Pub, hotel and tavern depreciation - BMT Quantity Surveyors

Contact

Pub, hotel and tavern depreciation - BMT Quantity Surveyors

The pub sector is a competitive arena. To retain popularity, pubs and taverns will often be made over, restored to former glory or reinvented entirely.

In doing so, pub and tavern operators and owners can claim thousands of dollars back annually with a tax depreciation schedule.

Tax depreciation is a tax deduction claimed for the natural wear and tear of an income- producing building and its assets over time. It is generally the second biggest tax deduction for property investors, after interest.

There are two types of depreciation. Capital works is claimed on the building’ structure and items that are permanently fixed to the property. And plant and equipment works are items which are easily removable from the property or are mechanical in nature.

Items such as drink dispensers, gaming machines, chairs and tables, glassware, carpet, air- conditioning units, glass washers, A/V equipment, cool room refrigerators and even the bar itself are all depreciable.

As pubs and taverns are regularly renovated by their owners, it’s important to keep in mind that additional deductions may be available to claim when renovating or installing new assets.

The Australian Government has introduced current temporary tax depreciation incentives and policies to boost economic growth and support businesses after the impacts of COVID- 19 by accelerating depreciation deductions.

These incentives include temporary full expensing, increased asset write-off and backing business investment. Under temporary full expensing eligible businesses may be able t claim an immediate deduction for the business portion of the cost of an asset. Business’s eligible for increased asset write-off may be able to claim an immediate deduction for the business portion of the cost of an asset. And business eligible for the backing business investment may be able to deduct the cost of new depreciating assets at an accelerated rate.

Depreciation case study: A Newcastle hotel

‘Business A’ is a medium-sized business running a hotel (a pub with accommodation) in Newcastle. The hotel was purchased in 2018 for around $5 million and is owner operated. The hotel was expanded in 2021.

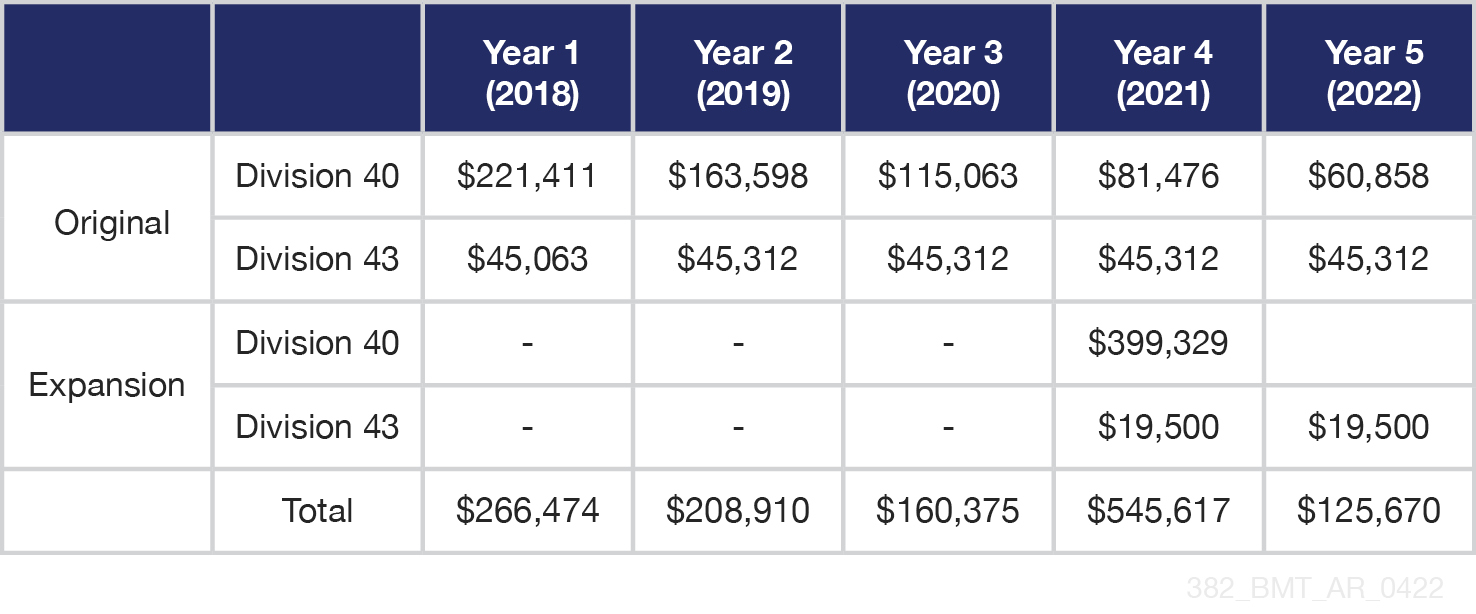

The following table outlines the available depreciation deductions and instant asset write offs before and after the expansion.

In year four when the expansion took place, the owner was able to claim the entire plant and equipment works amount due to current temporary tax incentives, while continuing to claim capital works through yearly depreciation deductions.

Here we can see a breakdown of the deductions from the top five new plant and equipment assets from the expansion.

This shows that there are significant deductions available to be claimed, both from depreciation as well as on new assets that fall under the instant asset write-off.

It’s always best to speak with a trusted accountant so they can assess your financial position.

BMT Tax Deprecation are quantity surveying experts with specialist knowledge in commercial deprecation. To find out more about pub and tavern depreciation contact BMT on 1300 728 726 to or Request a Quote via the link below.

The examples used within this article are based on a specific business entity, location and size, this information should not be used as a quote.