Hotel development dominating the market

Contact

Hotel development dominating the market

Colliers International Australia's Hotel Sales 2017 report released today found that new hotel development deals amounted to $394 million – almost a quarter of the total sales volume in 2017.

Colliers International Australia released its Hotel Sales 2017 research and analysis report today which also found that hotel sales volumes eased, following three of the strongest years on record.

Colliers International Australia Head of Hotels Gus Moors said offshore capital continued to dominate, but with a a notable broadening of the capital base, with purchasers from Japan, Singapore, USA, Hong Kong, Vietnam, Germany and the UAE.

“2018 is likely to see similar patterns to 2017, with limited opportunities in Sydney and Melbourne, as owners in those markets continue to enjoy strong cashflow,” Mr Moors said.

“More activity is likely to occur in the metropolitan markets and other State capitals, as owners capitalise on limited inventory in the market.

“The robust pipeline of new hotels should see activity increase again over the medium term.”

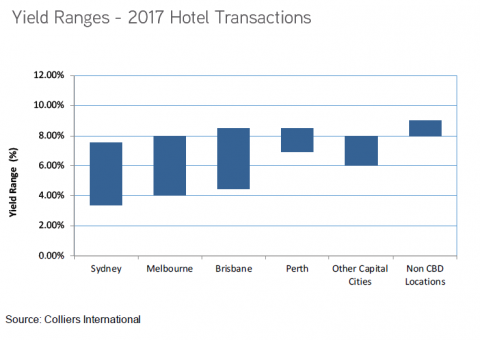

For the year to December 2017, Colliers International Australia analysed $2.02 billion of hotels that were transacted throughout Australia, culminating 47 sales, said Colliers International’s National Director Hotels Neil Scanlan.

“Whilst moderating, volumes remain well above the long-term average of $1.25 billion,” Mr Scanlan said.

The largest transaction of the year was in Melbourne, with the $230 million purchase of the Hilton Melbourne South Wharf.

The limited level of existing inventory on offer is pushing investors into the development and turnkey space. Key development transactions included the W Melbourne, Four Points by Sheraton Central Park Sydney and Quest Penrith.

Also, click here to view Gus Moors' profile and interview on The Hotel Conversation.

See also:

Australia's best and worst performing hotel markets

Hotel Urban Brisbane comes to market

JLL release their global Hotel Investment Outlook 2018 report