What depreciation looks like in a hotel kitchen - BMT

Contact

What depreciation looks like in a hotel kitchen - BMT

BMT Tax Depreciation outline what deductions look like in a hotel kitchen, how they’re claimed and what hoteliers should know to improve cash flow.

Hotel kitchens are one of the busiest areas of a hotel, not only servicing guest rooms but also on-site restaurants, catering for internal and external events, and staff meals depending on the location and type of hotel.

BMT Tax Depreciation outline what deductions look like in a hotel kitchen, how they’re claimed and what hoteliers should know to improve cash flow.

Deductions in a hotel kitchen

Commercial kitchens are a space where depreciable assets are abundant. Many kinds of kitchen assets qualify for depreciation and can make up thousands of dollars in deductions.

Commercial kitchens can cost anywhere from $15,000 - $350,00 for construction and a further $80,000 for kitchen equipment. These prices vary depending on size and the level of finish.

Hotel kitchens are designed and manufactured to be easily cleaned, have ample storage space and have an efficient layout to ensure operations are fluid and accident-free for staff. The assets within hotel kitchens clearly represent these standards with stainless steel materials, well-built appliances and overall quality fit-outs.

Plant and equipment assets within a hotel kitchen

Hotel kitchens are unique as their contents are nearly entirely plant and equipment assets due to their easily removable and mechanical nature. Preparation benches, ovens, kitchen hoods, storage cabinets and light fixtures are all categorised as plant and equipment.

The table below displays some commonly found plant and equipment assets in a hotel kitchen and their effective lives.

Plant and equipment assets are depreciated based on their effective life set by The Australian Taxation Office at a rate based on the selected depreciation method.

The diminishing value method is most common as it yields higher deductions in the earlier years of ownership, whereas the prime cost (straight line) method yields the same amount in deductions, but more consistently over the life of the asset. There is also a low-value pool available for assets costing $300 or less.

The owner selects which method is used to calculate deductions and if qualifying assets are pooled.

Capital works in a hotel kitchen

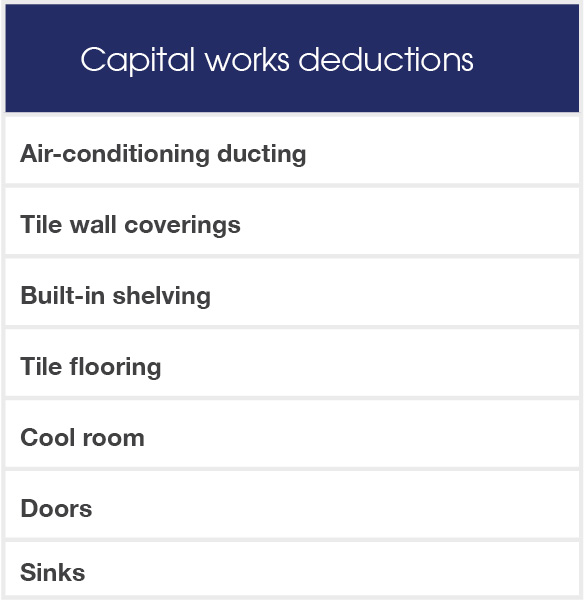

While hotel kitchens are mainly plant and equipment assets, this doesn’t mean capital works aren’t significant. The building’s structure itself yields deductions along with flooring, sinks, cool rooms and more.

The table below outlines some commonly found capital works deductions in a hotel kitchen.

These are only a few capital works deductions in a hotel kitchen, there are many more depending on the kitchen fit-out and size.

The table below demonstrates the yearly rate of depreciation for capital works based on the year construction was completed.

It’s important to get in touch with a quantity surveyor even if a property was constructed before 1979, especially in commercial property where upgrades and renovations occur regularly.

Scrapping

Scrapping is common, especially in hotels where renovations and upgrades occur often. Scrapping allows owners to claim the un-deducted value of removed assets.

The scrapping value is calculated as follows:

Scrapping value = original depreciable value – deducted value to date

For instance, if owners scrapped two ovens with a remaining value of $650 each, the owners are eligible to immediately deduct the total unclaimed amount of $1,300 in the same financial year they were removed.

This applies to all assets with remaining value and capital works deductions in scenarios where substantial renovations are completed.

Government incentives

There have been various temporary incentives and policies introduced by the Australian Government to boost economic growth and support businesses throughout the COVID-19 pandemic available until the end of the 2022/23 financial year.

These incentives include temporary full expensing, increased asset write-off and backing business investment. Under temporary full expensing eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year it is first used or installed ready to use for a taxable purpose. Find more information on the available incentives here.

The key to maximising claims is through site inspections

Because every commercial property is unique, only a tax depreciation specialist like BMT Tax Depreciation can ensure schedules are maximised and all deductions are identified and claimed correctly according to the commercial industry.

BMT conduct site inspections to ensure schedules are comprehensive while also applying all government business incentives where applicable.

To learn more about the deductions available in hotel kitchens, call BMT on 1300 728 726 or Request a Quote.

The information in this article is general in nature and shouldn’t be taken as a quote or a guaranteed outcome.