The humble bed and breakfast produces thousands in a single deduction - BMT

Contact

The humble bed and breakfast produces thousands in a single deduction - BMT

BMT Tax Depreciation have been providing depreciation services to hotel operators for over twenty years, ensuring these businesses maximise their returns.

The traveller accommodation industry is diverse. Providers include multi-story hotels, luxury resorts, holiday parks, motor lodges and new-kid-on-the-block Airbnb. It’s easy to forget the humble bed and breakfast among all these players, yet this sector of the industry makes up $80 million of the market, with approximately 800 bed and breakfasts across the country.

The common bed and breakfast set up

The ‘average’ bed and breakfast set up holds between six and eleven rooms, with hosts usually living on the property. Not only does the size make them different to hotels, but the guest experience is also a unique factor.

A bed and breakfast establishment is classed as a business even though the hosts usually remain on the property.

How much money can be made from a bed and breakfast?

This really depends on the size, location and the running expenses of the bed and breakfast.

Size and location will determine what can be charged per room. The expenses will be individual to the operator’s situation, but there is one tax deduction they can claim that can make a huge difference to cash flow – depreciation.

Claiming depreciation for bed and breakfast establishments

Depreciation is the natural wear and tear of a property and its assets over time. Owners of income-producing properties and businesses can claim depreciation as a tax deduction each financial year. It’s a non-cash deduction, so no money needs to be spent to claim it.

Depreciation can be claimed on a bed and breakfast property’s structural elements such as walls, doors, roofing and foundations. Depreciation can also be claimed on assets like room furnishings, bathroom accessories, kitchen appliances and hot water systems.

It gets more complex when the host also lives at the property. Only the portion of the property that is used for ‘business operations’ can be depreciated. For example, if the host lives in a separate house at the same address, depreciation can’t be claimed on the house since it’s solely used for private use. But if an office is also part of the home, they can claim depreciation on this area.

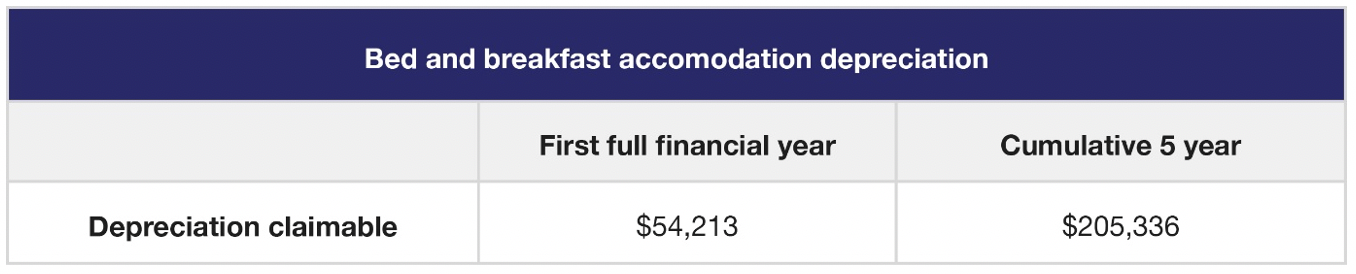

Despite the complexities, depreciation can still be lucrative. The below demonstrates the deductions a 6-room bed and breakfast can generate in just the first five years alone.

Bed and breakfast operators can claim the maximum amount of depreciation on their establishment with a comprehensive tax depreciation schedule.

A BMT Tax Depreciation Schedule lasts the lifetime of the property and can be easily updated if any renovations are made.

When the schedule is being prepared, a specialist BMT site inspector will attend the property. This allows them to identify all depreciable assets and structure, while separating the operators ‘private use’ assets and space. This important step not only ensures that claims are maximised, but it also guarantees that claims are 100 per cent Australian Taxation Office compliant.

To learn more about depreciation and how it can be claimed on all types of traveller accommodation properties, contact BMT on 1300 728 726 or Request a Quote.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

This is a sponsored feature article.

More from BMT:

Frequently asked hotel depreciation questions answered - BMT

The must-know commercial depreciation basics for hotel owners - BMT

BMT shares how hotel operators can get the most out of their renovation spend