Regional travel boon to kickstart Australia’s economy - CBRE report

Contact

Regional travel boon to kickstart Australia’s economy - CBRE report

Regional operators are benefiting from the absence of international holidaying, with a significant proportion of the 181 million domestic outbound visitor nights recorded in 2019 being diverted towards local options, according to new data from CBRE.

A CBRE Hotels’ survey of top-end regional operators has found that rerouting of domestic travel will be driven by heightened interest in local, authentic and indulgent offerings.

The survey results have been published in CBRE Research’s The Regional Travel Renaissance research report, which highlights how frustrated demand from outbound holidaymakers—a market segment that averaged a spend of around $7,700 per person in 2019—could be high-yielding for local and regional operators.

Tom Gibson, Director of CBRE Capital Markets – Hotels, said that tourism was a key driver to Australia’s economic growth, with 44 cents of every tourism dollar spent in regional Australia.

CBRE Hotels Regional Operators Survey - At a glance:

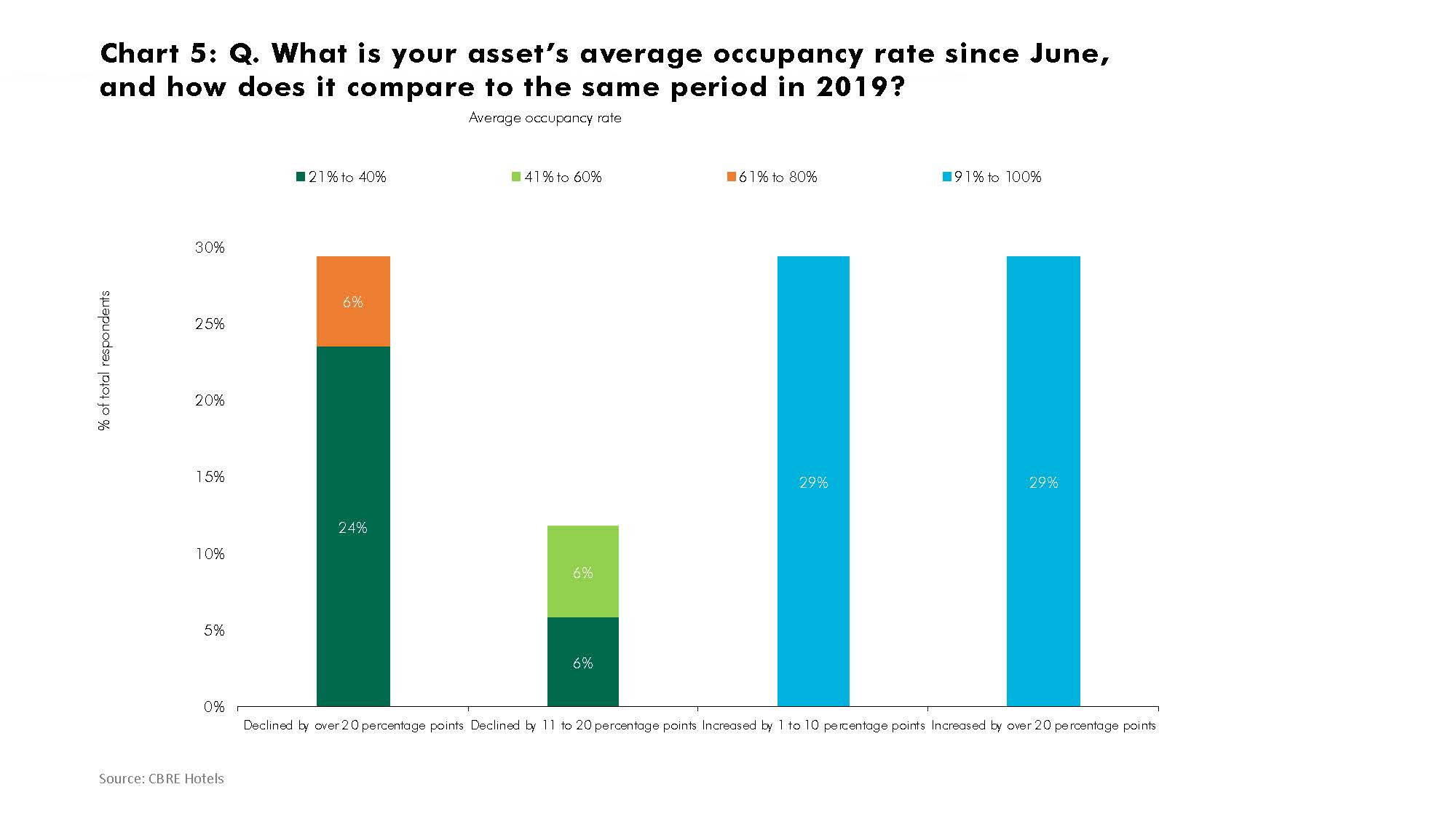

- Since June this year, 58 per cent of respondents recorded occupancy increases compared to 2019 over the same period, pushing their average occupancy levels to 91-100 per cent, with NSW-based operators represent a large share of these high-performing properties.

- Conversely, 42 per cent of surveyed operators recorded occupancy declines compared to the previous year, with 30 per cent of respondents suffering declines by over 20 percentage points, with most of the surveyed declines recorded in markets with a high reliance on flight access.

- Surveyed operators indicated the highest proportion of their guests were intrastate travellers, closely followed by interstate travellers.

“Regional tourism will be crucial in kickstarting Australia’s economy moving forward,” he said.

“An uplift in this space will continue to be supported by a displaced domestic outbound holiday market – representing an opportunity for local operators to capitalise on this high-yielding segment.”

Mr Gibson said the results from the survey, which examines the key drivers of regional travel and gauges market sentiment and performance, demonstrated a positive outlook for regional accommodation operators and, coupled with the recent strong performance of regional Airbnb markets, further highlighted the strength of regional Australia’s offering to local travellers.

“Healthy occupancies observed among the majority of surveyed operators underlines trending growth in demand for local holidaying, most notably destinations within a few hours’ drive of major CBD markets,” he said.

Since June this year, 58 per cent of respondents recorded occupancy increases compared to 2019 over the same period, pushing their average occupancy levels to 91-100 per cent, with NSW-based operators represent a large share of these high-performing properties.

Conversely, 42 per cent of surveyed operators recorded occupancy declines compared to the previous year, with 30 per cent of respondents suffering declines by over 20 percentage points, with most of the surveyed declines recorded in markets with a high reliance on flight access.

Surveyed operators indicated the highest proportion of their guests were intrastate travellers, closely followed by interstate travellers.

Despite the reintroduction of state border closures expected to limit interstate travel over the short-term, operators are still afforded access to their respective captive state markets and are well placed to become potential recipients of displaced interstate travel.

Troy Craig, Regional Director of CBRE Valuation & Advisory Services – Hotels, said Airbnb performance also represented a good bellwether indicator for regional travel, achieving a 46 per cent RevPAR increase over May to June this year, compared to a 11 per cent RevPAR decline observed in metro Airbnb markets over the same period.

“The bounce in regional RevPAR performance over this period reflects pent-up demand for leisure travel as restrictions in most states and territories gradually began to ease," he said.

“The RevPAR uplift in June 2020 across key regional ‘drive-to’ destinations has been underpinned by a strong intrastate market – a market which is likely to become more prominent following recent state border closures that will limit interstate travel over the short-term

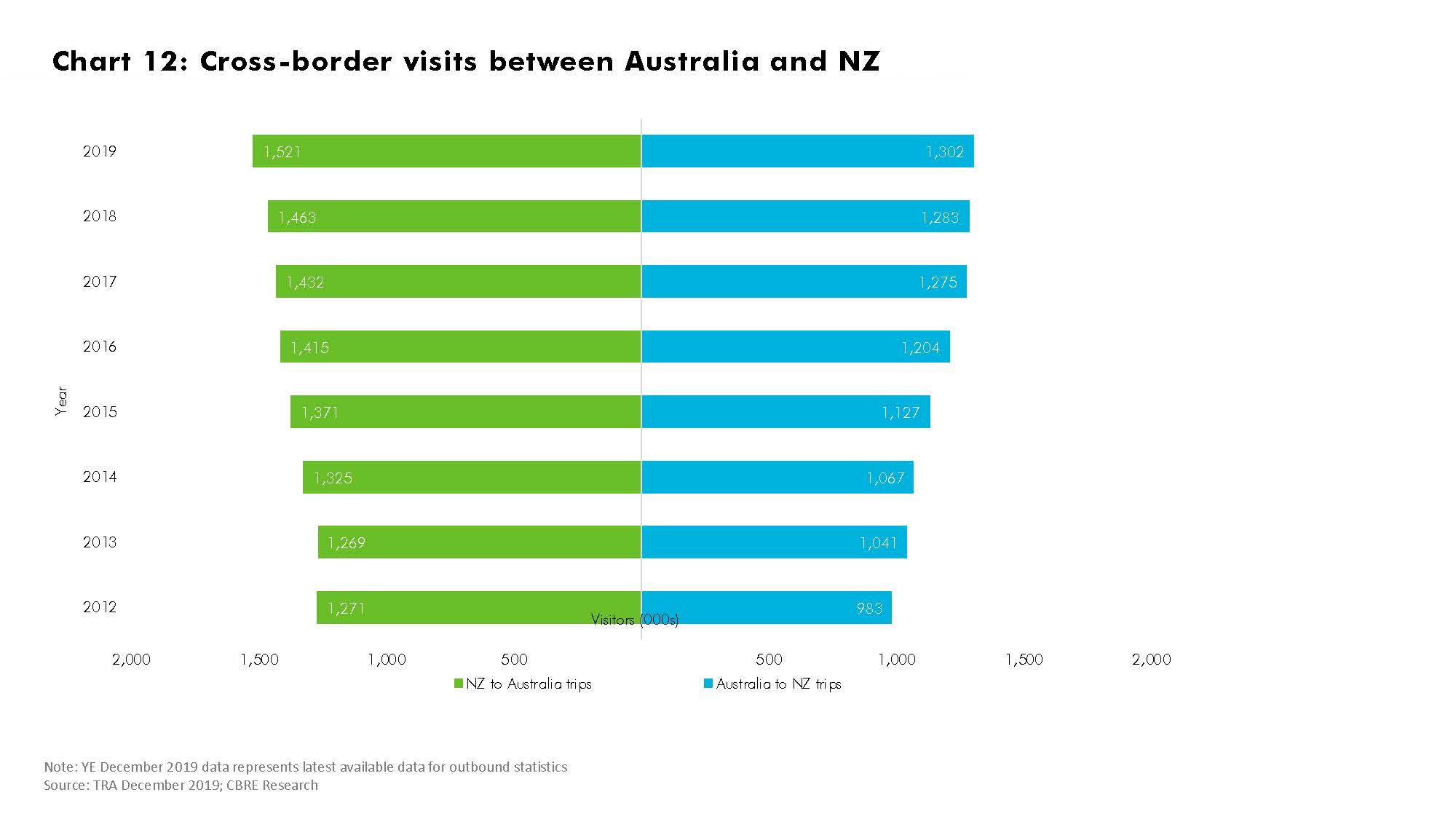

“The eventual reopening of the trans-Tasman travel bubble will be a litmus test for regional travel, as operators will look to protect their domestic demand sources once our borders with New Zealand open.”

Regional tourism markets in both Australia and New Zealand are expected to strongly compete over the 1.3 million cross-border visitors and regional operators will also look to increase their share of the inbound NZ market, with only 25 per cent of NZ travellers stopping over in regional Australia, historically.

Click here to view the full report.

Similar to this:

CBRE release their 2019 hotel market outlook research report

Adelaide hotel market benefitting from corporate growth: CBRE report

Hotel investors still on the lookout amid COVID-19 - CBRE Survey