How to maximise your cash flow during the off-season

Contact

How to maximise your cash flow during the off-season

One of the best ways to maintain a healthy cash flow during this time is to have a tax depreciation schedule prepared for the property according to BMT Tax Depreciation

Ample snowfall and ideal conditions produced another profitable winter for Australian ski resort owners. A late autumn cold snap in May delivered blankets of snow to ski fields, allowing some resorts to open earlier than expected. In fact, the official opening weekend in June delivered the best conditions since 2002.

As winter draws to a close it’s important for resort owners to plan for the off season. One of the best ways to maintain a healthy cash flow during this time is to have a tax depreciation schedule prepared for the property.

Property depreciation is the natural wear and tear that occurs to a building and the assets within it over time. The Australian Taxation Office (ATO) allows owners of income-producing properties to claim depreciation deductions for the natural wear and tear that occurs to a building and its assets over time.

Depreciation deductions relating to the building’s structure can be claimed as a capital works (division 43). Owners and tenants of traveller accommodation in which construction commenced between the 15th of September 1987 and the 26th of February 1992 are eligible to claim capital works deductions at 2.5 per cent per year over forty years. For properties constructed after the 26th of February 1992, the rate is 4 per cent per year over twenty-five years. All other types of accommodation entitle their owners to claim capital works at a rate of 2.5 per cent over forty years.

Plant and equipment assets refer to the easily removable fixtures and fittings within the building such as hot water systems, carpets and blinds. Each plant and equipment item is typically depreciated based on its individual effective life as set by the ATO. Assets found in traveller accommodation generally have a shorter effective life and therefore depreciate faster than the same assets found in residential property.

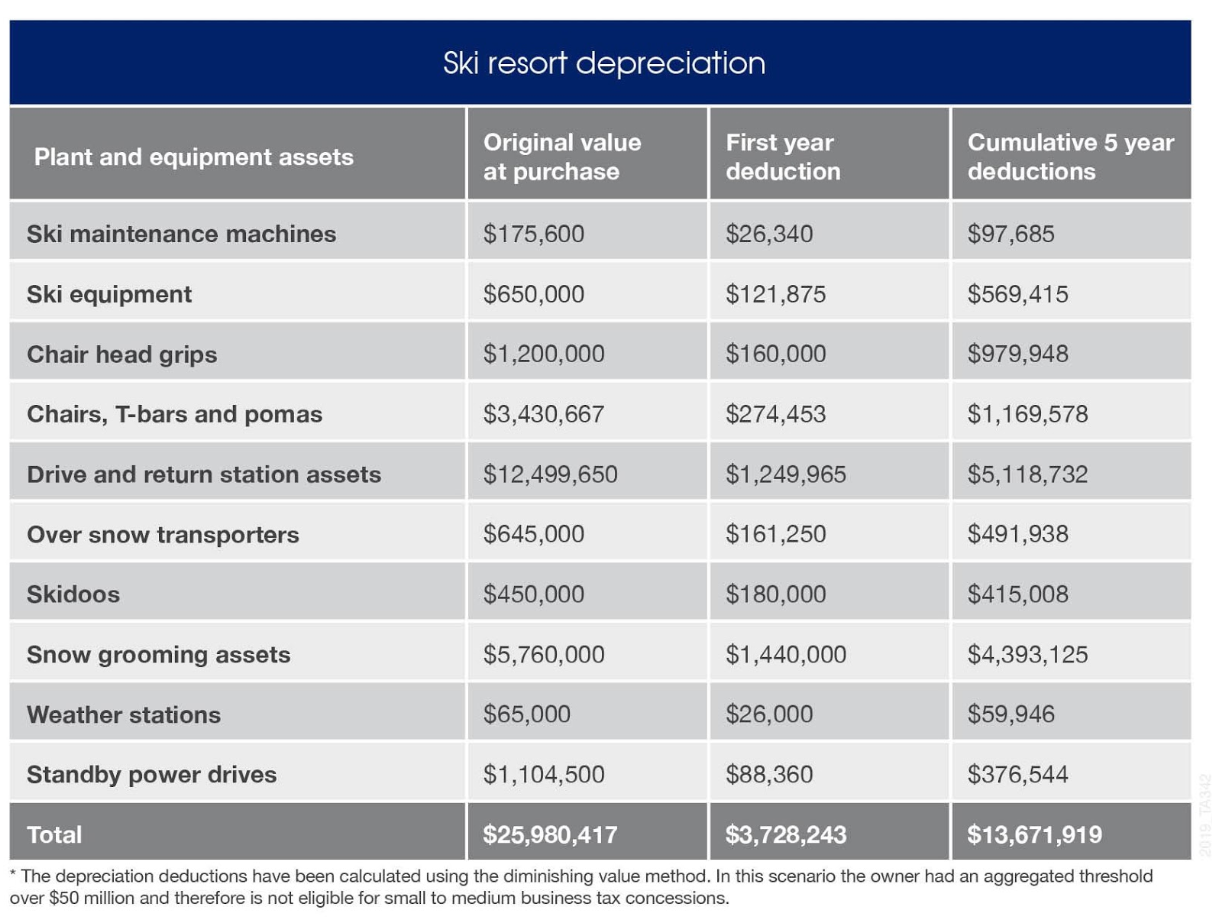

Let’s look at an example of how depreciation can boost a ski resort owner’s cash flow. The following table lists examples of plant and equipment assets found at a ski resort and highlights each asset’s original value at purchase. It also shows the first year and cumulative five year deductions available for each asset.

The owner is able to claim a substantial $3,728,243 for the listed plant and equipment assets in the first financial year alone. In the cumulative five years, this figure will increase to over $13 million. Given this is based on just ten plant and equipment assets, there are significant depreciation deductions to be claimed for the entire property.

To learn more about the deductions you can claim from your resort, Request a Quote or speak with one of the expert team at BMT Tax Depreciation - Click here to view the BMT Tax Depreciation website or phone BMT Tax Depreciation via the contact details below.

This is a Sponsored Article.

Related Reading:

See the depreciation deductions available in a hotel room