Unravelling the tax benefits of depreciation in hotel gyms - BMT

Contact

Unravelling the tax benefits of depreciation in hotel gyms - BMT

BMT Tax Depreciation delves into the depreciation deductions found with hotel gyms and examines a case study where hoteliers apply the Instant Asset Write-Off following upgrades.

Hotel gyms and fitness centres are now indispensable amenities for contemporary travellers aiming to uphold their fitness regimens on the go. With cutting-edge equipment and expert trainers, these gyms provide diverse fitness facilities.

BMT Tax Depreciation delves into the depreciation deductions found with hotel gyms and examines a case study where hoteliers apply the Instant Asset Write-Off following upgrades.

What does a hotel gym look like?

Hotel gyms can offer a range of equipment and additional amenities. Some hotel gyms have a fully equipped gym along with saunas and lap pools, while others have a more standard setup.

Typically, a hotel gym will have treadmills, stationary bikes, weight benches, free weights and various weightlifting and cardiovascular machines. Many hotels will also have changing rooms that house personal lockers and bathroom amenities.

Government-introduced incentives

The Australian Government extended the Instant Asset Write-Off, at a lower level, as part of the 2023 Federal Budget.

Under the Instant Asset Write-Off, businesses with an aggregated turnover of less than $10 million can immediately deduct the full cost of qualifying assets less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. This is on a per-asset basis, meaning multiple assets can be written off as long as they qualify.

Hoteliers may find applying these incentives ideal, particularly if they’re planning to invest in new gym equipment or upgrade existing facilities.

Depreciation within hotel gyms

Hotel gyms are home to lucrative depreciation deductions. Gym assets such as exercise machines and equipment, ceiling fans, blinds and light fixtures are depreciated as plant and equipment (Division 40) assets. The structure itself and permanent assets such as air conditioning vents, flooring, shelving, basins, and toilet bowls are depreciated as capital works (Division 43).

Because depreciation is a non-cash deduction, hoteliers don’t need to spend money to claim it.

Case study: Hotelier applies the Instant Asset Write-Off following upgrades of gym assets

“Hilltop Hotel” has a fitness centre with a fully equipped gym. The owners of Hilltop Hotel made improvements to the gym fit-out in July 2023, this qualified them to apply the Instant Asset Write-Off.

The upgraded assets included new exercise machines, a free weight area, TVs, surround sound and more. In this scenario, only the plant and equipment assets were upgraded.

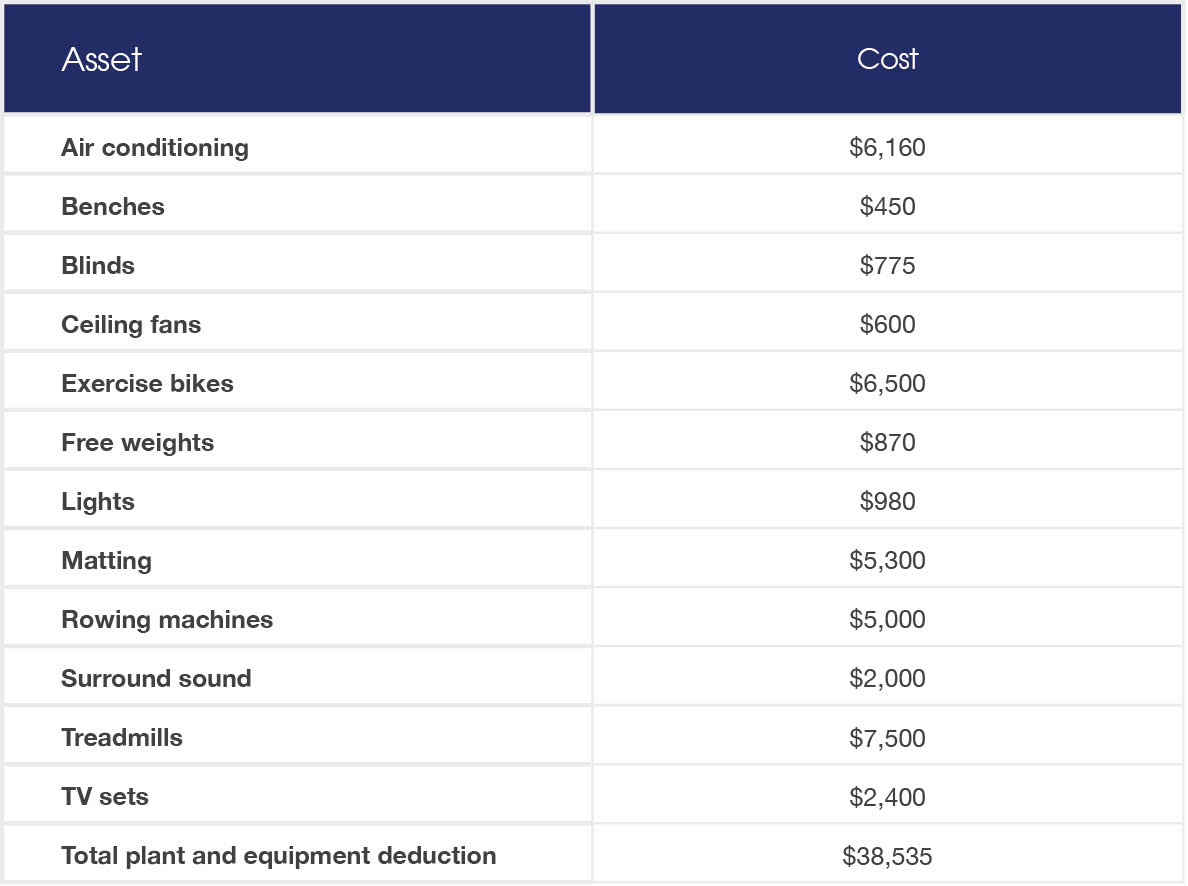

Table 1 shows the plant and equipment depreciation claim for the gym area of Hilltop Hotel following the upgrades and a breakdown of each asset and its cost.

Table 1: Plant and equipment deduction breakdown

The deductions listed in Table 1 are only plant and equipment assets within the gym and these deductions make up only a portion of what the hotelier can claim.

Because each asset costs less than $20,000, the owners were able to claim an immediate deduction for the full cost of the assets purchased.

In this scenario, the same assets have been grouped, however, they would be applied separately on an asset-by-asset basis. If the Instant Asset Write-Off wasn’t applied, and general depreciation rules were used, each asset would have been depreciated at a set rate over its effective life.

To optimise deductions and enhance cash flow, it's essential to obtain an ATO-compliant tax depreciation schedule prepared by experienced quantity surveyors, such as BMT Tax Depreciation.

Hoteliers wanting to know more about how to maximise deductions within hotel gyms should contact BMT on 1300 728 726 or Request a Quote.

The information in this article is general in nature and shouldn’t be taken as a quote or a guaranteed outcome.

Related Reading:

Hotel spas hold deluxe depreciation deductions - BMT

Hotels go green – improve sustainability by claiming depreciation deductions - BMT