Publicans should tap into depreciation deductions

Contact

Publicans should tap into depreciation deductions

"When arranging a depreciation schedule for a pub, a specialist quantity surveyor will perform a site inspection to uncover all available deductions," BMT Tax Depreciation

Pub stays are ingrained in Australian history, dating back to settlement when weary travellers on horseback would ride into town in search of a place to rest and replenish.

Today they remain at the heart of many Australian townships and are still a popular choice of accommodation among travellers.

While pub stays continue to produce solid profit, many publicans could be losing hundreds of thousands by failing to have a tax depreciation schedule prepared for their property.

Click here to request a tax depreciation schedule quote

Depreciation is the natural wear and tear that occurs to a building and the assets within it over time. The Australian Taxation Office governs legislation that allows owners of income producing property to claim this wear and tear as a deduction each financial year.

When arranging a depreciation schedule for a pub, a specialist quantity surveyor will perform a site inspection to uncover all available deductions. Depreciation can be claimed for a building’s structure via capital works deductions and for the plant and equipment assets contained within the property.

Assets such as drink dispensers, chairs and tables, carpet, beds and air-conditioning units all have substantial depreciable value and can help boost a publican’s cash flow.

Given most pubs are relatively old, the quantity surveyor will also identify any renovations completed to the property, including those completed by previous owners. This ensures the publican can claim the remaining un-deducted depreciable value of any assets scrapped and removed during the renovation.

Click here to learn more about Commercial Depreciation Schedules

Let’s take a look at how depreciation can help boost a publican’s cash flow.

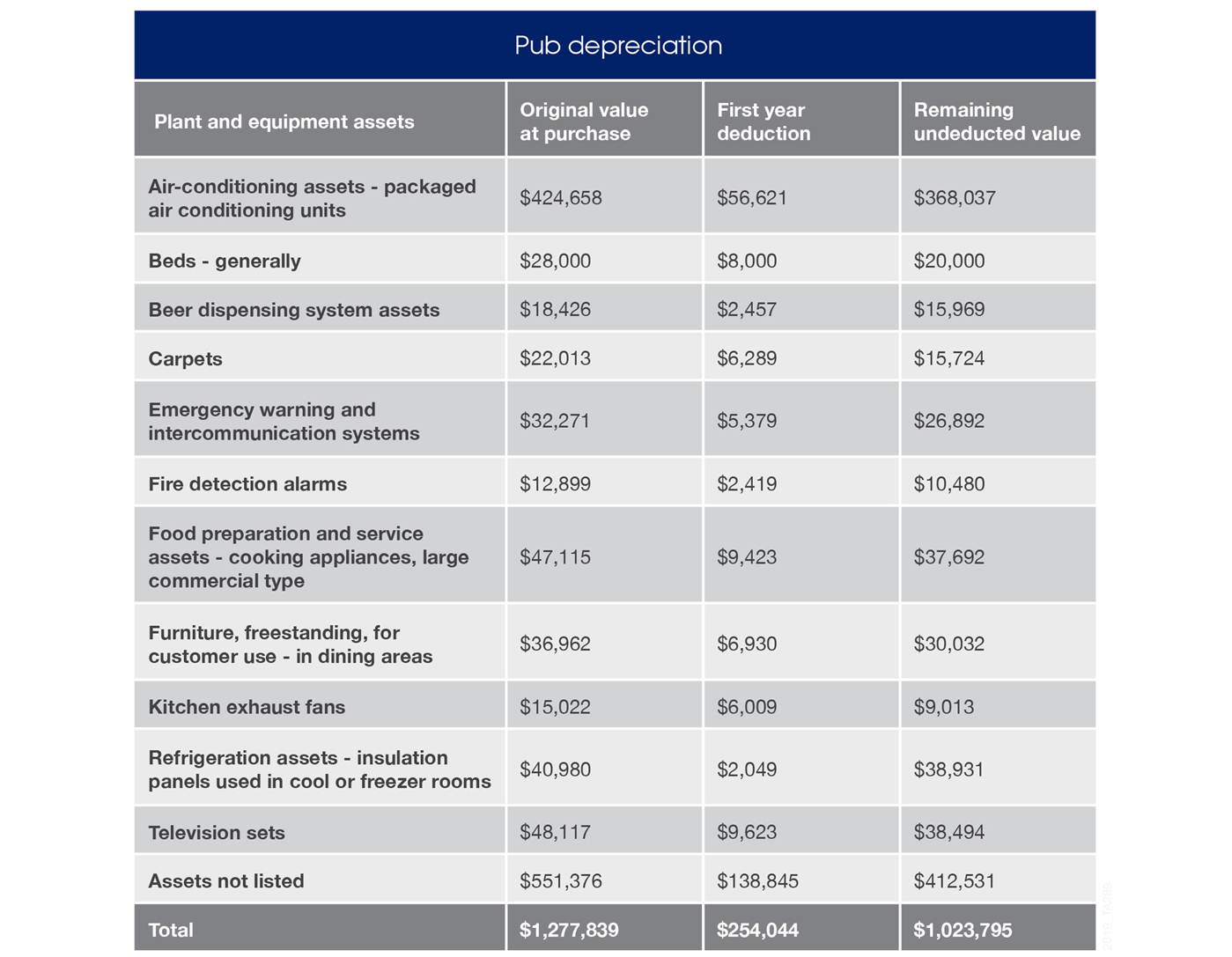

The following table lists examples of plant and equipment assets found within a pub stay and highlights each asset’s original value at purchase. It also shows the first year deductions available for each asset and any remaining undeducted value.

*In this scenario the owner had an aggregated threshold over $50 million and therefore is not eligible for small to medium business tax concessions

As you can see, the depreciation deductions available to the publican are significant. In the first full financial year alone, the owner can claim $254,044 in depreciation deductions. Over the life of the property, the publican can claim a total of $1,023,795.

To learn more about the deductions you can claim from your pub, Click here to request a tax depreciation schedule or speak with one of the expert team at BMT Tax Depreciation via the contact details below.

This is a BMT sponsored article

Similar to this:

Tax time depreciation tips for hoteliers

Can you claim depreciation for an older hotel?

Freehold vs. leasehold – what does this mean for hotel depreciation?