China narrows down selected sectors for investment creating a geographic impact on hotel and tourism assets in non-core markets

Contact

China narrows down selected sectors for investment creating a geographic impact on hotel and tourism assets in non-core markets

China’s trade route ambitions will affect developments owned by mainland groups both at home and abroad.

A spree of offshore acquisitions has Beijing concerned about the risk to the Chinese banking system and subsequent downward pressure on its currency. In an effort to avoid replicating the Japanese economic collapse of the 1980s and 1990s, Beijing is focusing companies such as Dalian Wanda Group, HNA Group, which owns 13 per cent of Virgin Australia; Fosun Group, focused on European acquisitions and Australian apartment developments; and Anbang Insurance, which owns New York's Waldorf Astoria Hotel, which they feel have all overpaid for foreign assets.

A new list of banned overseas investments includes casinos and defence technology. Overseas property development and hotels, plus investments in the film, entertainment and sports industries are classified as "restricted". But, Beijing is encouraging investment in areas including oil and gas exploration, minerals and energy in Australia. The official China Daily reported: "Officials should guide overseas investments according to different categories, providing support to those on the encouraged list, offering tips to those on the restricted list, while strictly managing those on the banned list."

"There won't be an en masse "abandonment" of sites or buildings or half-done deals” said heavyweight Chinese investor Shanghai United chief executive Yangdong Xu. “This is not the aim of the Chinese government, and it is bad for reputation. Those who have already closed deals and started construction will not be impacted," he said.

According to Dealogic, Chinese investors announced outbound deals were worth a record US$219 billion in 2016. In the first half of 2017 fell 44 per cent as Beijing started to crack down on capital flight, and criticised Chinese companies buying trophy assets such as European football clubs, iconic hotels such as Club Med, and Hollywood studios. China's National Development and Reform Commission has labelled the recent overseas buying frenzy by China's biggest private companies as "irrational."

Under pressure from Beijing, speculation has mounted that Wanda may be the first of mainland China's companies to withdraw from Australia. The Australian Financial Review (AFR) reported earlier in the week that discussions were underway in Hong Kong for the sale of Wanda's A$1 billion Circular Quay tower in Sydney and its A$900 million Jewel resort on the Gold Coast. In January 2015, Wanda paid A$415 million for Gold Fields House at Circular Quay with sweeping views of the Harbour Bridge and Opera House.

Dalian Wanda Group initially told the AFR it "denied it is fielding offers for its two giant development projects in Australia, although sources have maintained a deal could still be reached for part of the assets". However, on Thursday 10 August the AFR reported that Wanda would sell a 60 per cent interest in its Sydney and Gold Coast developments to a separate company controlled by Wang Jianlin - a move which is being seen as a first step towards offloading the assets.

According to a source, a number of parties are interested in the Australian properties, including a European pension fund, in a deal which could be worth up to A$270 million. Other global assets which Wanda are reportedly looking to sell include developments in Chicago and London as well as in China.

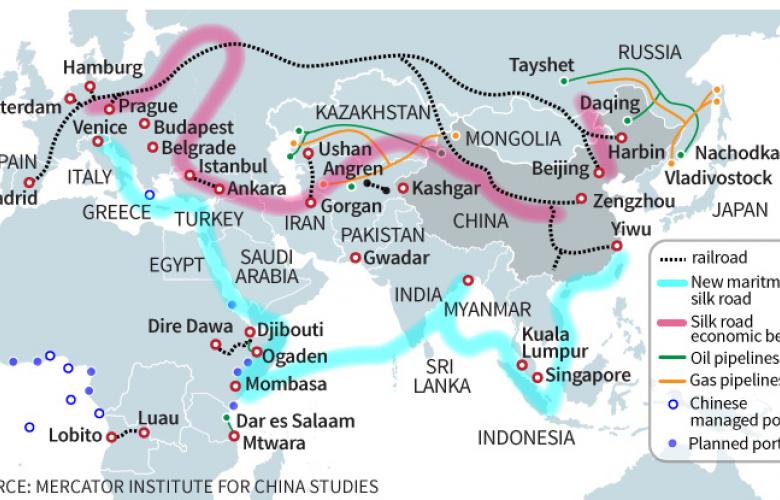

The One Belt, One Road project, a worldwide initiative by China to revive ancient land and ocean silk trade routes, creates a building boom across Central Asia up to Europe boosting trade and transport logistics. Land-based projects are ‘belt’ including roads, railways and the ‘road’ includes ports and maritime routes. According to the Sydney Morning Herald, it already has $US1 trillion ($1.3 trillion) of projects initiated, including major infrastructure works in Africa and Central Asia. It will involve 65 countries with a total population reach 4.4 billion and share of global economy of 30 per cent. It will help developing countries such as Pakistan and Afghanistan with infrastructure, and speed up their economic growth.

See also:

Australia and Japan attract funding as their tourism markets deliver on growth