Sydney hotel performance experiences softening despite tourist increase - CBRE

Contact

Sydney hotel performance experiences softening despite tourist increase - CBRE

An increase in tourist volume has not been enough to stop Sydney's hotels from recording a drop in revenue per available room and average daily rate in 2019, according to a CBRE report.

Sydney's reputation as a tourist hotspot may be well established, but data from CBRE indicates it does not guarantee the city's hotels are protected from declines.

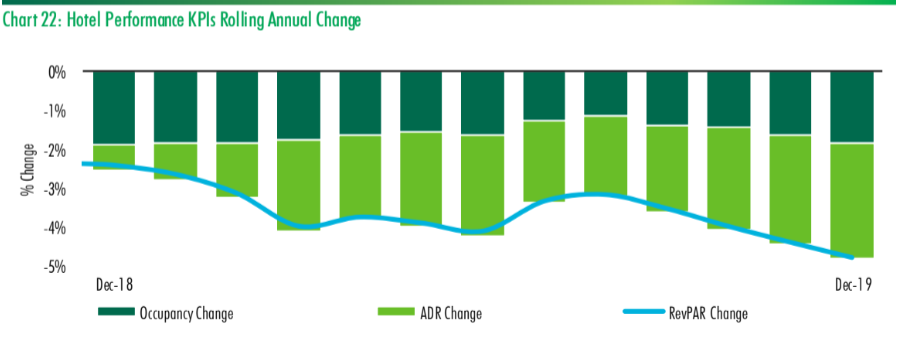

CBRE's Hotel Maketview for the fourth quarter of 2019 revealed Sydney's hotel performance was continuing to soften, with a 1.9 per cent decrease in average daily rate and a 3 per cent fall in occupancy, resulting in a revenue per available room decline of 4.8 per cent.

Sydney growth in hotel nights - at a glance:

- 7.2 increase in nights spent in hotels to more than 20.7 million annually.

- International guests accounted for 42 per cent of hotel nights.

- Average length of the stay was 2.7 nights.

Source: CBRE

According to the report, the data reflects a "reversion from historically high levels", with Sydney set to continue to "represent one of Australia's major drawcards as improved CBD activation and new high quality amenity appeal to international and domestic travellers".

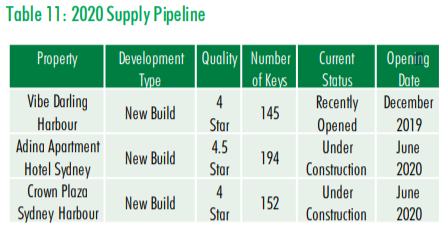

CBRE calculates that while 2100 rooms are under construction to be completed by 2022 within the city, a number of further DA Approved and mooted projects could "face increasing feasibility pressure" under construction costs and softer trading conditions, which could reduce the supply pipeline.

Click here to download the report.

Sydney's Vibe Darling Harbour sold $108 million

Similar to this:

Hobart hotel market 'stand out' performer in 2019 : CBRE Hotels report

Brisbane and Perth 'absorbing' increase in hotel supply: CBRE report

"Domestic demand in New Zealand offsets soft international numbers" - reports CBRE