A sharp rise in Chinese hotel investment follows record Chinese visitor growth

Contact

A sharp rise in Chinese hotel investment follows record Chinese visitor growth

Australian hotels look to two million Chinese visitors in the next decade with new wave of hotels and China‐friendly services.

On the eve of Chinese New Year and the start of the first‐ever Australia‐China Year of Tourism, Tourism Accommodation Australia (TAA) believes that the massive expansion in Australia’s hotel sector will help drive Chinese inbound numbers from the current one million to up to two million over the next decade.

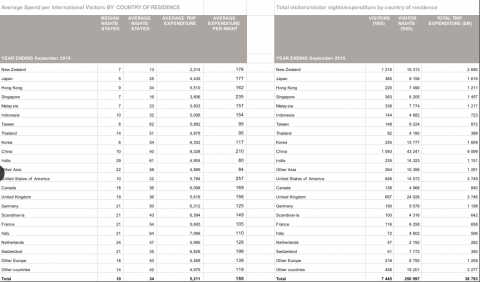

Since 2009, Chinese visitor numbers have grown over 350% from 300,000 to 1.1 million, with China expected to become Australia’s leading inbound market by the end of the year. China is also one of the highest spending markets, injecting $8.3 billion into the Australian economy last year, with spend estimated to grow to $13 billion by 2020.

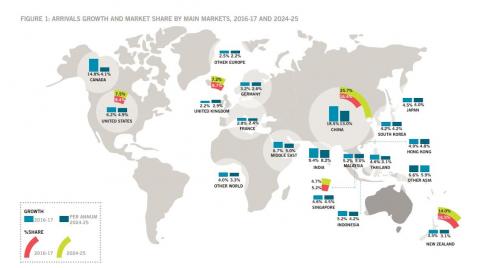

Arrivals Growth and Market Share Image Credit: Tourism Research Australia

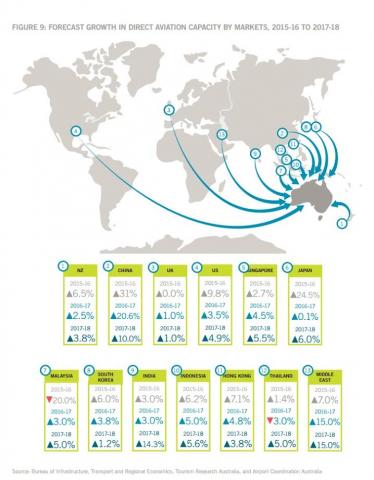

A record number of direct air services from China, and the capacity to grow the figures even higher as a result of Air Service Agreement signed by the China and Australian governments, combined with a more liberal and streamlined visa process for Chinese visitors, is set to drive annual double‐digit growth figures over the next five years. Already this month, Sydney attracted a group of 8000 Amway incentive winners to the city, and hotels were reporting record bookings for Chinese New Year.

Tourism Forecast Growth in Direct Aviation Capacity

Australia’s capacity to cater for the vast increase in numbers has been significantly boosted by the largest‐ever expansion of hotel rooms across the country, with up to 120 hotels and 30,000 new rooms in the pipeline for development over the next five years.

Australian hotels have embraced the Chinese market by introducing a wide range of ‘China Ready’ services and facilities, such as Mandarin translated compendiums, menus and maps, Mandarin speaking reception staff and guest relations, Chinese TV channels and papers, more Chinese breakfast buffet items, Union Pay facilities and extensive cultural awareness programs for managers and frontline staff. Many hotels also offer extensive Chinese decorations and features during Chinese New Year.

CEO of TAA, Carol Giuseppi, said that the Australian hotel industry’s willingness to introduce specialist services for the China market had played a key role in the rapid growth in Chinese visitor numbers. “The Australian hotel industry has invested heavily in catering for the China inbound market because it offers the greatest sustainable growth prospects for the industry,” said Ms Giuseppi.

“A significant follow‐on result from the China tourist boom has been the China hotel and tourism investment boom. In just three years, China has become one of the largest investors in the Australian hotel and tourism market, with some of their most high‐profile property groups – such as Dalian Wanda, Greenland, Forise and Nanshan – investing up to A$10 billion in the transformation of Australia’s hotel and tourism landscape," said Ms Giuseppi.

Colliers reported in 2016 Chinese capital accounted for 38% of total hotel transactions volume, compared to just 6% in 2012.

“The hotel and tourism sector is leading the way in the Australian economy by delivering economic and jobs growth, and we will be looking to governments to maintain their support for the industry by promoting tourism and conferences, encouraging employment and training in the industry, and cracking down on commercial unregulated short‐term accommodation,” said Ms Giuseppi.

The 2016 Tourism Forecast compiled by Tourism Research Australia states that overall, Australia’s top five inbound markets at 2015–16 (New Zealand, China, the UK, the US and Singapore) are expected to provide 67 per cent of the additional 5.2 million arrivals over the ten years to 2024–25. China alone is expected

to contribute 43 per cent of the growth in arrivals over the forecast period.

Average Spend Graph per Country Data provided by Tourism Accommodation Australia

China’s share of total visitors was 13.0 per cent in 2014–15 and this is forecast to increase to 16.4 per cent in 2017–18 and to 25.7 per cent by 2024–25 (Figure 1). Given this stronger-than- expected growth, China is forecast to overtake New Zealand as Australia’s largest international arrivals market in 2017–18, two years earlier than previously forecast.

See also:

Sydney and Melbourne hotel numbers set to soar

Chinese buyers increase their share of Australian hotel transactions