hotels - BMT Tax Depreciation

With the current climate arguably one of the toughest to be faced by hotel operators, reliable sources of cash flow are more important than ever, according to BMT Tax Depreciation.

Many variables can affect a hotel operator’s cash flow.

In order to remain economically sustainable in today's environment, hotel operators need to find reliable sources of cash flow.

While booking numbers go up and down, a source of cash flow they can always rely on is depreciation.

What is depreciation?

Depreciation is the natural wear and tear of a property and its assets over time.

For hotels, both the owner of the property and business operating from it can claim depreciation.

While it’s common for the same party to be the owner and operator, it’s important to be aware of the differences.

If the owner leases the building to a different operator they can only claim depreciation on the property’s structure and assets they own, while the operator can claim their own fit-out.

Click here to request a commercial depreciation tax schedule quote

How capital works deductions boosts cash flow

The structural component of a hotel can be depreciated using capital works deductions.

Some common capital works found in hotels include elevators, walls, swimming pools and stairwells.

For a commercial property, capital works deductions are generally available if the building’s construction commenced after 20 July 1982.

Capital works are depreciated at a set rate of 2.5 per cent of the asset’s original value.

They are often the most lucrative deductions due to high starting values and the extended period of time they are claimable.

Plant and equipment deductions are an added bonus

Hotel room furnishing, carpets, split system air-conditioners and reception seating are just some of the common plant and equipment items found in hotels.

Plant and equipment deductions work differently to capital works.

They are depreciated using either the prime cost or diminishing value rate of depreciation and have a designated effective life.

Hotel operators and owners may also be eligible to boost their plant and equipment deductions further through the increased instant asset write-off or Backing Business Investment incentive currently available.

Why is depreciation one of the most reliable sources of cash flow?

Many hotel operators are monitoring the current climate and experiencing a rollercoaster of changing guest numbers.

With bookings disappearing, some hotel operators are asking if depreciation is available even when guest numbers are low.

Operators must remember that as long as the property is genuinely available to produce income, depreciation deductions are available.

This means as long as the hotel is available for patrons to book in to, you can claim depreciation.

The same applies to other tax deductions such as utility costs, insurances and interest repayments.

The proof is in the numbers

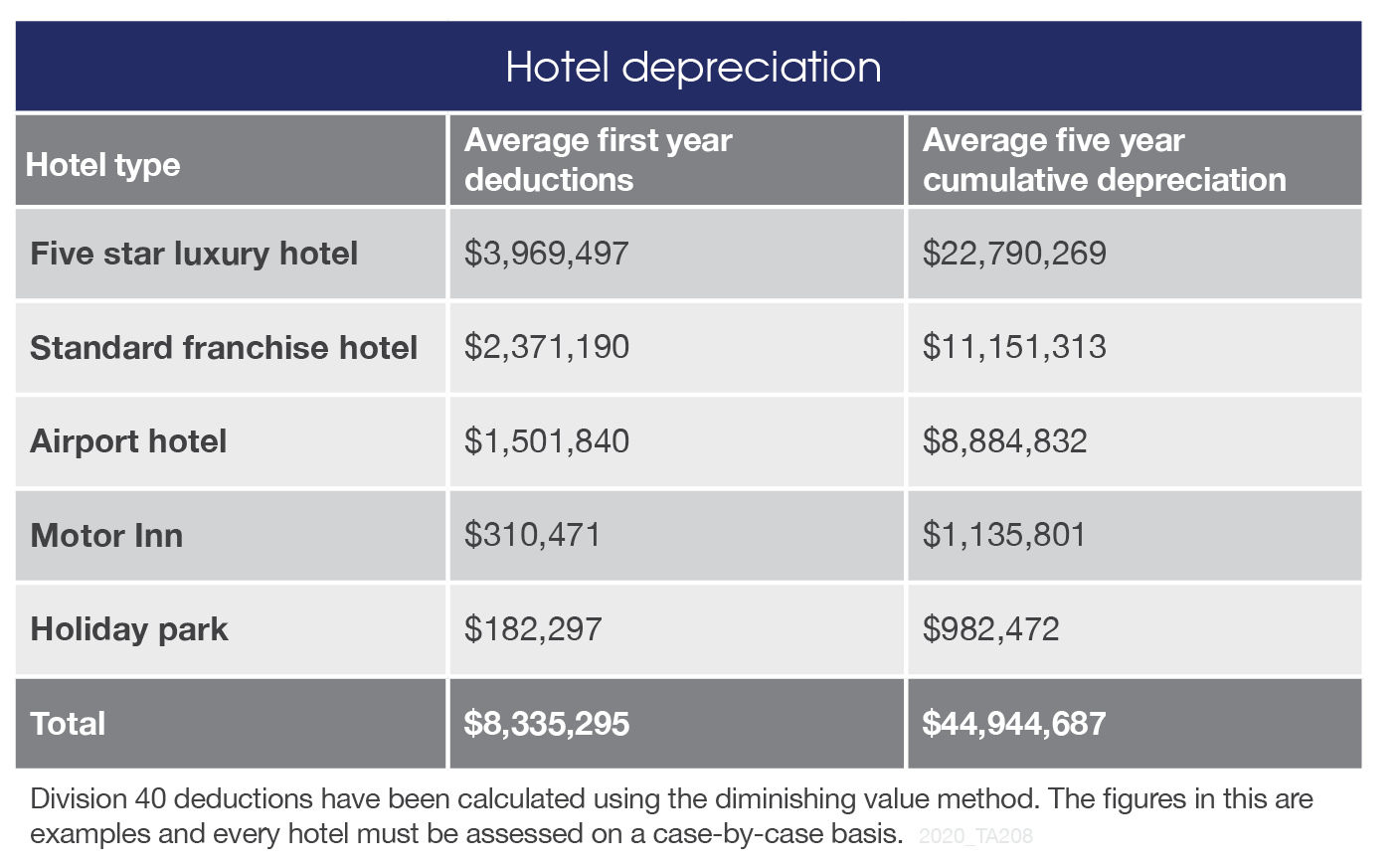

Any type of hotel or motel can take advantage of hundreds of thousands, sometimes millions, in depreciation deductions. From luxury city hotels to rural holiday parks, depreciation can boost an operators cash flow each year.

Sceptical? The table below are some average deductions BMT Tax Depreciation has found for similar hotels.

As you can see, any type of hotel can reap the benefits of claiming depreciation. Cumulative deductions can average in the tens of millions at the five year mark alone.

The only way hotel operators can take advantage of depreciation is with a tax depreciation schedule prepared by a specialist quantity surveyor, such as BMT.

The schedule lasts the lifetime of the property and the operator’s accountant will use it to maximise cash flow every financial year.

BMT Tax Depreciation has completed schedules on all types of hotels across the country.

They know what to look for and always ensure that depreciation deductions a maximised.

To learn more about depreciation and how BMT maximises claims, Request a Quote or contact BMT on 1300 728 726.

THIS IS A SPONSORED FEATURE ARTICLE

Similar to this:

Business pool lucrative for small hotel owners - BMT Tax Depreciation

Reducing fit-out costs when refurbishing your hotel function centre - BMT Tax Depreciation