HTL Research Report: NSW Pub Market - The Road Post Lockdown

Contact

HTL Research Report: NSW Pub Market - The Road Post Lockdown

As the New South Wales vaccination rates progressively rise, the population is looking towards the end of the lockdown period and anticipated ‘freedom’ by mid-October, 2021.

As the New South Wales vaccination rates progressively rise, the population is looking towards the end of the lockdown period and anticipated ‘freedom’ by mid-October, 2021.

This current lockdown period, which commenced on 26 June, has maintained businesses in a suspended state of uncertainty; comprising work from home mandates, the forced closure of retailers and a halt to trade for many operators including in the pub sector.

When these restrictions ultimately lift in a few week’s time, there will still be ongoing regulations governing patron capacity numbers by virtue of social distancing orders; however it is only anticipated that these restrictions enjoy validity for weeks and not months.

Yet despite the months of closures, the inimitable appetite for investors seeking entry points into the pub sector has meant we have seen remarkable growth in sales activity during this particular lockdown period; materially outstripping results seen during and post the 2020 lockdown equivalent. This strong level of activity patently highlights the confidence in the sector, as well as the consequent and widely anticipated demand going forward; making pub investments an attractive investment choice.

So whilst the volume of transactions continues to augment rapidly, the geographical profile of sales concluded has experienced differentiation. The increase in transactions has been amplified in NSW since March 2021, and during this time we have witnessed a significant increase in Regional activity; notably in the sub $10m price point.

Historically, demand for Regional assets has not been at the same level as that of its Metropolitan counterpart; however a definitive trend has emerged, propelled by experienced pub investors highlighting the long-term confidence in our Regional markets.

The lower price point at a circa $10m mean, serves to avail itself to new and emerging players; and which has placed further downward pressure on already contracted yields.

As an active participant, HTL Property has closely monitored NSW pub sales throughout the full period of the pandemic. During the onset of CV-19, most property markets found themselves in an opaque state of uncertainty, and this challenged sentiment saw the majority of both buyers and sellers adopt a ‘wait and see’ holding pattern type attitude. The net result being a significant decline in sales activity, and the traditional pub market was no different. However moving into 2021, we have seen substantial shifts in the levels of market confidence, spearheading a robust increase in both demand and transactional activity.

“At October’s impending completion of the current travel restrictions, the traditional hotel market will be enlivened by a volume of transactional activity greater than that at any other chronological juncture” commented Andrew Jolliffe, HTL Property Managing Director.

“The past month has some seen some shape-shifting events played out upon the national landscape, with the proposed and talismanic delisting of both Redcape Hotel Group (ASX:RDC) and ALE Property Group (ASX:LEP) involving $3bn worth of pub assets” added Andrew Jolliffe.

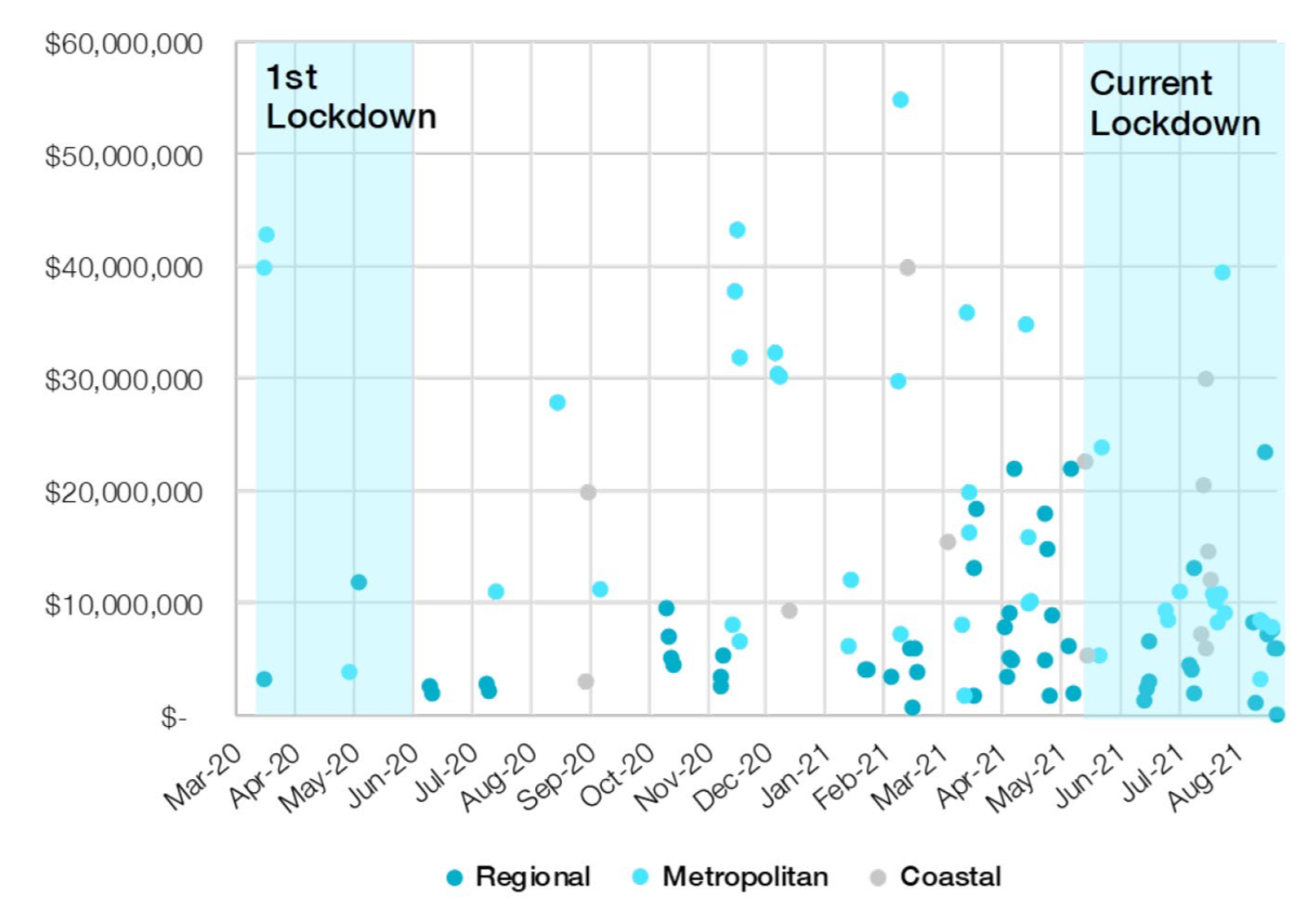

NSW Pub Transactions By location & lockdown

HTL Property’s recent analysis has highlighted that during the first lockdown there existed very few transactions recorded, with high value Metropolitan assets dominating the landscape. Even post lockdown and with restrictions easing from 1 June 2020, we saw very few sales occur; albeit a growth in the Regional sector at a lower price point ensued. By the end of 2020 we saw confidence return with transactional activity demonstrably improving; albeit again dominated by the circa $10m price point represented by Regional transactions. Whilst larger Metropolitan transactions continued to take place.

As we entered 2021, the post lockdown world revelled in an environment where trade was up, many businesses had returned to work, employment rates looked favorable; and commercial sales activity across the country had rebounded in earnest. For the Traditonal Pub market, this was no different; and the weight of funds orbiting the marketplace were enabled by both first and second tier lenders, making investment in the asset class more accessible than ever before. In early 2021 we posted record levels of sales transactions, with the first six months of the year recording $596.5million across 49 unique transactions. In fact, this continuing momentum has not been stifled by the lockdown announced on 26 June 2021; and remains allergic to inertia despite the current cessation of trade continuing through to the current period. On the contrary, transaction levels have exceeded all expectations.

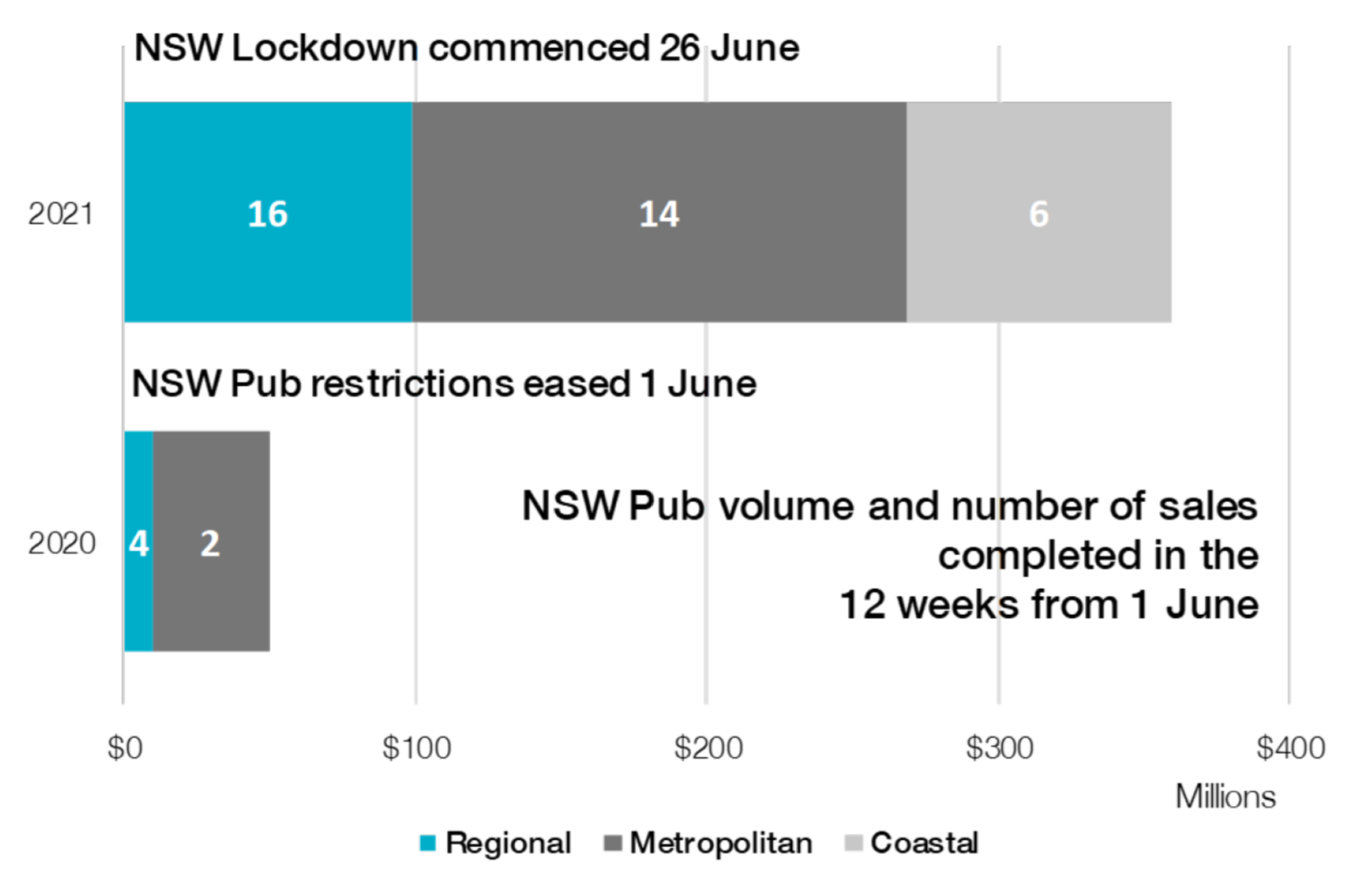

NSW Pub Transactions Lockdown 1 v Lockdown 2

When considering the 12-week period immediately following the lifting of restrictions for the Pub sector in 2020 (1 June), we saw some lingering hesitation remain in the marketplace. During this period, only six transactions took place totaling $49.4million. While only accounting for 20.55% of these sales, this included four Regional assets with an average sale price of $2.54million. Despite the community coming out of lockdown and pubs being able to trade, uncertainty remained high and sentiment appeared low; with the impacts of the pandemic on the broader economy still largely unknown, and as such we observed reluctance to transact. However, traversing through the latter months of 2020, this trepidation soon dissipated, with many larger trophy assets coming to market and transacting while experienced pub groups actively pursued these and other opportunities in new markets.

By the commencement of lockdown 2.0, transactional activity for NSW pubs was peaking, with the threat of lockdown prior and the subsequent closure being no deterrent to its continuation. Considering the 12-week period during Sydney’s lockdown from 26 June 2021, we have recorded $359.3million in pub sales across 36 transactions. Of note has been the perseverance of strong activity within Regional locations, representing 16 of these sales and with an average sale price of $6.16million; which illustrates the long-term confidence for this growing segment of the market.

We now see vaccination rates in NSW growing towards the magical 70% and 80% rate, and the community is more than ready to re-emerge from lockdown 2.0.

International travel is back on the table, as well as haircuts and drinks at your local pub; however some restrictions will remain in place impacting trade and income but only in the short term. For the pub investment market, we don’t expect to see a major change to the positive cadence following the cessation of the lockdown; as the continued vibrant activity is anticipated to remain through to the end of the year and well beyond.

The major catalyst for this prosperous trading environment being a combination of long term confidence in the sector, coupled with the accessibility and price efficiency with regard debt financing investments in the current environment. With interest rates remaining low for the foreseeable future and the weight of funds already in and on the periphery of the marketplace looking to be invested high; the pub sector will continue to flourish.

International travel is expected to recommence around Christmas, however we think that this is unlikely to dampen the improvements seen over the past 18 months in Regional tourism; with many Australians continuing to opt for drive holidays in the medium term.

Couple this factor with population movements also heavily skewed towards tree and sea changers; as many businesses continue to offer remote working opportunities for their staff. Accordingly, this only serves to further enhance the patent attractiveness of Regional pub assets for both new buyers looking to enter at a lower price point; and those experienced hoteliers looking to expand their portfolios.

Quality assets in both Metropolitan and Coastal locations will also remain in heightened demand, with increased competition compressing yields to benchmark lows in the short to medium term.

“More often that not traditional pubs are high street positioned, alternative use optioned, corner site domiciled cash flow generators of inimitable fashion; and the weight of capital within the sector let alone on the periphery looking to place a bet, is both plentiful and capable” commented Dan Dragicevich, HTL Property National Director.