How boutique hoteliers can boost their cash flow

Contact

How boutique hoteliers can boost their cash flow

BMT Tax Depreciation have advised that boutique hotel investors may be eligible for thousands of dollars in property depreciation deductions, a non-cash deduction, meaning hoteliers don’t need to spend any money in order to claim it.

Boutique hotels are quickly becoming the go-to accommodation for trendy travellers.

Equipped with quirky charm and niche décor, they generally offer between 1 to 100 rooms and have a more intimate feel than chain hotels.

As boutique hotels continue to grow in popularity, it’s important for hoteliers to be aware of their tax entitlements.

For example, boutique hotel investors may be eligible for thousands of dollars in property depreciation deductions.

Property depreciation refers to the wear and tear of a building and the assets contained within it. It’s considered a non-cash deduction, meaning hoteliers don’t need to spend any money in order to claim it.

The Australian Taxation Office (ATO) governs legislation that allows the owners of income producing buildings to claim depreciation for two categories: capital works depreciation and plant and equipment assets.

Capital works refers to the deductions available for the building’s structure and items deemed to be permanently fixed to it such as bricks, mortar and staircases. The owner of a commercial property in which construction commenced after the 20th of July 1982 can claim these deductions. Depending on the construction commencement date, these deductions can be claimed over either twenty years at a rate of 4 per cent or forty years at a rate of 2.5 per cent.

Although the ATO places restrictions on claiming capital works deductions, there are no date restrictions for depreciating plant and equipment assets in commercial properties.

Plant and equipment assets are items which can be easily removed from the boutique hotel such as flooring and furniture. Depreciation deductions for these assets are calculated based on each item’s individual effective life as set by the ATO.

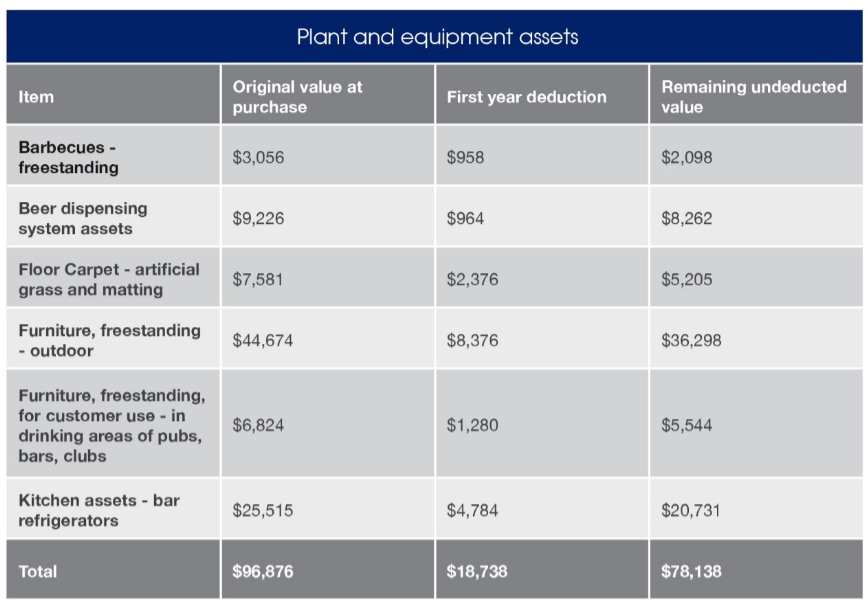

Let’s take a look at an example of how plant and equipment deductions can boost a hotelier’s cash flow.

In this scenario, the owner was claiming depreciation for a fifty-room boutique hotel featuring a rooftop beer garden.

The table below shows just a few of the depreciation deductions available for the plant and equipment assets found on the rooftop:

The depreciation deductions in this example have been calculated using the diminishing value method for a business with over $50 million annual turnover who are not eligible for small business instant asset write-off rules. This is not a comprehensive list of all available deductions.

The boutique hotel owner was able to claim a first-year deduction of $18,738 for the rooftop beer garden, with $78,138 worth of undeducted value remaining.

As the example shows, property depreciation can make a huge difference to a hotelier’s cash flow.

To maximise the depreciation claim for your boutique hotel, it’s important to engage a specialist Quantity Surveyor such as BMT Tax Depreciation for a tax depreciation schedule.

A BMT Tax Depreciation Schedule outlines all eligible deductions available over the lifetime of your property.

To learn more about BMT Tax Depreciation, contact 1300 728 726 or Request a Quote for a tax depreciation schedule today.

Click here to view the BMT Tax Depreciation website.

This is a Sponsored Article.

Related Reading:

See the depreciation deductions available in a hotel room