Colliers International release their Australia New Zealand Capital Market Investment Review Hotels research report

Contact

Colliers International release their Australia New Zealand Capital Market Investment Review Hotels research report

Gus Moors and Karen Wales of Colliers International have found that Australian hotel transaction activity slowed in FYE2018 with volumes easing to $1.338 billion - however deal flow increased with 35 transactions (above $10 million) concluding throughout the year; This compares to 30 transactions in FYE2017.

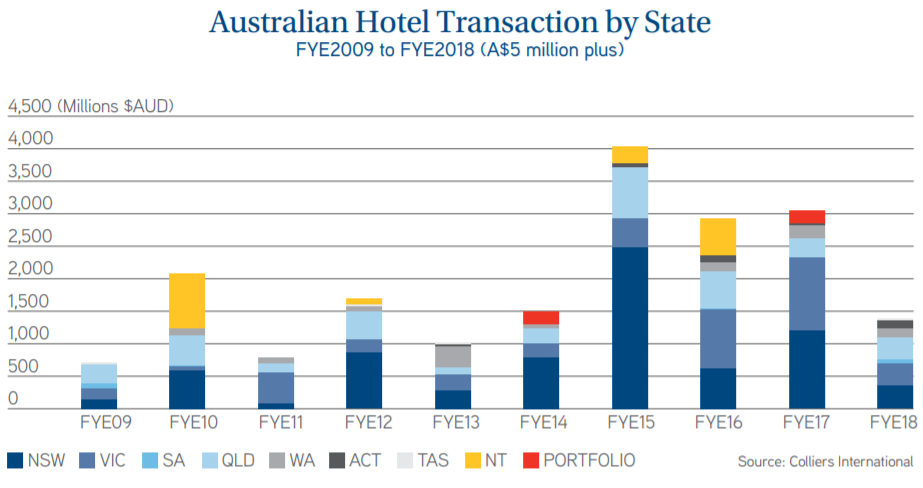

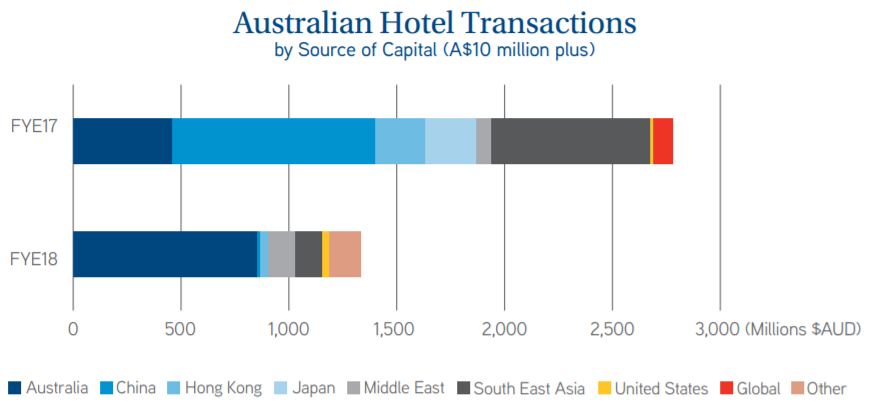

The Australia New Zealand Capital Market Investment Review published by Colliers International concluded that Australian hotel transaction activity slowed in FYE2018 with volumes easing to $1.338 billion, after a record three years, with a reduction in big-ticket sales.

Deal flow increased however with 35 transactions (above $10 million) concluding throughout the year. This compares to 30 transactions in FYE2017.

The report continues to state that fewer big-ticket sales also saw a shift in the capital base with locally domiciled funds stepping to the fore. Australian investors accounted for 63.7 per cent of asset trades in FYE2018, considerably higher than the 16.5 per cent recorded in FYE2017.

"Investors from Mainland China fell behind the rest of Asia as one of the more dominant sources of inbound capital, accounting for only 1 per cent of transactions over the year, as capital restrictions continued to bite. Continuing the trend of FYE2017, Middle Eastern investors remained active, as well as groups from Germany, Hong Kong, Singapore and the United States."

"Queensland was one of the more active hotel investment markets as investors made counter cyclical plays, ahead of improving fundamentals in Brisbane and as the key leisure markets continued to boom (aided by the Gold Coast playing host to the 2018 Commonwealth Games)."

"Whilst the Sunshine state topped the number of deals with nine assets transacting over the year, volumes were higher in NSW and VIC with the totals for both boosted by a few CBD sales."

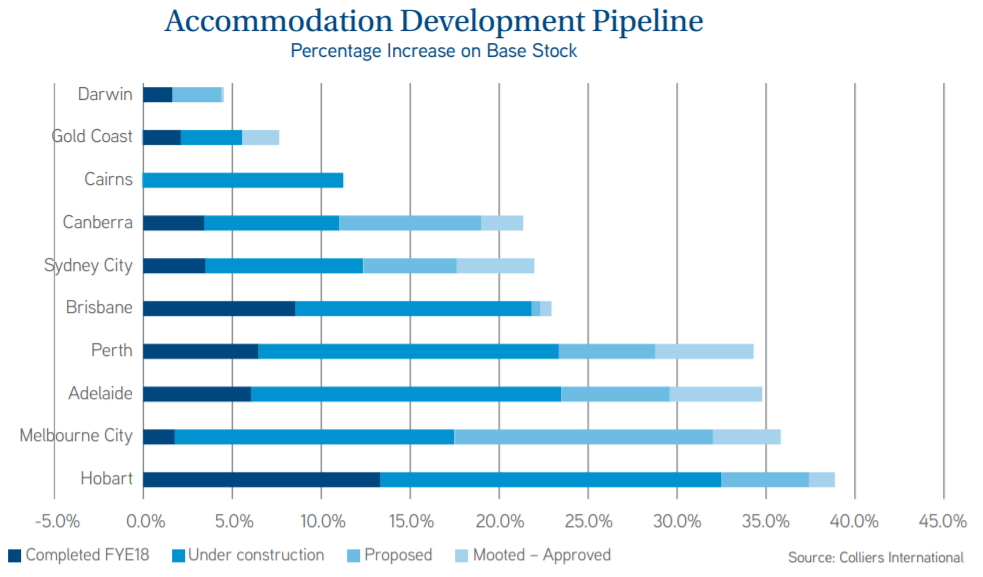

"For the first time for more than a decade, the number of rooms opening throughout the year surpassed the number traded with investors focussed on the development of new rooms. In FYE2018 almost 6,500 new rooms came on line in the ten major markets with an estimated value of more than $2.0 billion."

"This has also resulted in more hotel development site sales with projects offered in Sydney, Melbourne, Canberra and the Gold Coast over the year. Offshore groups continue to take a lead role in the development of new accommodation rooms, accounting for 40 per cent of rooms opening in FYE2018 and almost two thirds of rooms currently in the pipeline."

New Zealand

The New Zealand hotel market continues to perform at historically high levels on the back of the 5th consecutive year of a tourism boom, which has seen a record 3.8 million international visitors visit the country in the past 12 months.

This has culminated in positive RevPAR growth in all the major hotel markets over the past 12 months. In particular Queenstown which has experienced 17.1 per cent RevPAR growth for the YE June 2018 followed by Rotorua at 6.4 per cent.

Click here to view and download the full research report.

To discuss the report in further detail, phone or email Gus Moors or Karen Wales via the below contact details.

See also:

New Zealand hotel development on the rise, Dean Humphries Colliers International

Darwin and Gold Coast top hotel performers edging out Cairns, CBRE Hotels MarketView report