Branded residences sector more diversified than ever before - Savills

Contact

Branded residences sector more diversified than ever before - Savills

New research from Savills shows how hoteliers can benefit from new brands entering the branded residence sector.

Branded residences are on track for another record year in spite of the pandemic and wider economic situation, with more than 100 schemes opening, Savills says.

A Savills Spotlight report found the current trend is part "an extraordinary decade of growth" for the sector, during which the number of branded residences across the globe has increased by 170 per cent.

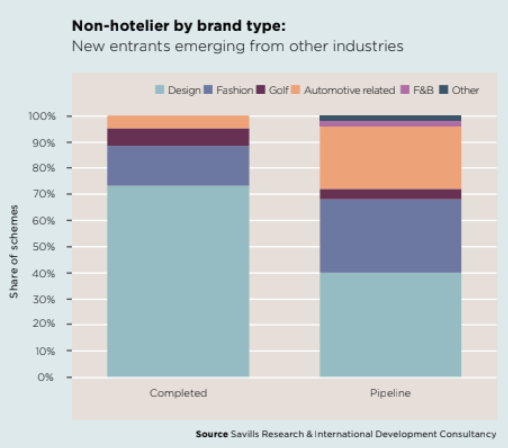

According to Savills World Research, the pipeline is more diverse and exciting than ever, with a new wave of brands emerging from the art, design, culinary and celebrity worlds, including the likes of Nobu, Tonino Lamborghini and Pharrell Williams.

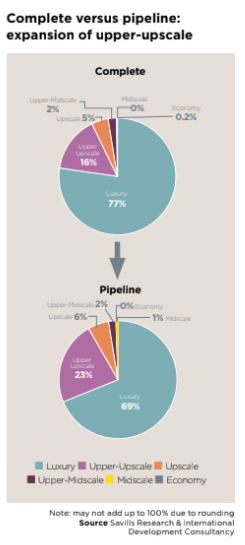

The report reveals that over the past 10 years, the growth of such schemes has outpaced hoteliers, rising from 11 per cent of the total market in 2010 to 16 per cent in 2020.

Looking ahead, Savills expects 11 new non-hotelier brands to enter the market by 2025.

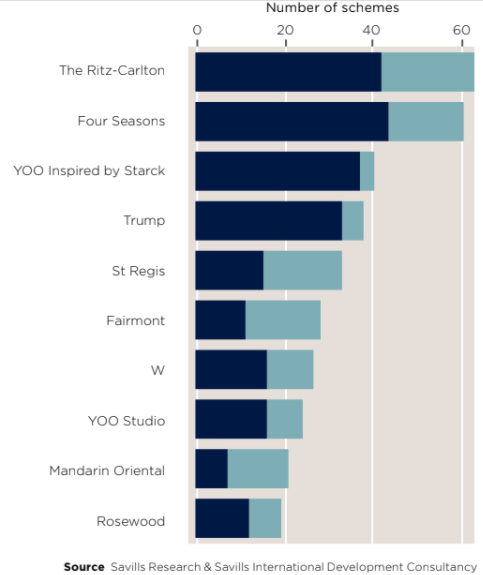

But Savills Head of International Development Consultancy, Riyan Itani, said hotel brands still accounted for 84 per cent of current schemes and 88 per cent of the pipeline, with Marriott, whose brands include W, The Ritz-Carlton and St Regis, by far the leader in the sector.

“We are seeing hoteliers bringing more of their brands into the sector," he said.

"The diversified income stream that the branded sector provides is more valuable than ever as the hospitality sector faces its challenges.

“In the longer term, the sector could also benefit from the behavioural changes we are seeing and more flexible working practices could mean that owners make greater use of what are often second properties.

"There may also be increased demand to rent hotel-branded residences from tourists seeking self-contained accommodation yet with the amenities that a hotel offers.”

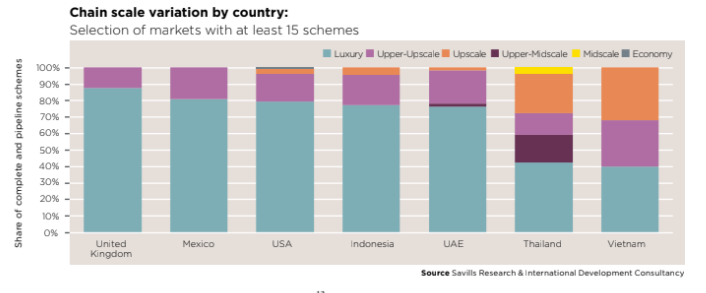

According to Savills, Miami, Dubai and New York are the top three cities for branded residences, but there is also evidence of brands are looking further afield for new opportunities, with twelve countries to have their first branded residential projects over the next four years in locations as diverse as Iceland, Paraguay and Nigeria.

Egypt is forecast to grow fastest of any country over the next four years, rising from one to 18 schemes.

Other countries moving from a low base include Spain (+83 per cent), Bahrain, Belize and Costa Rica (+80 per cent).

The United Arab Emirates, Mexico and Brazil are expected to add the most schemes by number amongst the fastest growing countries (those adding at least 50 per cent to their existing supply).

Vietnam, the UK, Morocco, Malaysia , Australia and Saudi Arabia also have a pipeline of at least six schemes.

Savills Australia Residential Director Chris Orr believes Australia is still in its infancy when it comes to luxury branded residences as historically buildings have been given their own identity in contrast to the super brand approach.

“Leaders in the field have focussed on large scale mixed use properties in the capital cities and a good example is Crown Sydney at Barangaroo which combines a Casino, Hotel and Luxury accommodation," he said.

Savills World Research Director Paul Tostevin said a mixture of emerging and established prime markets illustrated the ever-widening reach of the sector today.

"Now a proven formula, brands are confident entering new territories," he said.

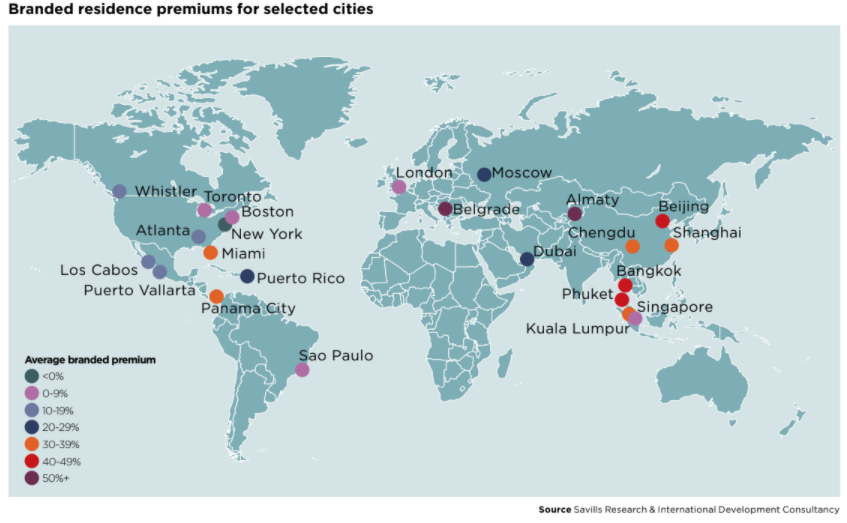

"When it comes to price, branded residences achieve a premium, on average, of 31 per cent over equivalent non-branded properties, although this figure can vary significantly by location.

"Recently established markets such as Bangkok, Beijing and Phuket achieve premiums between 40 per cent and 45 per cent, comparatively higher than more mature markets.

"Truly emerging markets which few branded properties can command prices that are double to non-branded stock as demonstrated by Almaty and Belgrade with premiums of 150 per cent and 120 per cent respectively."

Click here to download the Savills Spotlight report.

Similar to this:

Crown Group fast-tracks opening of SKYE Suites and Residences at Sydney's Green Square

Boutique hotel brand lyf to launch in Melbourne

Short-term accommodation and rooftop restaurant added to proposed Banyan Tree Brisbane Residences