Australia’s hotel market proves leaner and stronger as it undergoes luxury green facelift - Colliers

Contact

Australia’s hotel market proves leaner and stronger as it undergoes luxury green facelift - Colliers

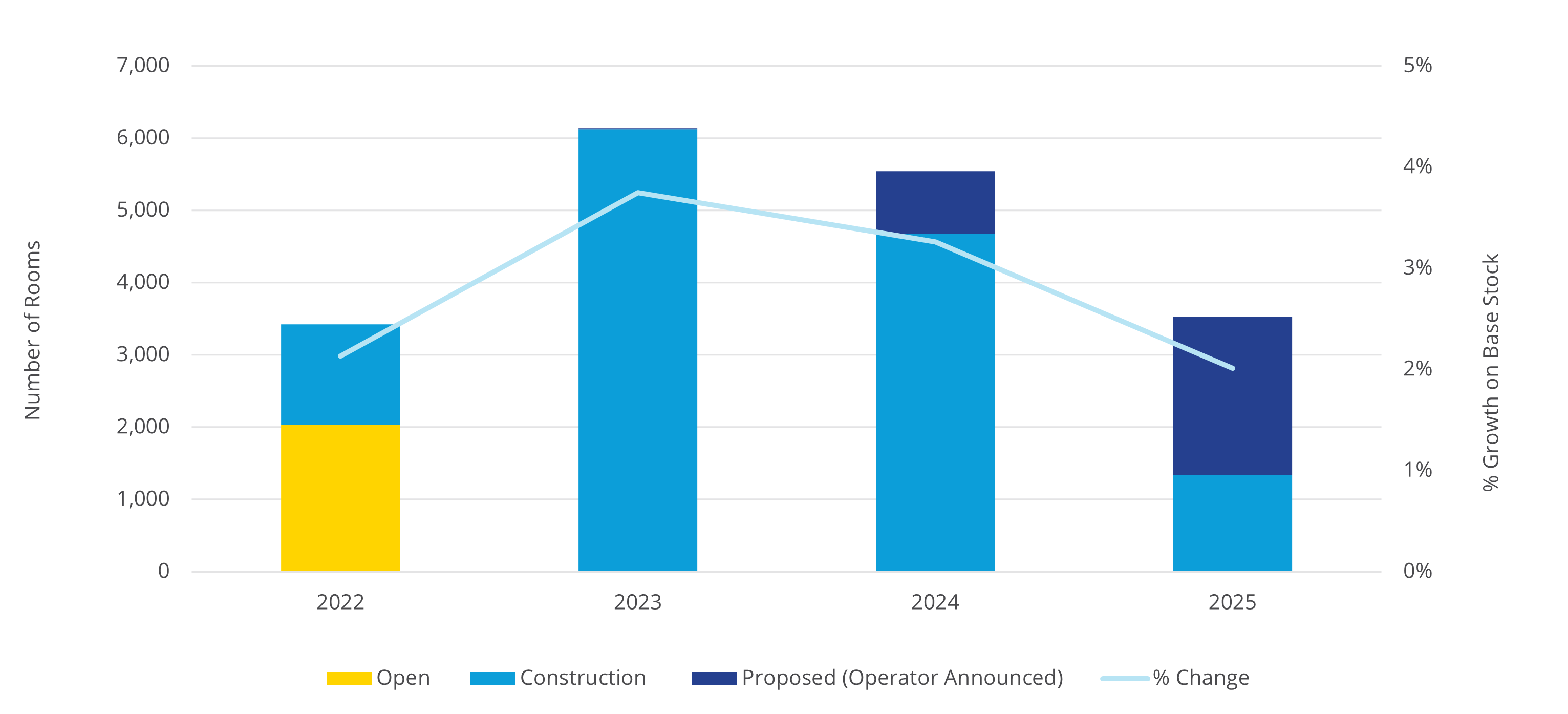

With the opening of around 3,420 rooms in 10 major markets throughout 2022, new hotel supply represented a moderation from the more than 5,000 rooms which opened in 2021, enabling hoteliers to respond dynamically to changes in tourism demand and spending and market conditions, according to Karen Wales, Colliers’ Asia Pacific Director of Hotels.

Australian hotel market is poised to leverage increased travel with 10% growth from 2021-2025, Colliers’ Australian Accommodation Supply Update 2022 reveals.

With the opening of around 3,420 rooms in 10 major markets throughout 2022, new hotel supply represented a moderation from the more than 5,000 rooms which opened in 2021, enabling hoteliers to respond dynamically to changes in tourism demand and spending and market conditions, according to Karen Wales, Colliers’ Asia Pacific Director of Hotels.

“By remaining leaner until international tourism rebounds to pre pandemic levels, hoteliers are better equipped to navigate trading market fluctuations for resiliency post pandemic.” Ms Wales said.

According to Colliers analysis of the Australian Government overseas arrivals and departures data, short term visitor arrivals into Australia totaled 2.1 million over the nine months to September 2022 - 31% of the arrivals recorded for the same period in 2019. However, international arrival numbers consistently improved throughout the year, highlighting the opportunity for future growth.

“As global travel reverts to pre pandemic levels, allowing for the fact that foreign travelers typically journey down under with a six month booking window and the cost of flights have yet to stabilise, the continued reinvigoration of Australia’s hotel industry will elevate the already renowned national brand.” Ms Wales said.

For the second consecutive year, Melbourne dominated new hotel openings with an additional 1,421 rooms in the city and 462 new rooms across the broader metropolitan area by the end of 2022, ensuring one of the fastest growing tourism markets post COVID is well positioned to leverage an influx of foreign visitors, according to Colliers’ research.

Additional room supply across Brisbane (51 rooms), Canberra (45 rooms), Gold Coast (702 rooms), Sydney (424 rooms) and Sydney Metro (315 rooms) will also uplift a hotel market which was predominantly built in the 1980s.

“This year and next year in particular will also see the elevation of luxury hotel standards in Australia, with the opening of eight new premium projects, including the Langham on the Gold Coast, the Ritz Carlton and Le Meridien in Melbourne and Capella and W in Sydney.” Ms Wales said.

“These hotels will set new luxury benchmarks in Australia and are expected to achieve a significant Average Daily Rate premium compared to rates already being achieved in these markets, similar to the experience of Brisbane and Perth.

“The future is also ‘green’ with demand for sustainable hotels growing amongst corporate clients and those travelling for Meetings, Incentives, Conferences and Exhibitions (MICE), who wish to align with businesses who share their social responsibility goals.

“An emphasis on sustainability will also increase due to new government policy driving change in this regard and financial incentives such as Green Financing and Grants, which now exist to encourage developers to pursue ESG certifications for their developments.”

The opportunity for a luxury green facelift is being leveraged by the Australian hotel market’s expansionary development phase, which is set to peak in the next 12 months with the opening of 5,949 rooms, according to Colliers’ research. There is a total of 12,517 rooms currently under construction and scheduled to open over the next three years.

“In addition to an increasing number of international tourists post pandemic, new hotel supply is being met with an uptick in demand from a reduction in Short Term Rental Accommodation (STRA).” Ms Wales said.

Due to demand for higher density housing and rising rents, the supply of STRA in major cities has contracted by 15% over the past year, according to AirDNA and Colliers.

Sydney saw the most significant reduction in active rentals which declined by around 30 per cent across its metropolitan area, while Melbourne has experienced a 9.5 per cent reduction in STRA over the past year and 21 per cent reduction over the past two years with the most significant declines in Docklands (-30.3 per cent), Southbank (-19.6 per cent) and the CBD (-21.5 per cent).

This is a trend that is evident across most markets except for Darwin and Canberra where STRA letting supply has increased over the past year.

Click here to view and download Colliers Australian Accomodation Supply Update