Effective lives of hotel assets

Contact

Effective lives of hotel assets

BMT Tax Depreciation outlines the methods of depreciation and the effective lives of some commonly found assets within a hotel.

Many hoteliers are aware of the benefits of claiming depreciation, but what they might not know is that different assets have different effective lives meaning they can be depreciated at varying rates.

Here, BMT Tax Depreciation outlines the methods of depreciation and the effective lives of some commonly found assets within a hotel.

Plant and equipment depreciation explained

Plant and equipment (Division 40) assets are easily removable from the property or mechanical in nature.

Unlike capital works (Division 43) which depreciate at a rate of 2.5 per cent over forty years, every plant and equipment asset has its own effective life, which determines the rate it depreciates using one of two methods.

The effective life of an asset is set by the Australian Taxation Office.

Depreciation methods

There are two methods of calculating plant and equipment depreciation. Under the diminishing value method, the deduction is calculated as a percentage of the balance you have left to deduct. This method returns higher depreciation deductions in the first years of ownership of the property. The diminishing value method decreases in value each year, so depreciation claims drop, until assets run out (or are rounded down to zero).

Under the prime cost method, the deduction for each year is calculated as a percentage of the cost. This method returns a straight-line depreciation amount until the full value of assets are claimed. It returns greater deductions in the latter years than the diminishing value method and allows investors to reply on a more consistent depreciation claim each year. It’s suitable for investors looking to maximise their depreciation in later years.

The diminishing value method is typically more common as it generates higher deductions in the first few years. Once a method of depreciation is chosen, it can’t be changed.

Low-value and low-cost pooling

Low-cost assets are those depreciable assets that have an opening value of less than $1,000 in the year of acquisition.

Low-value assets are those which have depreciated over one or more years and now have a written down value of less than $1,000. This means the asset’s value was more than $1,000 in the year of acquisition but the residual value of depreciation is now less than $1,000.

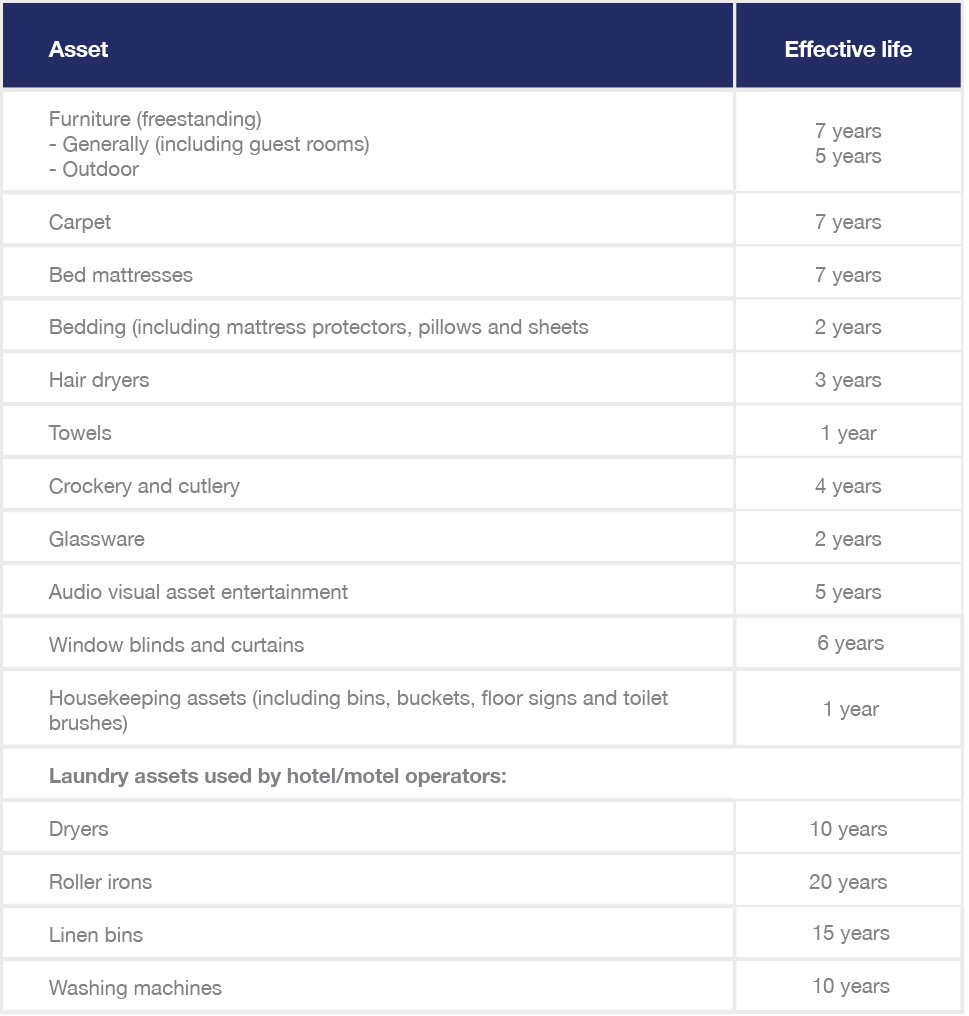

The following table outlines the effective lives of commonly found assets in a hotel.

As we can see there are different effective lives according to each asset. Items that are typically replaced more often such as housekeeping assets, bedding and glassware have shorter effective lives whereas assets that last longer and are typically replaced less frequently like carpet, furniture and bed mattresses have longer effective lives.

It’s not unusual for the same asset to have a different effective life across different industries. The reason for this is that the asset may be used more frequently, at different intensity levels and for a different purpose, in one industry than another.

For instance, freestanding furniture in a hotel has an effective life of seven years whereas freestanding furniture in retail has an effective life of ten years. This is because furniture in a hotel room is used more and for longer periods than in a retail space.

Use the BMT Rate Finder to calculate the effective life and depreciation rate in both the diminishing value and prime cost method for all plant and equipment assets.

Government depreciation incentives

There are various government incentives available to accelerate depreciation deductions.

These incentives include temporary full expensing, increased asset write-off and backing business investment. Under temporary full expensing eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year it is first used or installed ready to use for a taxable purpose. Find more information on the available incentives here.

To learn more about the effective life of assets and how they can be depreciated call BMT on 1300 728 726 or Request a Quote.

The information provided in this article is of general use only and should not be used as a quote or advice. BMT recommend consulting an accountant before making financial decisions. Contact BMT for a specialised tax depreciation schedule.

Related Reading:

Depreciation boost returns for luxury hotel operators - BMT | The Hotel Conversation

Top tips for hoteliers in 2022 - BMT Tax | The Hotel Conversation

Pub, hotel and tavern depreciation - BMT Quantity Surveyors | The Hotel Conversation

Depreciation at the snow – ski resort case study by BMT | The Hotel Conversation