New Zealand hotels well positioned but recovery will be protracted, says Colliers International

Contact

New Zealand hotels well positioned but recovery will be protracted, says Colliers International

A new report from Colliers International has outlined the challenges for New Zealand's hotel sector as it recovers from the disruption of COVID-19.

A new survey from Colliers International has found that while New Zealand's hotel sector has the potential to set the standard in rebounding from COVID-19, it will have to overcome its most significant downturn in order to do so.

The Pathway to Recovery report, released today, reflects the view of nationwide hotel operations at the beginning of April, shortly after the New Zealand government closed the country’s borders to non-residents on March 20 and implemented Level 4 lockdown restrictions on March 25.

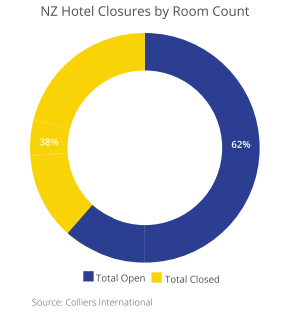

According to the report, 40 per cent of hotels were either closed or placed in temporary ‘hibernation’ while a further 40 per cent remained open with limited inventory and skeleton staff.

At a glance:

- Colliers International has released a Pathway to Recovery report on the New Zealand hotel sector.

- The research is based on a survey of hotel operators that was conducted at the beginning of April, shortly after the New Zealand government closed the country’s borders to non-residents and implemented Level 4 lockdown restrictions.

- According to Colliers International, the majority of New Zealand's 27 hotel projects under construction will continue, although some will be deferred until the market improves.

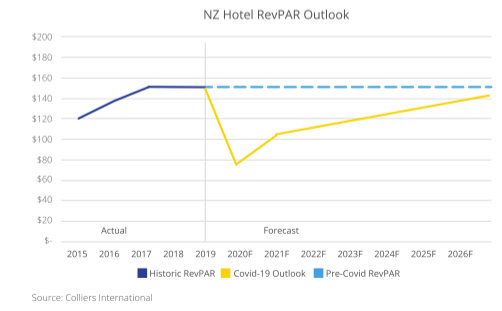

Hotel occupancy fell from 80 per cent in the first quarter of 2020 to under 20 per cent in all key markets in April. Room rates also fell by up to 50 per cent.

Dean Humphries, National Director of Hotels at Colliers International, said Covid-19’s impact on the financial performance of the hotel sector was the most significant in New Zealand’s history.

“Covid-19 is having a profound impact on the global tourism and hotel sector and will likely reshape the way our industry operates for many years to come, ultimately redefining the short stay accommodation sector as we know it," he said.

“There is no doubt there will be some causalities in our sector as owners and operators establish whether they can efficiently run their businesses in this new era.

“However, this will also create opportunities for others who can quickly adapt and adopt new strategies.”

Mr Humphries said New Zealand would remain reliant to some degree on how wider global markets emerged from the pandemic, with the initial recovery to be led by domestic tourism.

“While we need to adopt a ’wait and see’ approach until clear trends emerge, we now have time to prepare for the inevitable changes in the marketplace," he said.

"Before Covid-19, domestic guests accounted for more than 50 per cent of hotel room night demand throughout the country with the exception of Queenstown at 34 per cent.

“We expect an initial uptick in domestic tourism from May 14, when Level 2 came into play, followed by demand from a trans-Tasman and Pacific bubble that may be established as soon as the third or fourth quarter of this year.

The report indicates a possible trans-Tasman and Pacific bubble is likely to be followed by a period of bilateral travel agreements, primarily focused on the South East Asian seaboard including Hong Kong, South Korea, China and Taiwan if these countries showcase that they have contained the virus to manageable levels.

Mr Humphries said while New Zealand had an opportunity to lead the way to be for many tourism-focused initiatives and become a benchmark, the recovery would be gradual to start off with, although is likely to gain momentum from 2021.

“Another factor in New Zealand’s favour is the early hosting of global sporting and cultural events such as the America’s Cup and APEC, which are both still scheduled for 2021," he said.

“While a path to recovery is emerging, hotel performance is unlikely to fully recover to pre-coronavirus levels for up to five years, in part because of a large number of new hotel rooms currently under construction.

“The majority of New Zealand’s 27 hotel projects under construction will continue, although some will be deferred until the market improves.

"Most projects will face a delay in completion in the order of three to six months."

These projects account for close to 4,200 additional rooms with the majority of these projects being located in Auckland and Queenstown.

However, proposed new hotel developments are likely to be halted over the short to medium term.

Chris Bennett, Director of Hotel Valuation and Advisory at Colliers International, said investment yields for prime hotel assets remained largely at pre-Covid levels, although some reductions in values due to lower forecast earnings were anticipated.

“Investors with long-term objectives, who can weather the next 18 months, will likely emerge in a stronger position, having fully re-evaluated their current operating model and positioning themselves for a robust recovery," he said.

“Conversely, those owners who are under-capitalised or unable to sustain some pressure on their balance sheets over the short term may need to divest or restructure their business and/or assets.”

Bennett says it is more important than ever for clients to receive specialist, up-to-date hotel and tourism advice across the breadth of New Zealand.

Click here to download the report.

Similar to this:

Record tourists ensure healthy growth for New Zealand hotel industry

Investment demand for New Zealand hotel assets remain high - Colliers International

New Zealand's tourism boom waiting for new hotels Dean Humphries Colliers International