Colliers New Zealand hotel market report confirms a recovery is underway

Contact

Colliers New Zealand hotel market report confirms a recovery is underway

Colliers report confirms New Zealand Hotel sector continues its pathway to recovery in the YTD 30 June 2021. Key performance indicators are improving against the same period last year, when we first entered into a Covid impacted trading environment.

Colliers latest report on the New Zealand hotel market confirms a recovery is underway.

Dean Humphries, Colliers National Director of Hotels, notes that key performance indicators have improved against the same period last year, when New Zealand first entered a Covid impacted trading environment.

The long-awaited trans-Tasman travel bubble, which commenced in April 2021 was welcomed by the wider industry, particularly those regions most reliant on international inbound visitors.

In other positive news for the sector, Government MIQ contracts for over 30 major hotels across the country have been extended until the end of 2021, and in some cases longer. This will provide many hotel owners with a secure cashflow over these challenging times.

In addition, the nationwide vaccination rollout will enter its full phase in Q3 and Q4 of this year, which will ensure we can safely reopen our borders to international visitors from H1 2022.

As a result, investment enquiry for hotels is increasing from a range of parties, who foresee a robust recovery for hotel assets in the short to medium term.

Investment yields appear to be trending downwards on the back of low capital costs and return profiles associated with alternative asset classes.

Key findings YTD 30 June 2021:

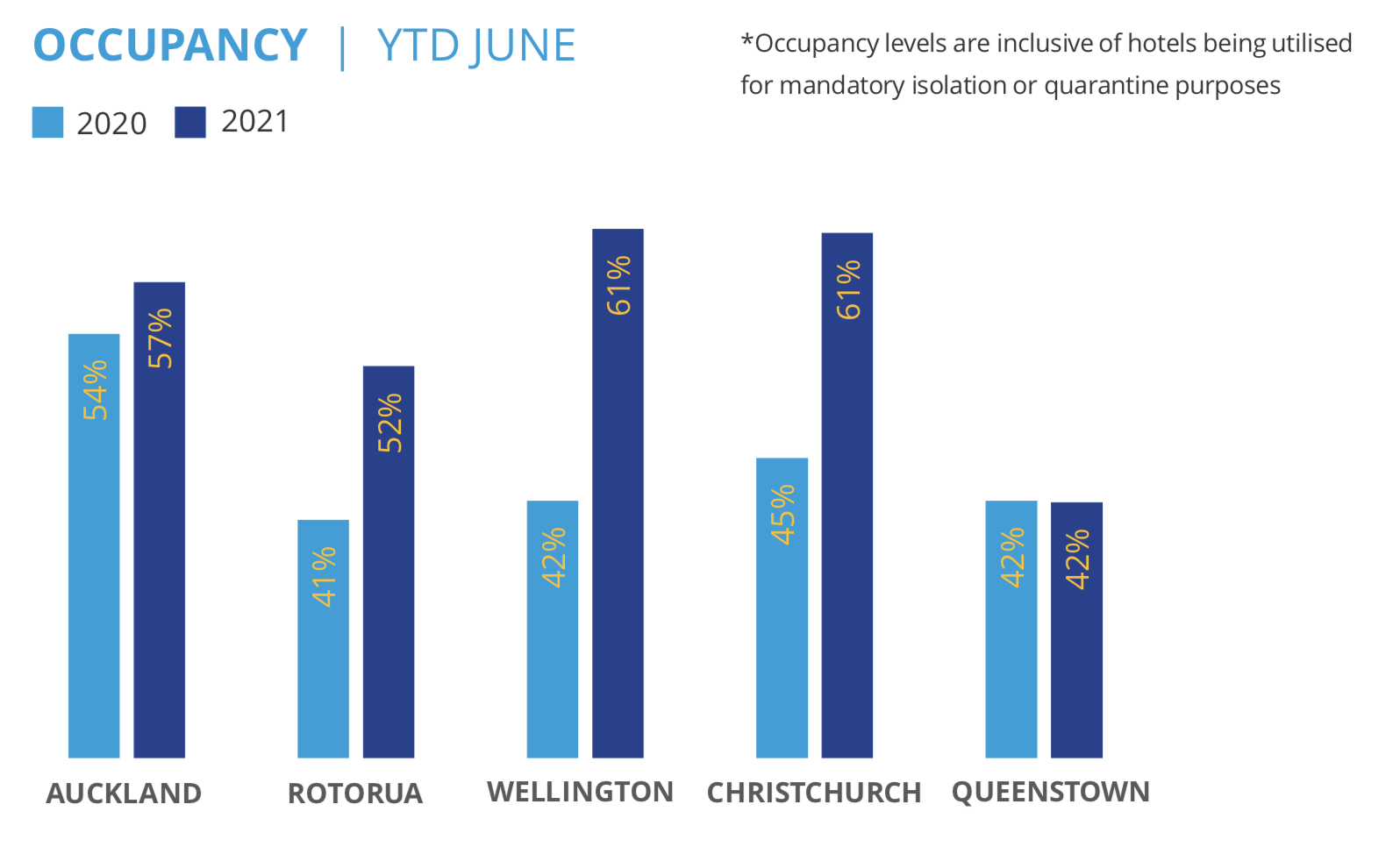

- Occupancy rates now sit between 50% and 60% in all major regions with the exception of Queenstown

- Average room rates have remained firm sitting in a tight band between NZ$160 and $185

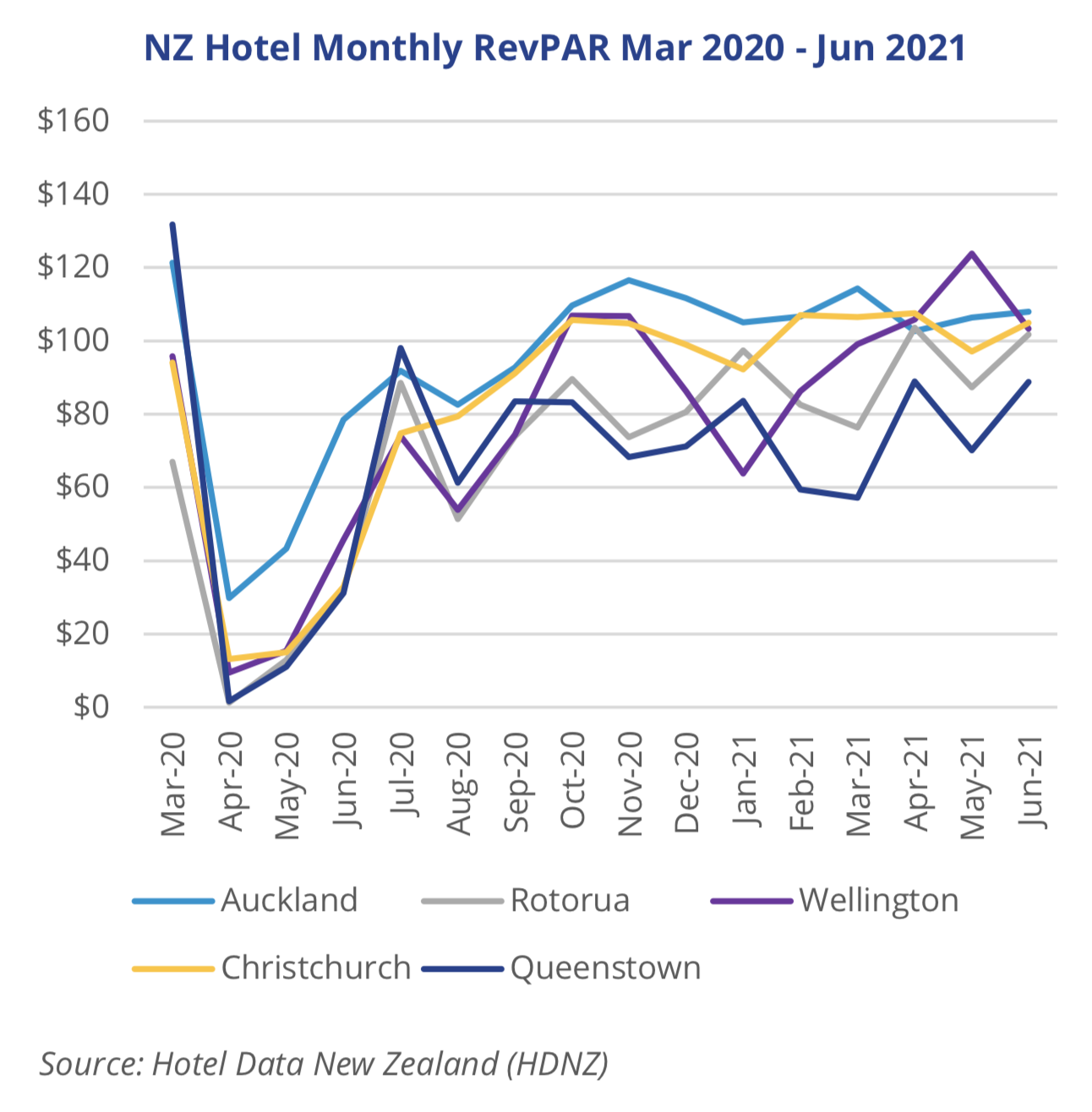

- Top performing regions by RevPAR are Rotorua (+47%) followed by Christchurch (+41%) and Wellington (+35%)

- The opening of the trans-Tasman bubble, an increase in business demand and fewer lockdown periods have been the main contributors to recovery patterns

- Some 552 new hotel rooms have opened so far this year with a further 2,080 under construction, primarily in Auckland

Humphries notes that “Despite these encouraging trends, the NZ hotel sector remains compromised until our international borders open to key inbound markets”.

To view and download the report click here.

Similar to this:

Colliers International New Zealand Hotel Market 2020 Review

New Zealand hotel occupancy rebounds following August drop - Colliers

Australian hotels 'on the road to recovery' - Colliers International