"Queensland hotel market having its time in sun" - iProsperity Hotel Research Report

Contact

"Queensland hotel market having its time in sun" - iProsperity Hotel Research Report

Figures released in iPG’s Half Yearly Report 2018 have revealed high levels of confidence in the Queensland hotel market with a significant amount of transaction activity recorded in the second half of 2018.

According to the report, QT Port Douglas, Kingfisher Bay Resort Group, Novotel Twin Waters Resort and Hilton Surfers Paradise all changed hands over the second half of last year.

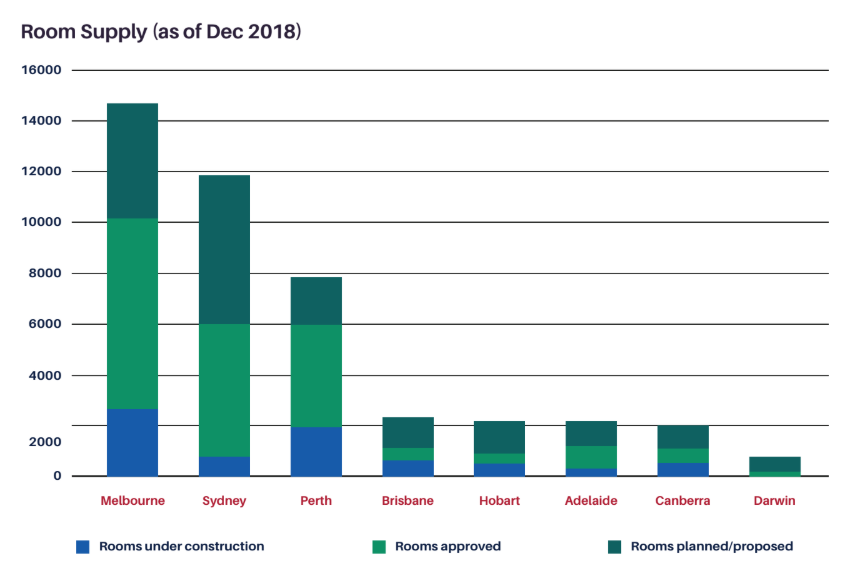

iPG also reported that across Australia an estimated 15,000 hotel rooms are currently under construction and scheduled to open in 2020. This underpins hotel supply growth estimates of approximately 8% per annum in both Melbourne and Sydney over the next three years.

Surging interest in attractions such as MONA in Hobart and nearby natural wonders, Cradle Mountain and the Bay of Fires are responsible for the 20% p.a. supply surge forecast for Hobart where occupancy rates are consistently above 80% as tourists flock to one of Australia’s most fashionable weekend getaway destinations.

See also: Howard Smith Wharves Art Series Hotel opening March 2019

According to iPG in early H2 there was a 20.1% increase in room supply in the Sydney Airport Mascot area which may have had a ricochet effect on Sydney’s CBD where rates retracted a compounded 6% for July and August, marking an end to the golden run of consecutive growth for Sydney as a whole.

Source: iProsperity

Launching the report, iPG’s Hotel Investment & Asset Manager, Raymond Tran, noted that while Sydney CBD growth has stalled, iPG expects the West of Sydney to generate significant interest from investors and developers as the $5.3bn Western Sydney Airport takes off.

See also: From vision to fruition: Howard Smith Wharves' summer takeover

“To be a truly international city, Sydney needs two airports and a Western Sydney Airport will roll out the welcome mat to more visitors as well as the expanding low-cost airlines servicing Australia.

“International visitors are forecasted to rise in 2019, supported by a weaker Australian currency presenting favourable exchange rates for overseas visitors. With only 1% of the outbound Chinese tourist market Australia-bound, we are seeing the tip of the iceberg. Advancements in Chinese payment platforms such as WePay and Alipay will accelerate this.”

iPG estimates that there will be at least 41 new hotels opening this year offering 8,000 new hotel rooms. As Chinese tourism increases, iPG is predicting the entry of luxury hotel brands to take advantage of increased visitors and limited high-end room supply.

Click here to download the full iProsperity Hotel Research Report.

See also:

Tighter yields and limited stock lead pub buyers to broaden their horizons - CBRE Hotels