Sir Stamford Circular Quay hotel on Macquarie Street sold to JDH Capital for $210.5 m

Contact

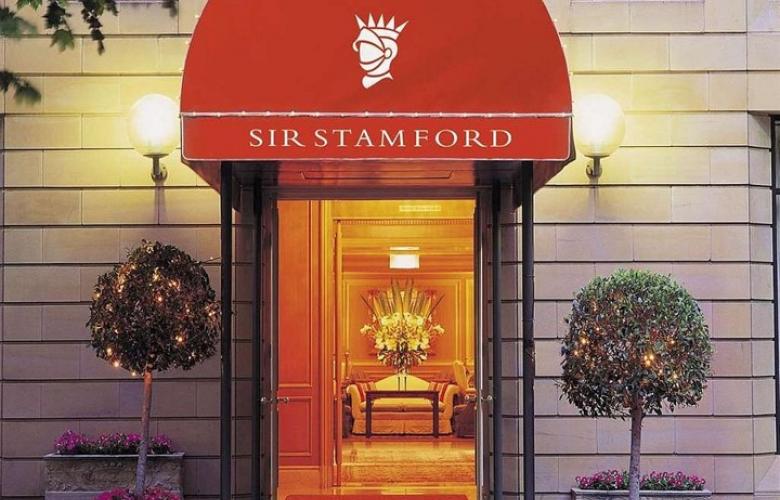

Sir Stamford Circular Quay hotel on Macquarie Street sold to JDH Capital for $210.5 m

In a deal via an exercisable option agreement with Singapore property tycoon CK Ow’s SGX-listed Stamford Land Corporation agreed at just over $2m per room and some $120.5m above valuation, JDH Capital have purchased the 105 room 5 star hotel recently planned for a $380m redevelopment near the Sydney Opera House and opposite the Royal Botanical Gardens.

In a statement to the Singapore Stock Exchange, on 23 August Stamford Land said the sale price was $120.5 million above its most recent company valuation of $90 million as of March 31. Sir Stamford sold to JDH Capital who are also redeveloping the Sirius building in the Rocks and the former Vibe hotel in Rushcutters Bay into luxury apartments.

The Sir Stamford Circular Quay hotel is a freehold 10-storey 5-star hotel comprising 105 bedrooms built in 1990 but incorporating the heritage listed former Health Department building on the corner of Albert and Macquarie Streets. Facilities include restaurant, bar, roof top fitness centre, pool and parking for 109 cars. The Property is situated in a prime Sydney CBD location overlooking Circular Quay, Sydney Harbour and the Sydney Harbour Bridge.

Stamford Land had previously focused on redeveloping the the Sir Stamford Circular Quay Sydney and the Stamford Plaza Brisbane.

The owners Stamford Land had previously announced on 7 December 2021, 3 January 2022 and 6 January 2022 that part of the proceeds from the rights issue completed on 15 February 2022 amounting to approximately S$68 – S$73 million was intended to be utilised in, among other things, the redevelopment of the Property.

On 12 March 2020, the Sydney Council approved the concept building envelope for the development of the Property into residential units, subject to conditions. The initial Phase 1 approval granted by Sydney Council on 12 March 2020 was for the Redevelopment of the Property into residential units with ancillary commercial and retail units, for both sale and investment income. Phase 2 approval by the Sydney Council was underway and was expected to complete in January 2023. Under the Phase 2 approval phase, the Company was required to undertake a design competition, with construction commencing in October 2023. The total estimated development cost was estimated to be more than A$380 million spread over the course of 3 years. The development was estimated to complete in 2026.

In the statement to the Singapore Stock Exchange, the book value of the Property as at 31 March 2022 is S$59,407,000 with net profit attributable to the Property before tax for the financial year ended 31 March 2022 (“FY2022”) of approximately S$2,046,000.

“It’s another opportunity in a key location for a luxury residential project that will capitalise on the Macquarie Street location and the views,” John Green, development director at JDH Capital, told The Australian Financial Review. “It’s a great site for a great project.”

In June 2021 it was reported the Singapore based group were to list six Australian and New Zealand hotels with an expected sale price to total more than $1 billion.

One month earlier The Intercontinental Hotel Double Bay sold in May 2021 for circa $180m to apartment developer Fridcorp by The Agency’s Steven Chen who negotiated the deal on behalf of its owner Shanghai United, who’d bought it for $140m just two years earlier.

Stamford Land own five other hotels in Australia and one in New Zealand.

It's understood JLL brokered the deal, but declined to comment.

Related Reading:

JLL closes largest sale of a single hotel asset in New Zealand history | The Hotel Conversation

Sofitel Brisbane Central Hotel for sale by CBRE and McVay RE | The Hotel Conversation

Sofitel Adelaide for sale - CBRE Hotels & Savills | The Hotel Conversation

JLL advises on landmark Hilton Sydney Hotel Transaction | The Hotel Conversation