Future transactions hold the key to hotel sector's COVID-19 response: JLL

Contact

Future transactions hold the key to hotel sector's COVID-19 response: JLL

New research from JLL's Hotels and Hospitality's Valuation Advisory Division Joint Head, Julian Whiston, has highlighted a potential disconnect between hotel purchasers looking to capitalise on the Covid circumstances faced by owners and those of experienced hotel investors with long-term confidence in the sector.

The uncertainty of the COVID-19 climate has put renewed focus on the specific property and market characteristics of hotels available for sale, according to JLL.

The firm's Hotels and Hospitality valuation experts have released a new report highlighting the impact of the pandemic and the cash flow response on the parameters of hotel property investment, including discount and capitalisation rates.

Author and Joint Head of JLL’s Hotels & Hospitality Valuation Advisory Division, Julian Whiston, told WILLIAMS MEDIA the research indicated a likely disconnect between the views of some purchasers looking to capitalise on current circumstances faced by owners and those of experienced hotel investors with long-term confidence in the sector.

At a glance:

- JLL's Hotels and Hospitality Valuation Advisory Division has prepared a report on hotel yields in reponse to COVID-19.

- The firm uses a hypothetical managed four-star hotel in central Brisbane to examine potential yield behaviour in response to COVID-19.

- The report also notes a potential disconnect between the views of some purchasers looking to capitalise on current circumstances faced by owners and those of experienced hotel investors with long-term confidence in the sector is noted.

"Although the hotel industry is focused on the immediate operational and trading challenges, it remains a dynamic sector that responds quickly to changing circumstances," he said.

"While facing ongoing headwinds, the recovery process is also in sharp focus."

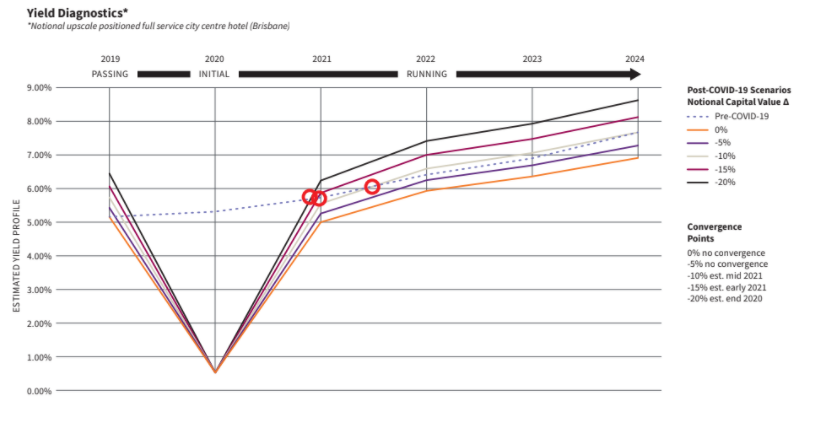

As part of the report, JLL used a hypothetical managed four-star hotel in central Brisbane to examine potential yield behaviour in response to COVID-19.

Source: JLL Hotels and Hospitality Group

Analysis was prepared on the basis of both a pre-COVID-19 and a Post-COVID-19 cash flow, incorporating capital assessment moderations of between 5 and 20 per cent, with the derived yields (passing, initial and running yields) then compared.

Mr Whiston said while the passing yields softened as expected, the initial yields reflected a defensive yield compression, whereby cash flow performance moderates, but there is not a corresponding or proportional change to capital value.

"Subsequently, in the case of this hypothetical hotel in Brisbane, based on a notional value reduction of 10 per cent, running yields were estimated to return to pre-COVID-19 levels in 2021," he said.

"It will be hotel transactions that ultimately reveal the market’s response to COVID-19 and JLL encourages discussion with its hotel valuation and investment sales experts who are monitoring trends closely."

Click here to view the report.

Similar to this:

Hotel owners and operators examining ways to reinvent themselves after COVID-19, says JLL

JLL announces APAC leadership changes to Hotels and Hospitality Group