Elevating Hotel Investment Analysis: A Strategic Edge in Indonesia - HIS

Contact

Elevating Hotel Investment Analysis: A Strategic Edge in Indonesia - HIS

Ross Woods, Hotel Investment Strategies CEO and Founder, explores pivotal development in the field of hotel investment analysis that could significantly impact the industry in Indonesia.

In the competitive realm of hotel investment, conventional wisdom often suggests a focus on nancing decisions, cash ow projections, or tax planning. Signicant as they are, they represent just the beginning of the analytical depth required for astute investment. At PT. Hotel Investasi Strategis, we probe deeper, reaching the core of investment analysis: sophisticated identication, measurement, and strategic risk management. This ethos is the bedrock for realizing superior risk-adjusted returns, a metric only quantiable through meticulous, context-specic analysis, particularly pertinent to the burgeoning Indonesian hotel market

The Outmoded Paradigm of Hotel Feasibility Studies

Paradigma Usang Studi Kelayakan Hotel

While traditional hotel feasibility studies have provided foundational insights in the past, they have remained largely static, with methodologies unaltered since the 1970s. This stagnation endures despite calls for enhanced effectiveness from academia and industry leaders. These models, as Pellat1[1] critically observed in 1972, are starkly insucient for generating realistic estimates of return and associated risks on real estate investments. At PT. Hotel Investasi Strategis, we distance ourselves from these outdated practices by employing probabilistic simulation models, such as Monte Carlo techniques—a practice we've rened and successfully implemented for over three decades, advancing beyond the historical context that once limited such studies.

Risk Reimagined: From Concept to Quantication

Risiko yang Dibayangkan Ulang: Dari Konsep ke Kuantikasi

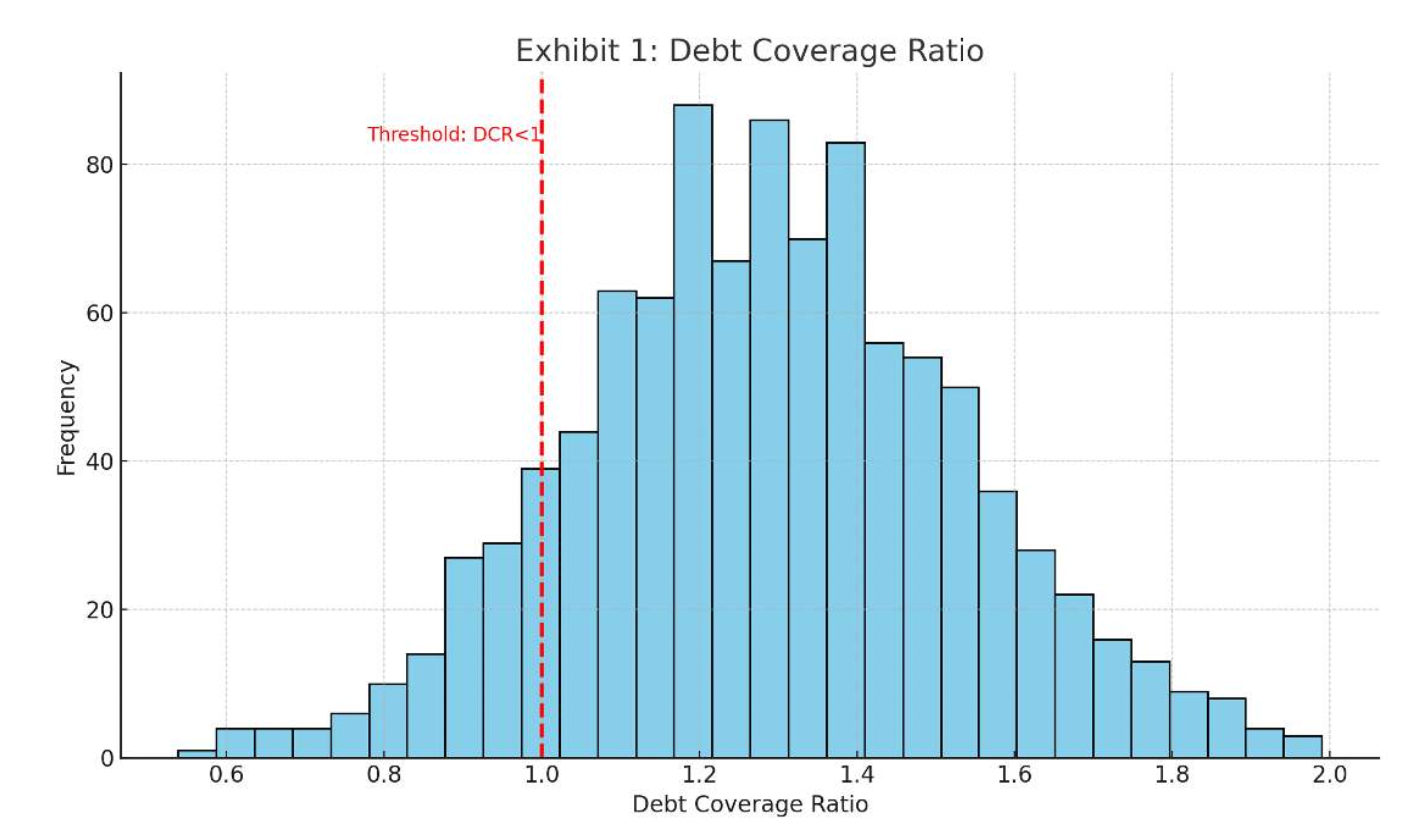

The notion of risk is inextricably linked to hotel investment, especially within the dynamic landscape of emerging markets such as Indonesia. The conventional approach provides 'point estimates'—singular gures that suggest a most likely outcome. Such a method, however, does not account for the full spectrum of risk. Exhibit 1 illustrates the potential variability in the debt-coverage ratio, offering insight into the range of possible nancial outcomes under varying market conditions. This level of analysis, absent in traditional feasibility studies, is pivotal for investors who seek a more substantive evaluation of their prospective ventures.

Elevating Hotel Investment Analysis: A Strategic Edge in Indonesia

Monte Carlo Simulation: A Vanguard in Risk Analysis

Simulasi Monte Carlo: Garda Depan dalam Analisis Risiko

Developed in the 1960s and popularized by David Hertz[2], the Monte Carlo simulation remains a cornerstone of our hotel feasibility and risk analysis methodology. This technique constructs probability distributions for uncertain variables based on either historical data, controlled experiments, theoretical models, or expert judgment. For instance, payroll expenses might follow a lognormal distribution, while the terminal cap rate could be determined by synthesizing diverse expert opinions. By simulating countless scenarios, we not only ascertain the range of potential outcomes but also the likelihood of each, providing investors with a comprehensive risk-return prole.

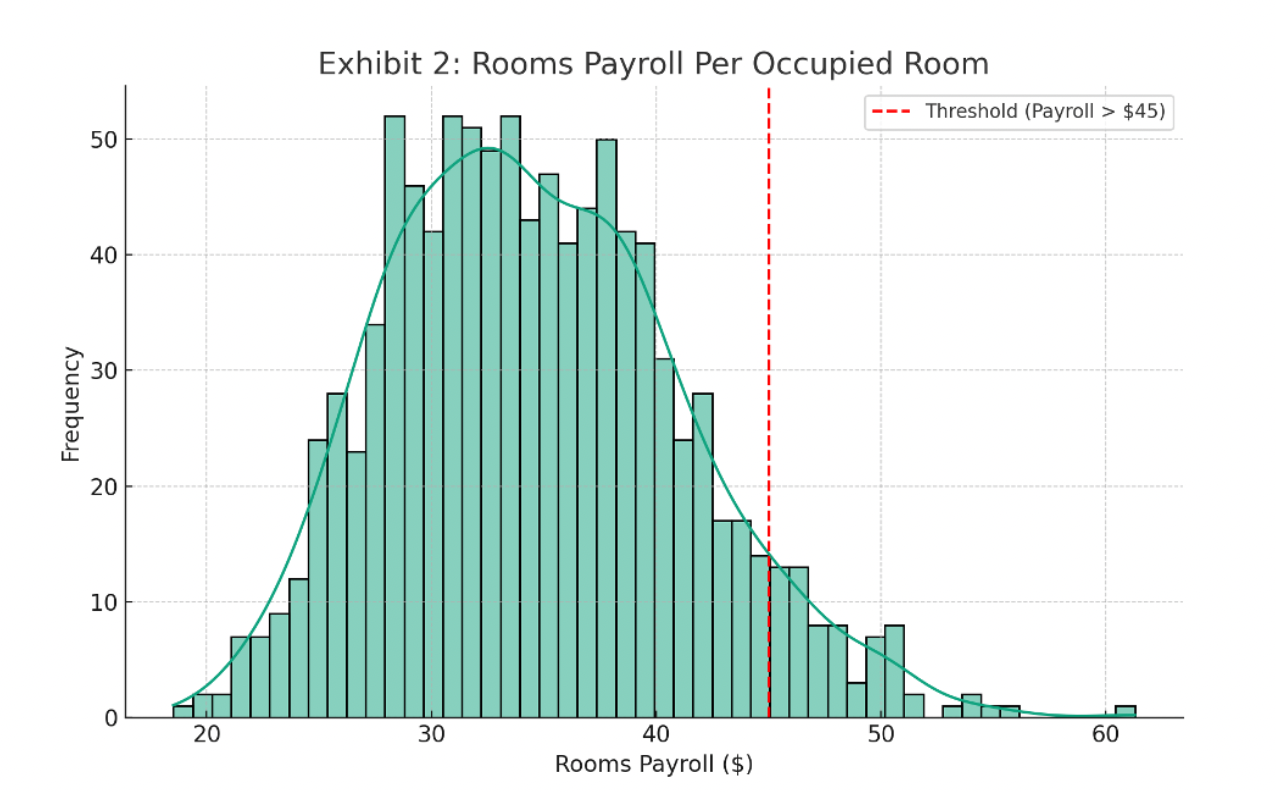

In the delicate balance of hotel operations, managing expenses is as critical as optimizing revenue. One of the most signicant operational costs is payroll for the Rooms Deparment, which can uctuate based on a variety of factors including occupancy levels and stang eciency. Traditional feasibility studies may offer a static estimate, yet the reality is far from xed. Exhibit 2 presents a more dynamic approach, showcasing the rooms payroll per occupied room through a lognormal distribution, which accounts for natural asymmetry in nancial data. This model, based on a mean of US$35 and a standard deviation of US$7, provides a probabilistic view of payroll expenses, giving investors a clearer understanding of potential cost variances, they may encounter.

By examining the distribution in Exhibit 2, stakeholders can anticipate the likelihood of payroll expenses exceeding a certain threshold — information that is critical for rigorous nancial planning and budgeting. From the simulations, the probability that the rooms payroll per occupied room will be greater than US$ 45 is approximately 8.7%. This nuanced analysis allows for more informed decision-making, aligning operational expectations with the complex realities of hotel management.

Our advanced simulations underscore the potential nancial impact of variable costs, equipping our clients with the strategic foresight to manage them proactively. It is this level of detail and analytical precision that sets PT. Hotel Investasi Strategis apart, ensuring our clients are not just prepared for what is likely, but for the full range of what is possible.

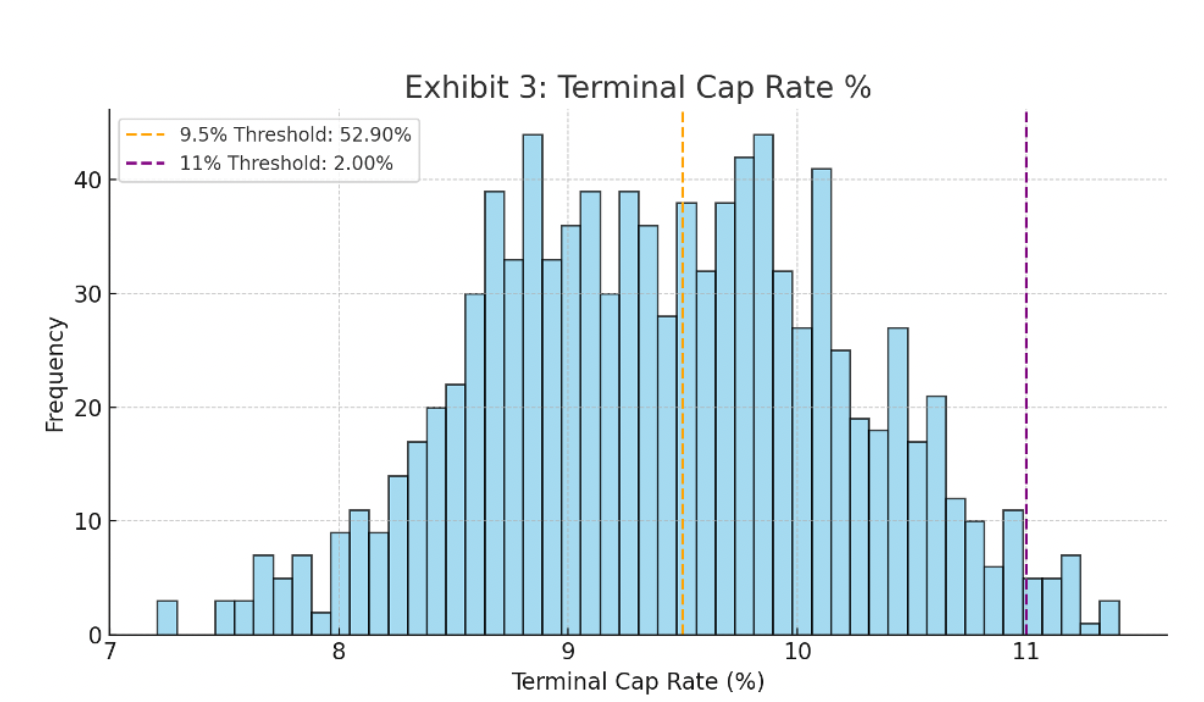

Understanding the potential exit value of a hotel investment is paramount. It necessitates a forward-looking analysis that transcends the immediate operational metrics to encompass the long-term nancial horizon. The terminal capitalization rate, or 'cap rate,' serves as a pivotal indicator in this regard, inuencing the resale value and overall return on investment.

Exhibit 3 provides a sophisticated visualization of terminal cap rates derived from a composite of expert forecasts. By integrating a range of insights into a weighted probabilistic model, we offer a granular view of future valuation scenarios. This exhibit amalgamates three triangular distributions with distinct means and ranges, weighted to reect the nuanced perspectives of seasoned industry experts.

Through this probabilistic lens, Exhibit 3 illustrates not just a single projected cap rate, but a spectrum of potential outcomes, each associated with a calculated likelihood. This method empowers investors with the ability to gauge the exit value of their investments under a variety of future market conditions, providing a strategic advantage in both acquisition and disposition planning.

At PT. Hotel Investasi Strategis, we harness such advanced simulation techniques to fortify your investment strategy with robust, data-driven projections. The terminal cap rate analysis exemplied here underscores our commitment to delivering investment evaluations that are as comprehensive as they are precise, ensuring that our clients are well-equipped to make decisions that stand the test of time and market uctuations.

Projected returns are a cornerstone of any investment evaluation. Yet, the true measure of an investment's merit lies not solely in its expected return but in the breadth and depth of its return prole. At PT. Hotel Investasi Strategis, we believe that understanding the variability and probability of returns is just as crucial as the returns themselves.

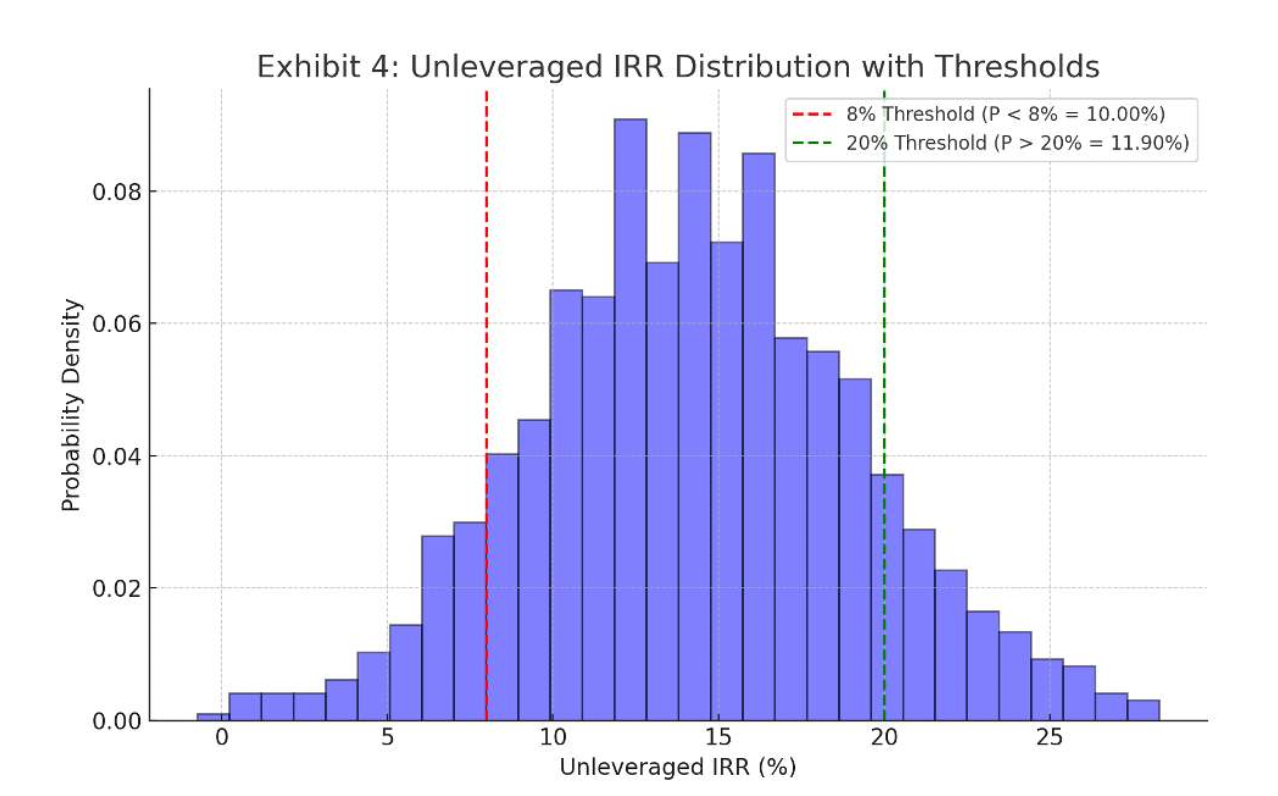

Exhibit 4 demonstrates the power of advanced risk-adjusted return analysis. Utilizing a Monte Carlo simulation, we depict the range of potential Internal Rates of Return (IRR) for a hypothetical hotel investment. The graph illuminates the variability of returns, providing a probabilistic forecast that is meticulously calculated with a mean of 14.5% and a standard deviation of 5%.

This exhibit allows us to analyze the likelihood of achieving various IRR thresholds, granting investors insight into the potential for both conservative and optimistic nancial scenarios. It offers a visual representation of the probability that the IRR could fall below a certain benchmark — say, 8% — or surpass more ambitious targets, such as 20%. From the simulations, the probability that the unleveraged IRR will be less than 8% is approximately 10%. Similarly, the probability that the IRR will exceed 20% is about 11.9%. This comprehensive perspective on potential returns is invaluable for investors seeking to balance their portfolios with investments that align with their risk tolerance and nancial objectives.

Our analytical rigor and commitment to providing a full spectrum of investment outcomes underscore our advisory services. The detailed IRR analysis presented in Exhibit 4 is emblematic of our approach: nuanced, strategic, and always investor-centric. We invite you to delve deeper into our methodologies and discover how our expertise can optimize your investment portfolio for the complexities of the Indonesian hotel market."

Decoding the Numbers: A Comprehensive View of Investment Performance

Mengurai Angka: Pandangan Komprehensif terhadap Kinerja Investasi

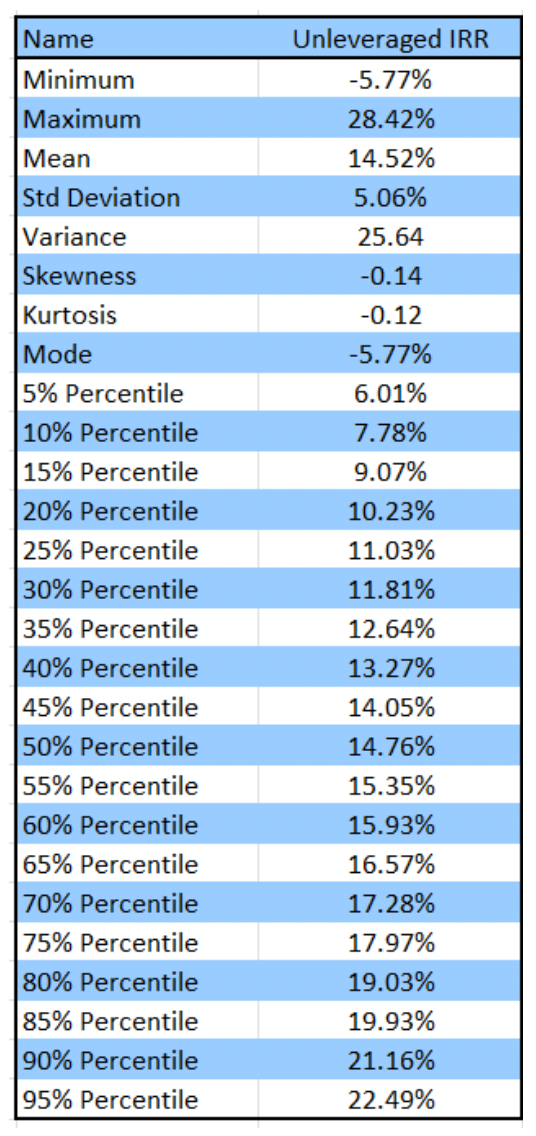

At the intersection of risk and return lies the potential for informed investment decisions. Exhibit 5 provides a detailed statistical tableau, "Descriptive Statistics for Simulated Unleveraged IRR," which encapsulates the breadth of outcomes derived from our rigorous Monte Carlo simulations. This exhibit is a testament to our analytical precision, offering a full perspective on the expected performance of hotel investments.

Exhibit 5: Descriptive Statistics for Simulated Unleveraged IRR

The data ranges from a minimum IRR of -5.77%, reecting the most adverse scenarios, to a maximum of 28.42%, illustrating the upper bounds of potential returns. With a mean IRR of 14.52%, we capture the central tendency of investment yield, while the standard deviation at 5.06% quanties the variability around this mean, presenting a clear picture of volatility and risk.

Notably, the skewness and kurtosis values hover around zero, indicating a distribution of returns that is fairly symmetric and follows a normal distribution's tail behavior, suggesting a balanced risk prole for the savvy investor. The mode of -5.77%—an outlier inuenced by extreme negative scenarios—serves as a critical reminder of the importance of downside risk assessment.

The percentile breakdown further enriches the narrative, offering investors foresight into the range of probable outcomes. For instance, there is a 95% chance that the IRR will exceed 6.01%, providing a substantial buffer above the break

Strategic Insights: Prioritizing Risk with Sensitivity Analysis

Wawasan Strategis: Memprioritaskan Risiko dengan Analisis Sensitivitas

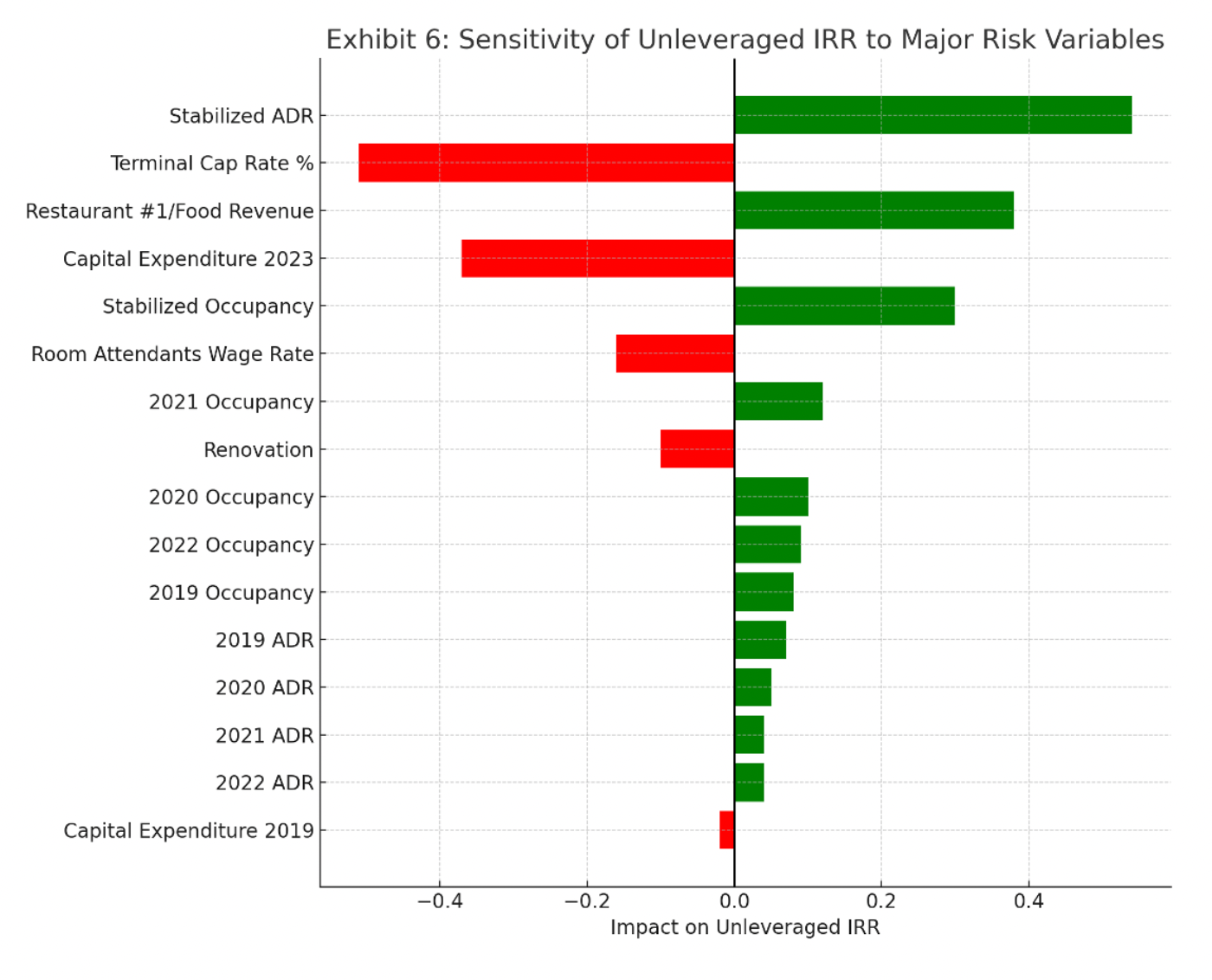

To navigate the complex terrain of hotel investment, stakeholders must discern which factors exert the most signicant inuence on nancial outcomes. Exhibit 6 presents a Tornado Graph, "Sensitivity of Unleveraged IRR to Major Risk Variables," offering a visual hierarchy of risk variables ranked by their impact on the Unleveraged IRR. This analytical tool crystallizes our strategic approach—prioritizing attention on factors with the greatest leverage on investment performance.

Stabilized Average Daily Rate (ADR) emerges as the most inuential positive contributor, underscoring the critical role of revenue management in asset performance. Conversely, the Terminal Cap Rate holds a substantial inverse relationship with IRR, reecting its pivotal role in investment exit strategies. The graph delineates other variables such as food revenue from Restaurant #1 and capital expenditures, highlighting their contribution to the investment's protability.

This precise identication and ranking of variables are instrumental in crafting a robust risk management strategy. It allows investors to focus on managing signicant risks and to consider mitigation strategies where necessary, thus optimizing the investment's risk-return prole.

Take the Next Step Towards Enlightened Investment Decisions

Melangkah Lebih Jauh Menuju Keputusan Investasi yang Berwawasan

At PT. Hotel Investasi Strategis, we believe in equipping investors with the foresight that only the most advanced analytical tools can provide. Our pioneering application of Monte Carlo simulations and quantitative risk analysis techniques stand at the forefront of investment strategy, offering a depth of insight into the dynamic hotel industry landscape that traditional methods simply cannot match.

We invite you to partner with a visionary advisor who brings over three decades of global expertise and a proven track record of achieving the highest risk-adjusted returns. Embrace a future where data-driven clarity empowers your investment choices, and strategic foresight becomes your competitive edge.

Contact us today to explore how our bespoke analytical services can illuminate the complexities of your hotel investments, transforming uncertainty into strategic opportunity. Request your complimentary copy of “Toward Improving Hotel Prognostications Through the Application of Probabilistic Methodologies” and begin the conversation that could redene the way you invest.

1. Pellat, P.G.K.: “The Analysis of Real Estate Investments Under Uncertainty”, Journal of Finance, Vol 27, No.2, p.459. ↑

2. David B. Hertz. “Risk Analysis in Capital Investment,” Harvard Business Review, Vol. 42, No.1 (1964): 95- 106 ↑