Australian hotels sector in strong recovery as ADR and RevPAR grow - Savills

Contact

Australian hotels sector in strong recovery as ADR and RevPAR grow - Savills

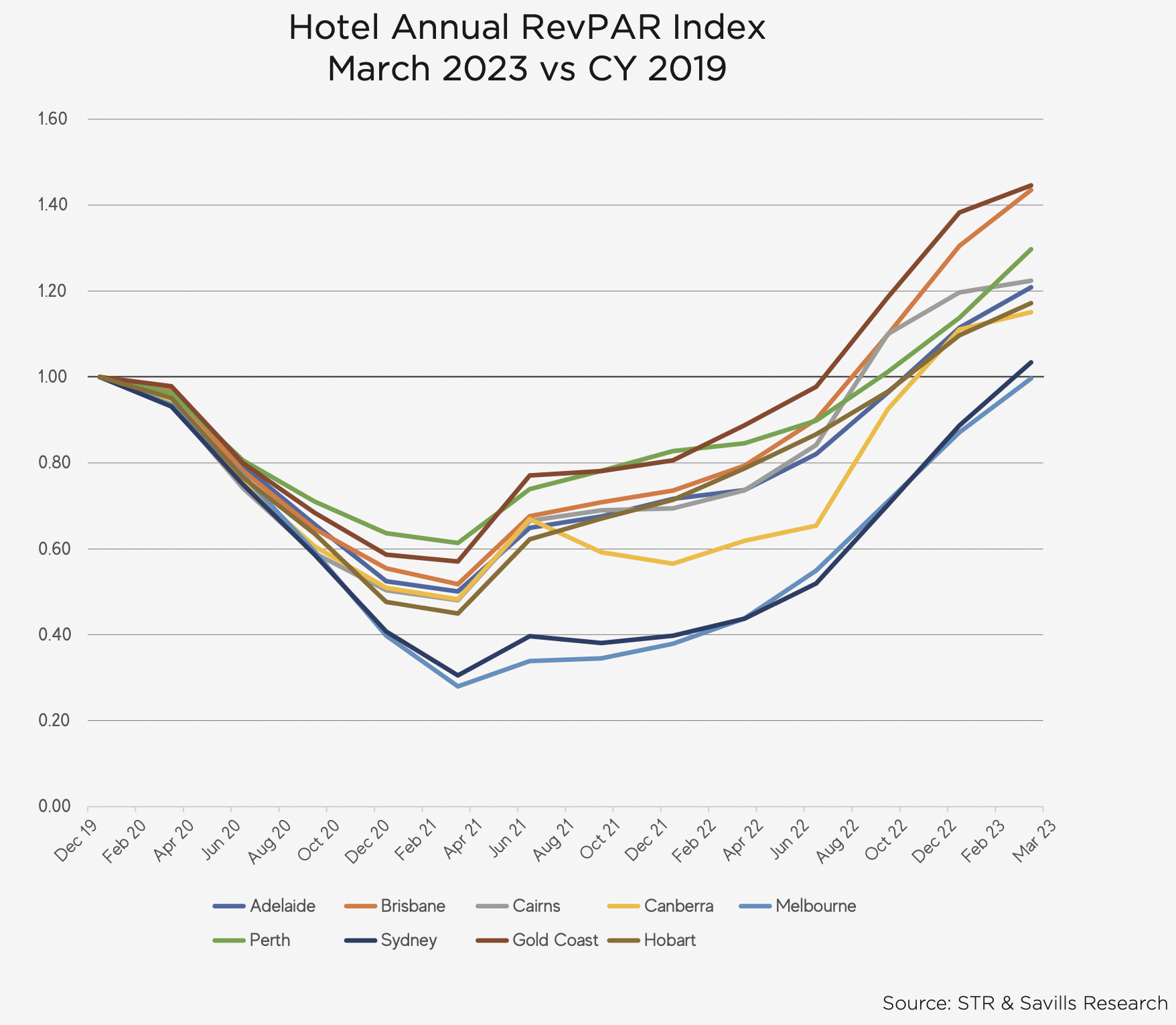

The Australian hotel market is showing strong signs of recovery with ADR growth driving the rebound, according to new data from Savills Australia and New Zealand.

The Australian hotel market is showing strong signs of recovery with ADR growth driving the rebound, according to new data from Savills Australia and New Zealand. With ADR averaging a third higher than pre-COVID levels, the sector is making steady progress towards pre-pandemic levels, while showing solid potential for further growth with occupancy still having significant room to improve across the country.

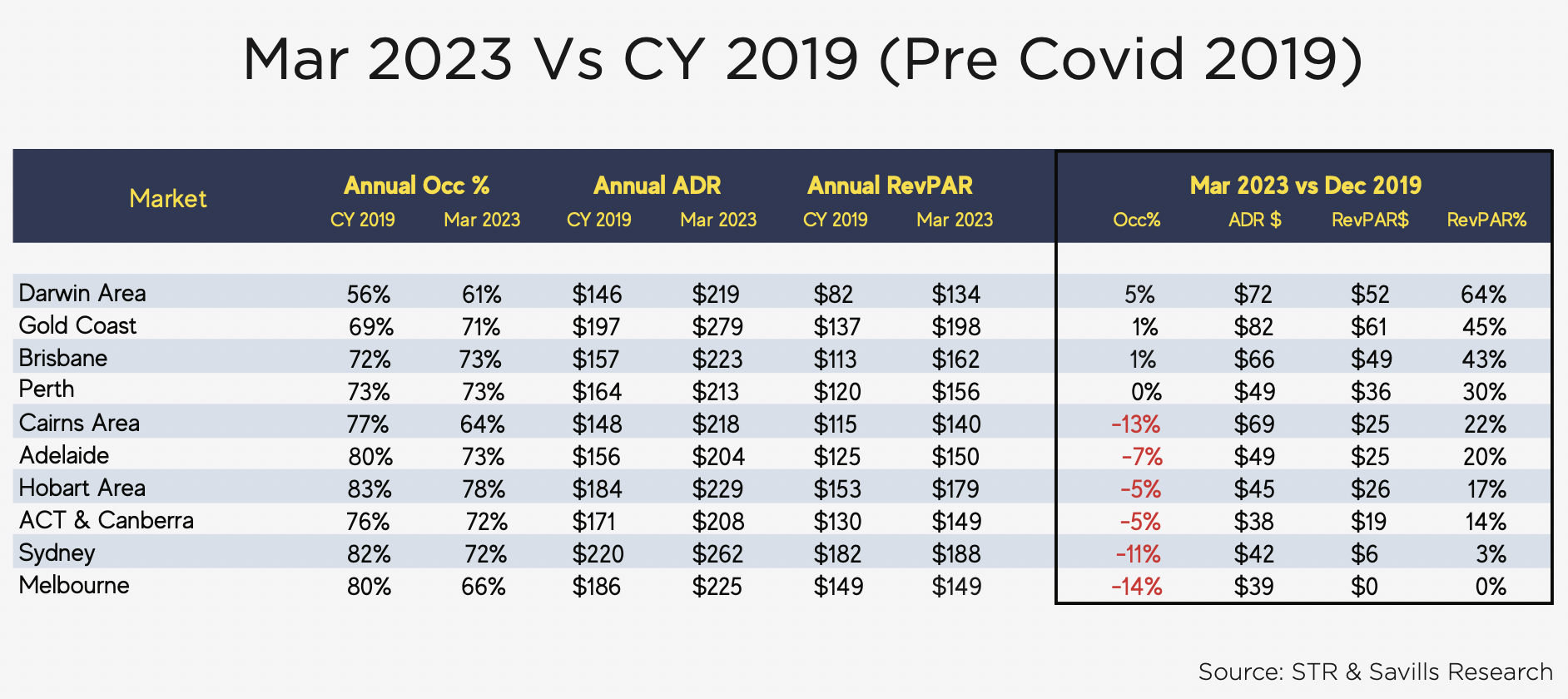

The data shows the rolling 12 months up to March 2023 have seen the highest ADR growth across cities such as Darwin (50%), Cairns (47%), Brisbane and the Gold Coast (42% respectively) compared to the same period in 2019. These locations are up from figures in 2018, with the exception of Sydney and Melbourne, which are just below pre-COVID levels.

For the same period to March 2023, the figures show every major market is now at pre-COVID RevPAR levels with Darwin again showing the largest growth across the country at 64%, followed by the Gold Coast (45%) and Brisbane (43%) for the same period.

Speaking on the data, Max Cooper, Director of Hotels at Savills Australia and New Zealand said, “What we are seeing in the current hotel market is not typical of recovery in past cycles; this is a rate-led recovery, not occupancy-led and is supported by new product in most major markets.”

Meanwhile, Savills’ National Director of Valuations and Advisory, Adrian Archer said “The trading performance across the country is incredibly strong, with the key to RevPAR growth mainly being that operators have held strong on ADR as occupancy recovers.”

Occupancy in most cities still lags below that of 2018 figures, the strongest hit being the gateway cities of Sydney and Melbourne but exponential growth in these locations is expected as international tourism starts to return in earnest.

Speaking on these east coast markets, Nick Lower, Savills’ State Director – NSW & VIC, Hotels said, “With Sydney and Melbourne being the largest cities in terms of supply, these markets are also more reliant on international tourism and corporate travel than any other states, but with those markets returning we predict strong trading conditions ahead for both markets.”

Mark Durran, MD, Hotel Capital Markets at Savills noted, “With corporate FIT travel still around 70%+ of pre-COVID levels, business travel demand also has significant headroom to grow and drive occupancy this year particularly in the major capitals.

“Sydney Airport is almost back to pre-pandemic levels of activity with an approx. 87% recovery in passenger movements in March 2023 compared to March 2019,” he added.

Click here to view and download the report.

Related Reading: