Depreciation at the snow – ski resort case study by BMT

Contact

Depreciation at the snow – ski resort case study by BMT

BMT Tax Depreciation outlines the depreciation deductions available for ski resorts and just how advantageous they can be.

The Australian snow season has well and truly kicked off with many ski resorts having opened a week earlier than planned.

While many people are shredding up the slopes, it’s no time for ski resort operators to forget about the lucrative depreciation deductions available.

Here, BMT Tax Depreciation outlines the depreciation deductions available and just how advantageous they can be.

What is depreciation and what does it look like in a ski resort?

Property depreciation is the natural wear and tear of a building and the assets within it over time. The Australian Taxation Office (ATO) allows owners of income-producing properties to claim this as a tax deduction.

There are two types of depreciation claimable. Capital works deductions (Division 43) can be claimed on the building itself and assets permanently fixed to the property, and plant and equipment depreciation (Division 40) is claimable on the assets that are easily removable from the property or mechanical in nature.

There are substantial capital works and plant and equipment deductions in ski resorts. Some of the commonly found capital works deductions in a ski resort include car parks, flooring and ducting for heating. Some of the commonly found plant and equipment deductions include ski equipment, chair head grips and snow grooming assets.

The following case study focuses on the plant and equipment deductions found in a ski resort located in Perisher Valley.

Case study: Plant and equipment depreciation available in a ski resort

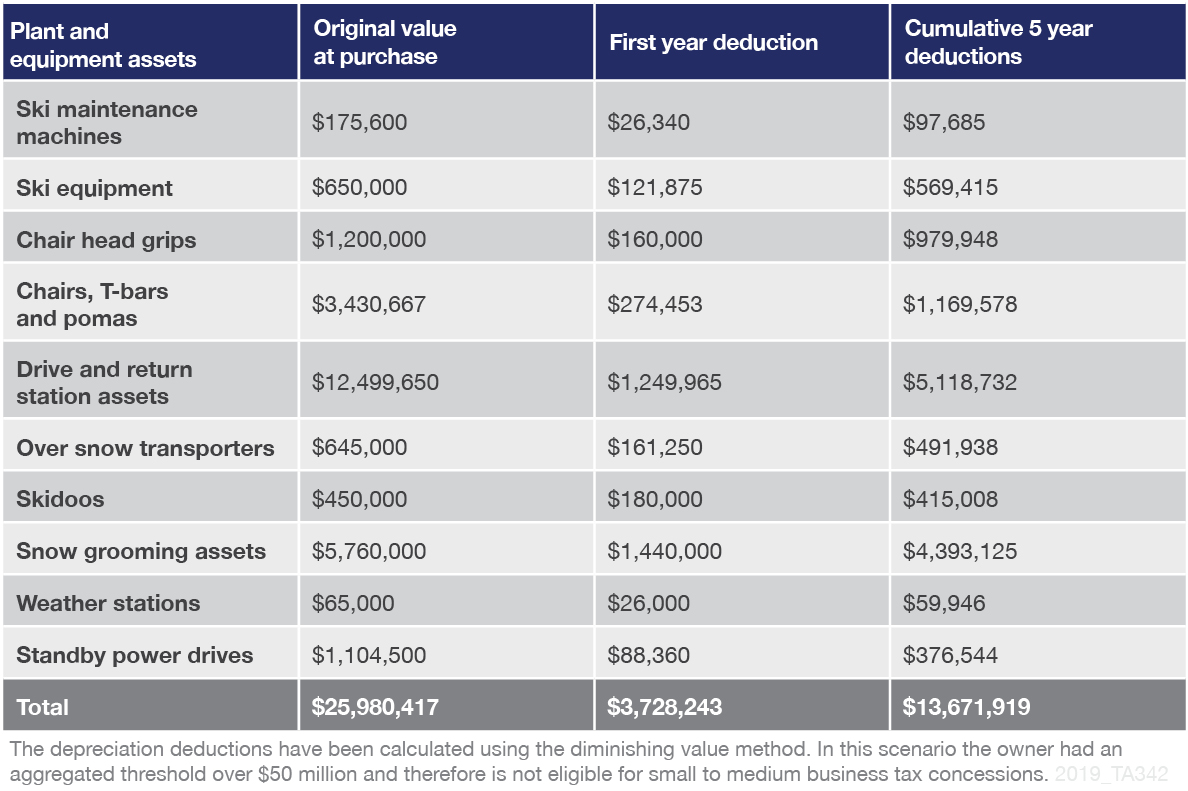

Rose and Noah are owners of a large sporting organisation that recently acquired a ski resort. The resort was purchased during the summer so they could upgrade the facilities with several new assets during the lull period. The below table provides an overview of ten assets they purchased and the deductions available.

Shortly after purchasing and installing the new assets, Rose and Noah organised an update to their tax depreciation schedule.

Rose and Noah could claim over $3 million for the listed plant and equipment assets in the first financial year alone. In the cumulative five years, this figure increased to over $13 million. Given this is based on just ten plant and equipment assets, there are significant depreciation deductions to be claimed for the entire property.

Because the depreciation deductions boosted their cash flow, they were able to further renovate the interior of the resort such as guest rooms, dining areas and the resort foyer.

BMT Tax depreciation conduct physical site inspections to ensure all tax depreciation schedules are maximised and fully ATO compliant. Their comprehensive commercial schedules include every business incentive available.

To find out more about the lucrative depreciation deductions available in ski resorts call the depreciation specialists on 1300 728 726 or Request a Quote.

The information provided in this article is of general use only and should not be used as a quote or advice. BMT recommend consulting an accountant before making financial decisions. Contact BMT for a specialised tax depreciation schedule.

Related Reading: