Asia Pacific tourism and spend remain in a growth phase, presenting attractive investment opportunities - Colliers

Contact

Asia Pacific tourism and spend remain in a growth phase, presenting attractive investment opportunities - Colliers

Leading diversified professional services and investment management company Colliers today released the Hotel Insights Q2 2021 report, a quarterly digest of key trends in the Asia Pacific hospitality sector.

Leading diversified professional services and investment management company Colliers released the Hotel Insights Q2 2021 report, a quarterly digest of key trends in the Asia Pacific hospitality sector.

Govinda Singh, Executive Director, Valuation & Advisory Services, commented: "The global economic outlook continues to improve, with a cautious return to travel underpinned by a rebound in domestic demand, as witnessed in the US, UK and China. As the vaccination rollout gathers pace and more green lanes or corridors open, we expect a rapid recovery led by pent-up leisure demand, followed by business. Hotels across Asia Pacific should continue to attract capital as the hunt for yield continues. Yields, whilst relatively low currently, reflect capital values growth outpacing income, but this will increase to historic levels as performance improves. For those looking to invest, depending on motivation, most gateway and regional cities across Asia Pacific continue to be attractive."

Mr. Singh added; "The Singapore recent COVID-19 restrictions revealed that the hospitality sector remains one of the most vulnerable industries, mostly sustained by government support over the last 18 months. With the recent reopening in the US, and as mass vaccinations in Europe and China gain pace, the only ways to lead this sector out of the woods would be through higher vaccination rates, rapid testing and localised lockdowns. Singapore is well positioned for these, compared to most parts of the world. This raises the possibility of opening at least some travel corridors with similarly aligned countries. With this anticipation, hopefully we will witness a return of much-needed tourists to Singapore's hotels around Q4 this year!"

Cruise industry has been recovering quickly in H12021

The cruise industry faced its toughest year in 2020. In Asia, nearly all major cruises have been suspended since March 2020 and have altered future bookings until COVID-19 eases. Nevertheless, the industry is also one of the fastest recovering sectors in 2021. With pent-up demand for overseas travel, along with an increasing number of vaccinated citizens across various countries, the cruise sector in Asia has been picking up steam over the last six months. In Singapore, for example, more than 120,000 people have set sail on "cruises to nowhere," with no COVID-19 cases on board, since a pilot programme to reboot the cruise industry began last November. Colliers anticipates any meaningful recovery to continue to be directly linked to the removal of quarantine restrictions in both source and destination markets, as demand for cruises continues to ramp up with the rollout of mass vaccinations in Asia and worldwide. This will bode well for both home and destination ports, with Asia poised to become the largest source market for cruises globally over the next decade.

Deals are limited as hotel owners wait and see

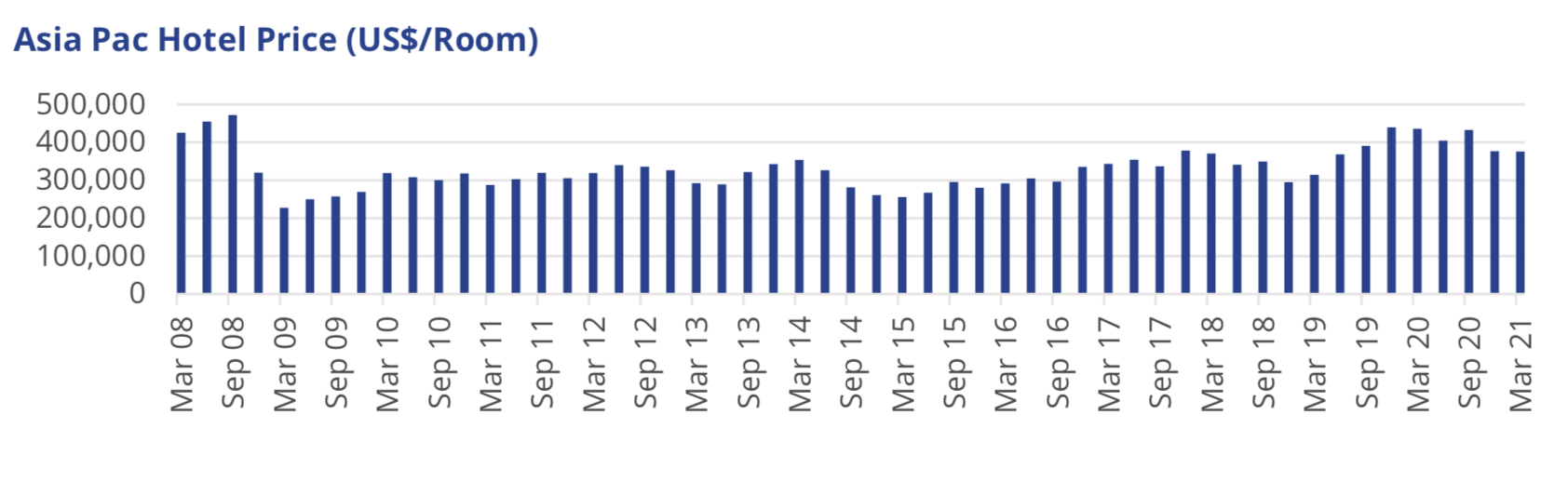

Investors have placed more faith in hotels in urban areas and established resort destinations, with transactions of limited-service hotels still higher than 2017 levels. In addition, Colliers notes that some hotels have managed to break even with the trickle of lesiure and extended-stay business arrivals, while others have signed up as quarantine facilities. Although green lanes for business travel have emerged, the development of travel bubbles has been slow. Deals in areas such as the South Pacific and Southeast Asia have been limited, with owners adopting a wait-and-see approach, as banks are more willing to offer forbearance given stronger balance sheets and lower exposure to leverage covenants.

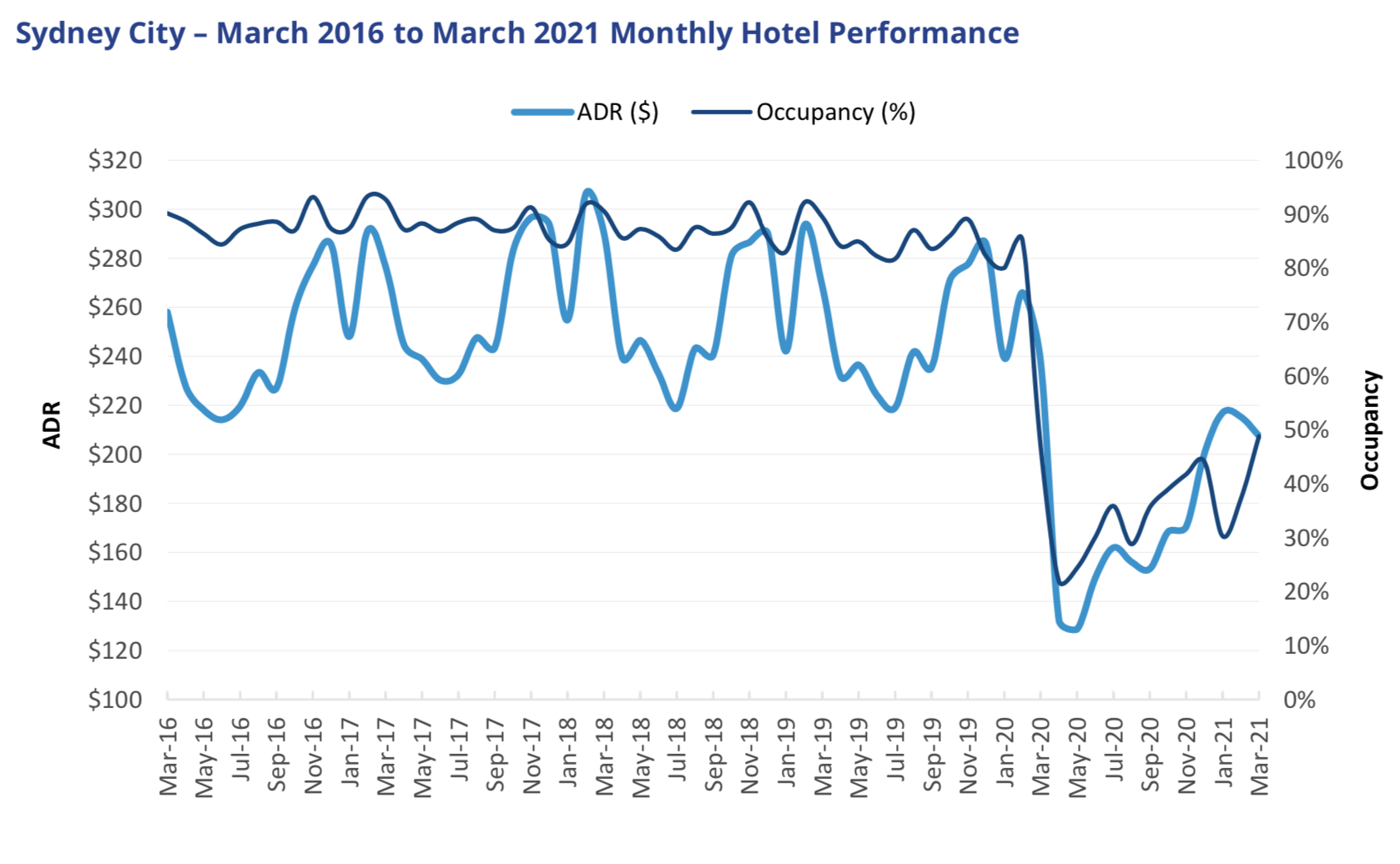

Increasing interstate travel should improve Sydney hotel performance

In 2019, hotels in Sydney achieved year-round occupancy levels of 85.4%. In 2020, however, full-year occupancy levels were significantly down at a historic low of 43%, compared to the same period in 2019, as the restrictions on travel due to COVID-19 were realised. Demand for hotels in 2020 was predominantly from those undertaking the mandatory quarantine period in hotels and a small proportion of intrastate leisure demand. In the month of March 2021, Sydney hotels recorded a higher occupancy compared to March 2020, where occupancy levels were 48.8%, compared to 47% in March 2020. This may signal that the market is starting to recover.

Gus Moors, Head of Hotels, Hotel Transaction Services, Australia, commented: "The current demand for hotel is predominated by guests serving their mandatory quarantine period and a small proportion of instrastate leisure demand. Recent hotel performance figures for March 2021 do show some improvement, and as interstate travel builds, this performance is anticipated to improve over the course of the year. With more people getting vaccinated and travel restrictions ease, travel demand from domestic and international travellers is likely to increase."

Domestic demand to prop up Japan's accommodation market

In 2021 and throughout Q1 2022, Japan's accommodation market will be supported mostly by domestic demand, with little demand from international visitors, except for the limited capacity that the much delayed Olympics will take up in H2 2021, given the current restrictions. It is possible that accommodation demand from international visitors will recover after restrictions on sightseeing tours are relaxed and COVID-19 is resolved through the provision of vaccines and various other policy measures. As such, it is likely that the number of incoming international visitors will not recover to 30 million annually until after domestic accommodation demand has recovered, and certainly not before 2023.

View Colliers Hotel Insights Q2 2021 report here.

Similar to this:

Why independent hotels need to automate to rebound from COVID-19 - IDeaS

New Zealand business events industry hails return of Australian buyers

Olivia Newton John’s beloved Gaia Retreat & Spa for sale by Colliers