NZ hotel markets reach saturation point

Contact

NZ hotel markets reach saturation point

The performance of New Zealand hotels nationwide continues to improve with a recorded occupancy rate of 81.2% in the year to December 2017, with Queenstown the fastest growing market again in 2017 reporting RevPAR growth of 16.1%.

According to CBRE's latest research report, all markets achieved RevPAR growth in excess of 5% with the exception of Christchurch which recorded RevPAR growth of only 0.2% in 2017 as the market struggles to driving guest demand growth despite a strong national tourism market.

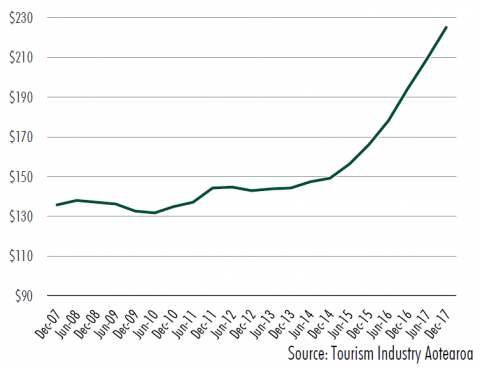

Queenstown ADR

"Nationwide hotels achieved an occupancy rate of 81.2% in the year to December 2017 up 0.4 percentage points on last year. ADRs increased to $190.47 (up 10.9%) and RevPAR increased by 11.4% to $154.58," the report states.

"International visitors to New Zealand continue to put pressure on tourism infrastructure across the country with 3,733,707 visitors recorded across 2017, an increase of 6.7% on 2016 levels. The rate of growth decreased from last year when international visitor arrivals increased by 11.8%."

"The growth in visitors from China was considerably lower than in recent years at 2.2% across the year although this appears to be largely driven by a change in visa rules affecting three months of April to June only with an average y-o-y increase of 11.1% achieved in the final six months of the year."

"The strongest visitor growth out of our key source markets in 2017 were from the USA and UK with increases of 13.3% and 12.8% respectively with UK visitor growth pumped up by a 245% increase in visitors in June for the Lions Rugby Tour."

The need for new hotels to be built in main centres is growing with most markets indicating plateauing occupancy rates as existing supply reaches natural points of saturation.

Click here to download the full CBRE research report.

To discuss the New Zealand hotel market in further detail contact Peter Hamilton or Zoltan Moricz via the below contact details.

See also:

Kiwi tourism and increase in superyacht numbers set to deliver strong returns in 2021