Hotels sector set for 'swift bounce back' after early challenges in 2020, says Colliers

Contact

Hotels sector set for 'swift bounce back' after early challenges in 2020, says Colliers

Colliers International has launched its 2020 Capital Markets Hotels Investment Review & Outlook, which predicts Australia's market will be able to withstand the current challenges.

The impact of recent demand shocks on the Australian hotels sector are expected to be short-lived despite a challenging start to the year, Colliers International says.

According to the firm's 2020 Capital Market Hotels Investment Review and Outlook, the resilience and competitiveness of the Australian tourism industry will enable it to grow overnight visitor spend from $70billion in 2009 to a projected level of $131 billion by the end of 2020, exceeding the government’s own goal of $115billion.

Colliers Head of Hotels Gus Moors said the current climate meant it was more important than ever to reflect on the long-term growth of the tourism industry, as highlighted by the "over achievement" of the economic contributions relative to the ambitious goals set by the government in its Tourism 2020 plan.

Colliers International 2020 Capital Markets Hotels Investment Review & Outlook - At a glance:

- In 2019, occupancy across the 10 major markets sat at 78 per cent - this compares to a peak of 60.8 per cent and 73.4 per cent during the previous two supply cycles.

- Colliers International believes the resilience and competitiveness of the Australian tourism industry will enable it to grow overnight visitor spend from $70billion in 2009 to a projected level of $131 billion by the end of 2020, exceeding the government’s own goal of $115billion.

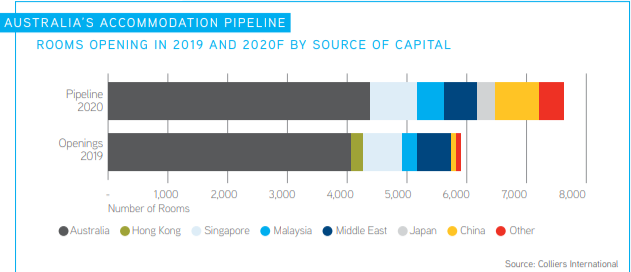

- Supply is expected to peak in 2021, before moderating thereafter.

“The growth in spend has resulted in increased investment in hotel development over this timeframe, which will see the sector deliver the 30,000 new rooms target across the ten major accommodation markets," he said.

“Supply is expected to peak in 2021, before moderating thereafter.

"After an extended period of very little new supply, the expansion and rejuvenation of Australia’s accommodation market is now well underway and has brought a more interesting but complex operating landscape, with consolidation between operators and an explosion of new hotel brands.”

While the Coronavirus was likely to result in a short-term slowdown in 2020, experience from the SARS outbreak in 2003 suggested the accommodation market had the ability to bounce back faster than some other property sectors.

This was due to the daily dynamic pricing of room rates, which could move up quickly as demand recovered.

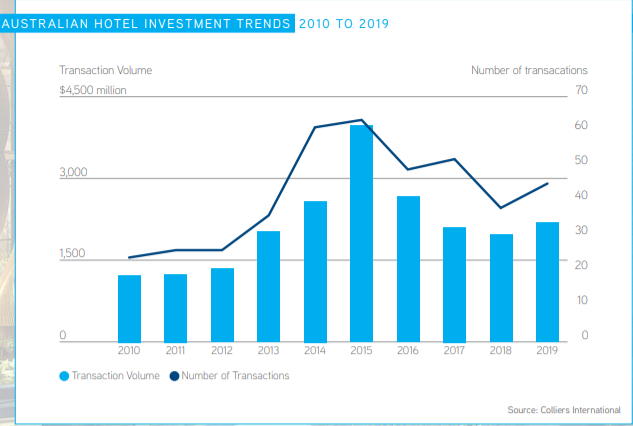

Colliers International Director of Hotels Karen Wales said the positive nature of the longer-term fundamentals was what attracted $2.2billion of hotel investment in 2019, a figure which is nearly 40 per cent above the longer-term average.

“There was a broad geographic mix of investors, representing all types of capital and purchasing a wide range of assets from portfolios, to resorts, development and deals and mixed-use projects.

"These investors can look beyond one-off demand shocks to see the long-term strength of the accommodation sector.”

The report also found that while supply injections and demand shocks had created material impacts on accommodation markets in the past, the sector was currently trading at high levels of occupancy that would help buffer this latest shock.

“In 2019, occupancy across the 10 major markets sat at 78 per cent - this compares to a peak of 60.8 per cent and 73.4 per cent during the previous two supply cycles,” Ms Wales said.

“It is important to also stress that accommodation demand is still majority driven by domestic markets, which insulates us from global shocks.”

With the Federal government committing $20million to a marketing campaign targeting domestic travellers and the Queensland State Government a further $2million to encourage Queenslanders and people from interstate to holiday in the Sunshine State this Easter, demand from within Australia was set for a boost.

Mr Moors said a sense of mateship to support regional communities hurt by the bushfires, coupled with the low Australian dollar, should see more Australians holiday onshore, helping to offset the slowdown in international travellers in 2020.

“Whilst the outlook for the industry looks challenged at the start of 2020, the impact of the most recent demand shocks are expected to be relatively short-lived," he said.

“An uneven foundation now may also in turn be the saving grace for the decade to come as more marginal accommodation projects are shelved and the national tourism focus turns to rebuilding those regional communities which have been directly impacted by bushfires.”

Click here for more insights from the report.

Similar to this:

Investment demand for New Zealand hotel assets remain high - Colliers International

Record tourists ensure healthy growth for New Zealand hotel industry