JLL Report - Return of international visitors boosts hotel sector, but is New Zealand ready for Swift-hotel-onomics?

Contact

JLL Report - Return of international visitors boosts hotel sector, but is New Zealand ready for Swift-hotel-onomics?

Nick Thompson Senior Vice President, Investment Sales JLL advises research by JLL, shows that as NZ international tourist numbers edge closer to pre-pandemic levels, hotels have experienced a resurgence in bookings.

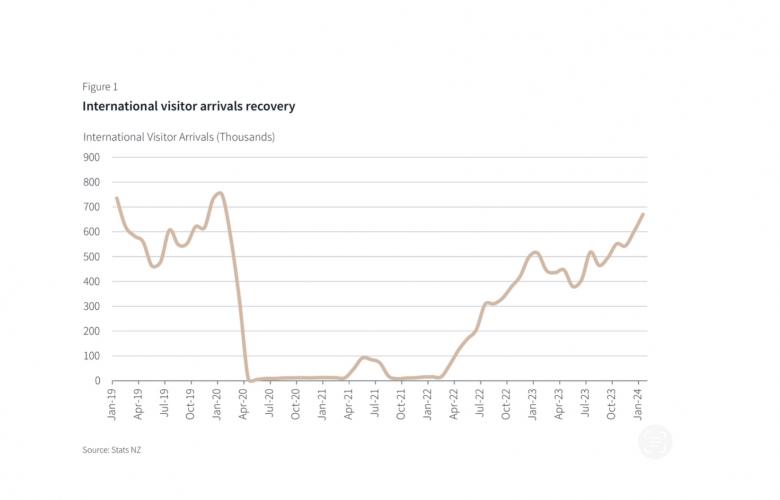

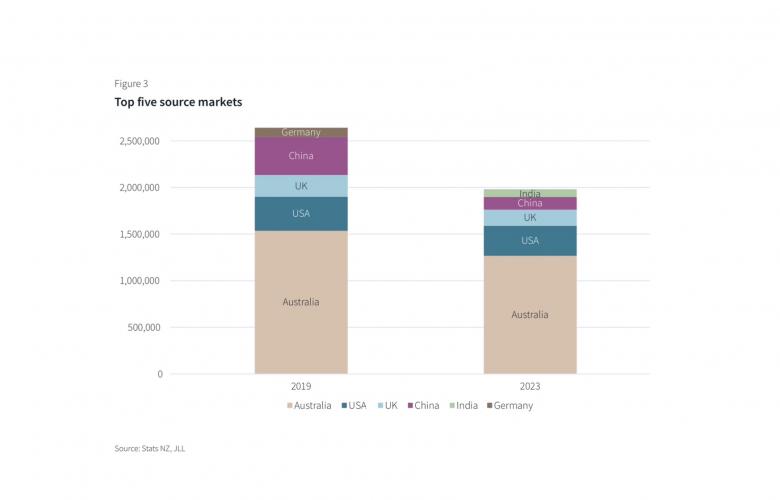

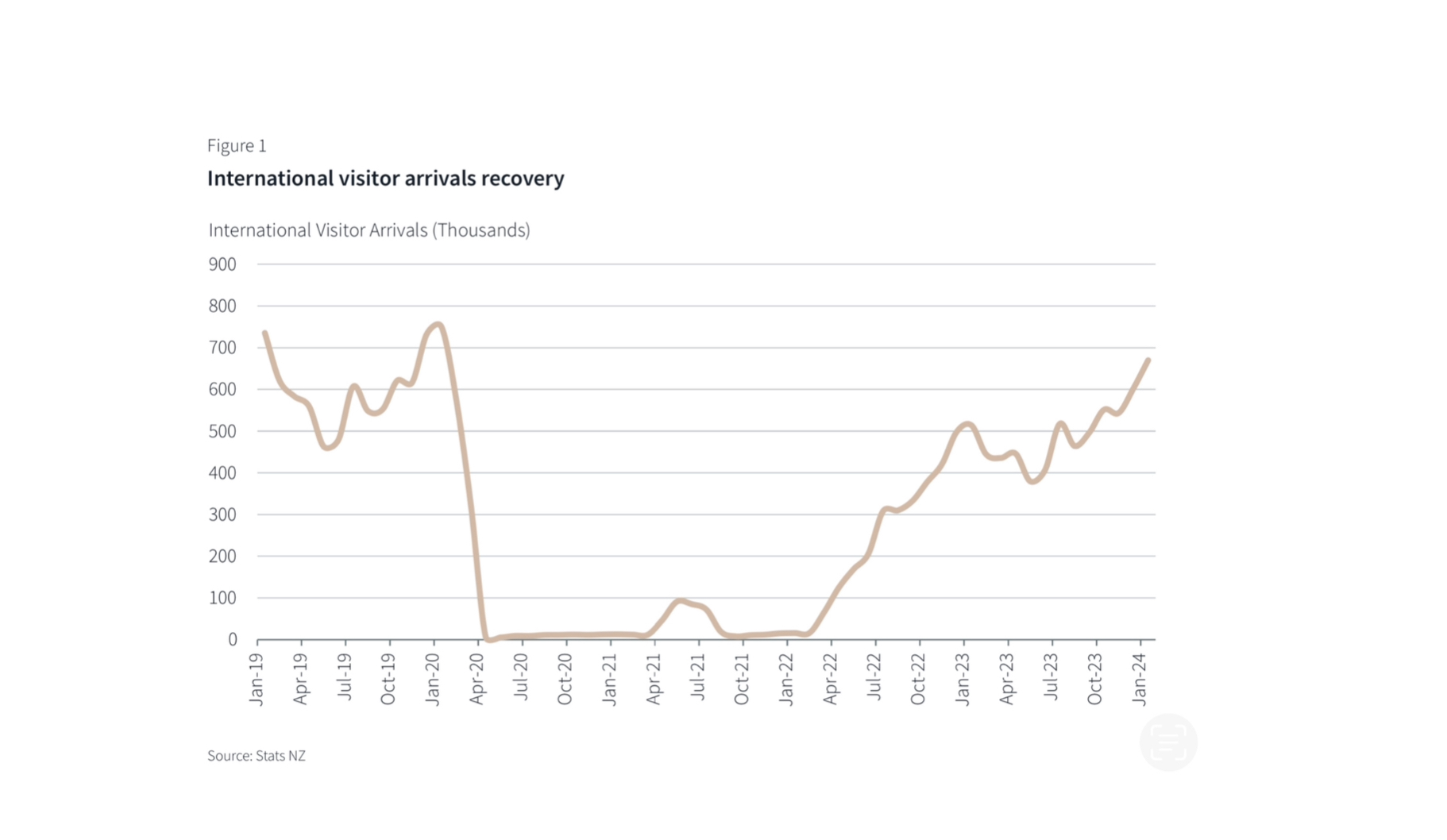

Research by JLL, an industry leader in real estate and investment management, shows that as international tourist numbers edge closer to pre-pandemic levels, hotels have experienced a resurgence in bookings.

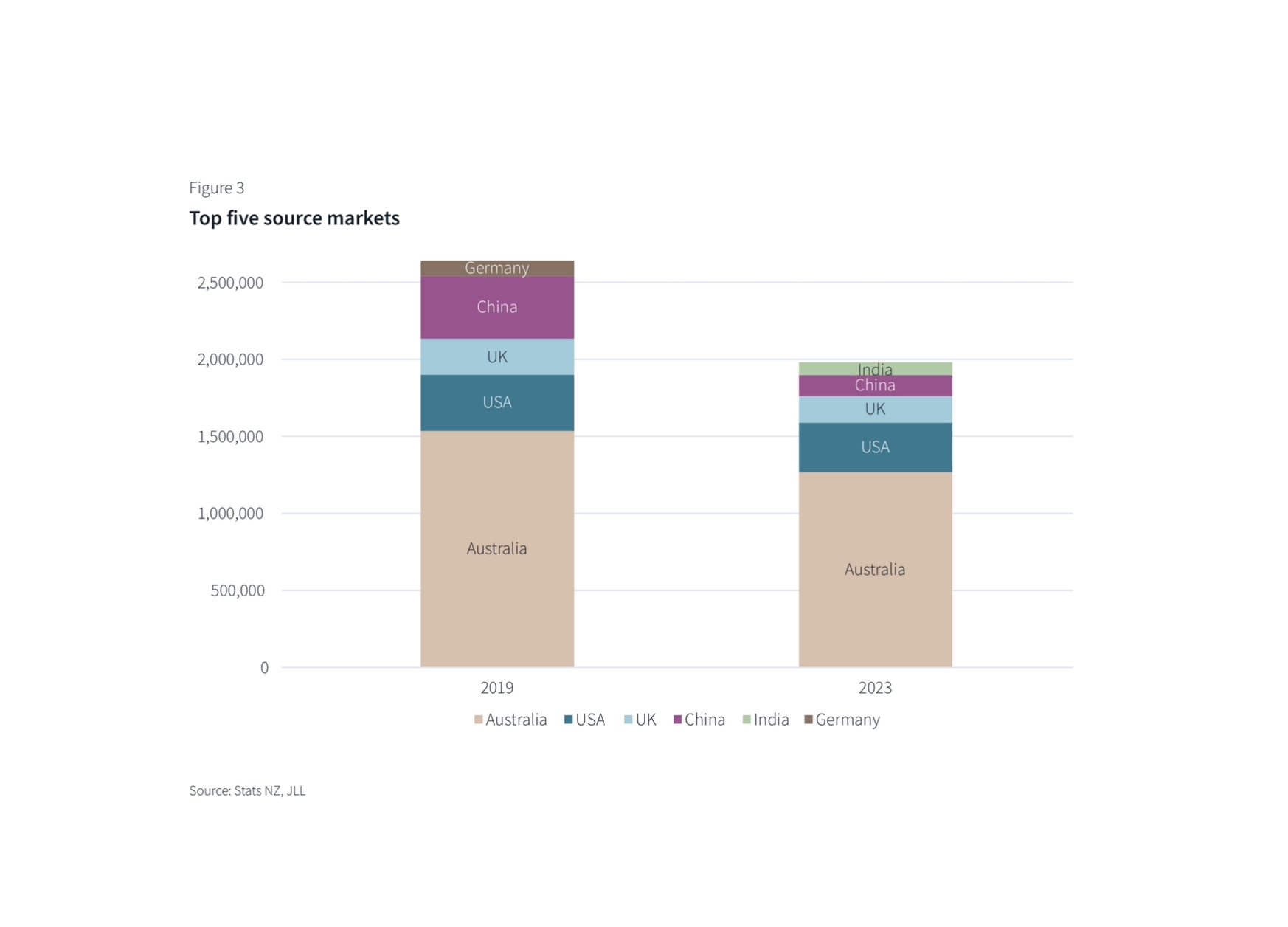

Hotel occupancy, which is at a market average of 70%, is up 15% year-on-year, but remains down (-9%) on pre-pandemic levels. Rotorua’s hotel occupancy rate improved 39% compared to 2022, slightly more than Queenstown (38%) and higher than Auckland (33%), Christchurch (22%) and Wellington (16%). JLL anticipates most regions will continue to see a steady rise in occupancy over 2024 driven by international visitors.

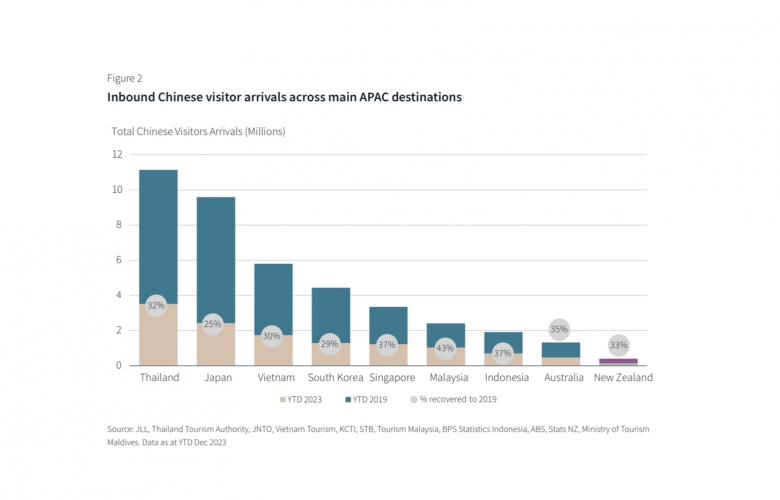

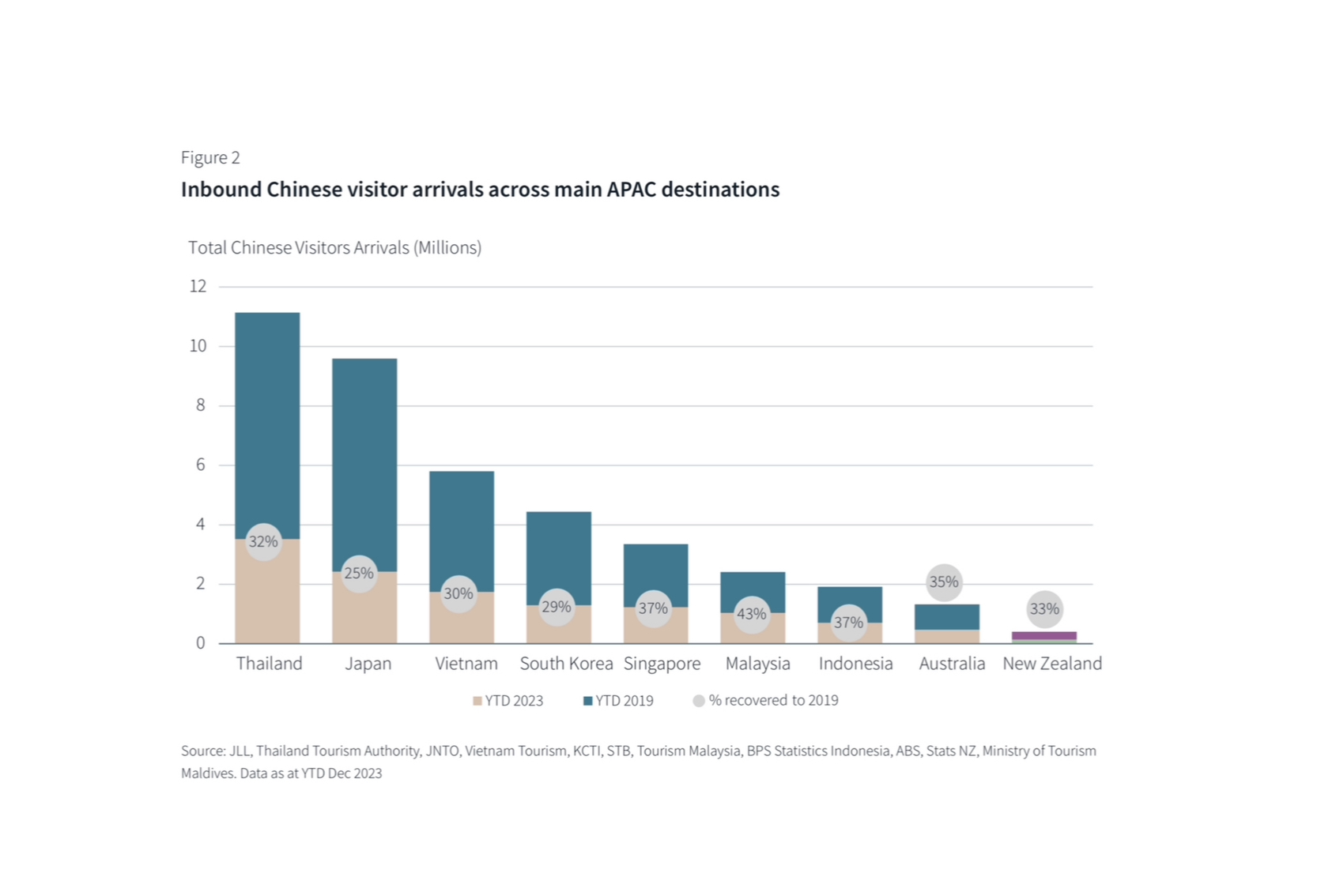

“Current global geopolitical issues will likely favour travellers wanting to visit safe destinations like New Zealand. At the same time, the reopening of China’s borders, an increase in flights to New Zealand, an attractive New Zealand Dollar, and events such as the World Hockey Masters in November, are all expected to drive visitor numbers and hotel occupancy,” says Nick Thompson, Senior Vice President, Investment Sales at JLL.

Premium hotel projects cater for luxury stays

"One of the key trends we’ve seen because of the pandemic is a shift in operator and brand loyalty. Guests were wanting to try new hotels they’d never stayed at and displayed a willingness to pay for better quality products.

“That is reflected in the new hotel projects that have been delivered since 2020, with 64% of total rooms being in the midscale to upscale segment and 36% in the upper-upscale to luxury end of the market.”

In 2024 visitors will benefit from the opening of new hotels, including premium projects catering for the upper end of the market, such as Horizon by SkyCity Hotel (303 rooms), Hotel Grand Chancellor (191 rooms), Hotel Indigo (225 rooms), and the Hyde Queenstown (60 rooms).

“Whilst there are still several proposed and/or mooted projects across the country, given high construction costs and the increased cost of debt, it is unlikely that many new-build hotels will proceed,” says Mr Thompson.

Offshore investor interest on the rise

Following the $31 million Mount Cook Hotel Collection sale in 2023 and landmark $170 million transaction of Auckland’s Stamford Plaza in late 2022, both brokered by JLL, New Zealand hotel investment volumes were relatively subdued in 2023.

Historically, investment activity in the hotel sector has been heavily weighted to domestic and local capital, although JLL forecasts offshore investor interest in New Zealand will continue to grow. A helping hand from an offshore perspective will be overseas buyers’ ability to borrow at lower interest rates in their local countries, and a weaker NZD against many currencies. Over the past 10 years, the NZD/USD average has been above 0.6650 (at the time of the collating JLL data it was mid-0.6100).

“We anticipate the hotel investment market will bounce back strongly in 2024, with a pickup in sales activity and transaction volumes, despite current headwinds. This will be driven by a continued recovery in hotel performance and the rebounding of international tourism numbers. Investors are seeking stable, long-term performance and a potential hedge against inflation,” says Mr Thompson.

Measuring our capacity against Swift-hotel-onomics

Australia’s hotel industry greatly benefited from Taylor Swift’s February visit, with Sydney and Melbourne both recording record hotel occupancy rates and wider economic benefits, but New Zealand’s capacity for an event of that scale is yet to be truly tested.

“The need for cultural and sporting events to support domestic and international tourism cannot be overstated, as shown by last year’s FIFA Women’s World Cup, which drew an estimated 30,000 visitors to New Zealand. Proposed developments for a waterfront stadium in Auckland, seating 50,000 or more, signal a future of Swift-level events,” says Mr Thompson.

Upcoming events, such as Coldplay, Tenacious D, and Pearl Jam, may serve as tests for hotel capacities.

For the full New Zealand Outlook 2024 report, as well as other insights into commercial real estate, JLL’s reports are available here.

Related Reading:

Above: Nick Thompson, Senior Vice President, Investment Sales at JLL.