Hotel sector bounce back to continue into 2022 - Colliers

Contact

Hotel sector bounce back to continue into 2022 - Colliers

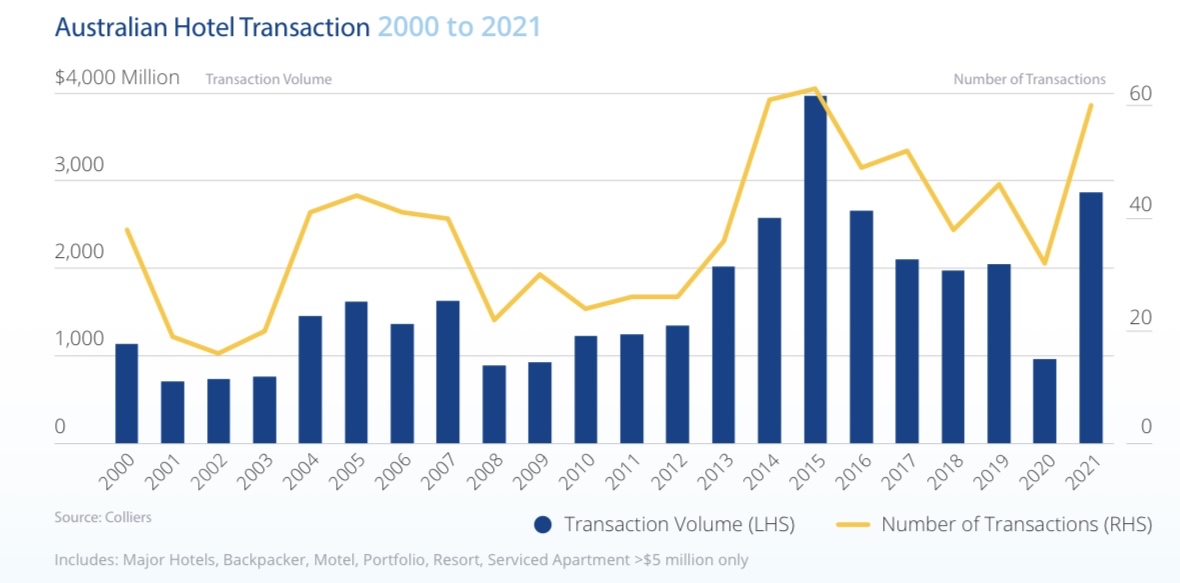

With more than $2.8 billion worth of assets sold in 2021, it was the second strongest year on record.

Strong investor confidence in the hotel industry looks set to continue into 2022, as transaction volumes in 2021 finished well above the long-term average despite the disruption of lockdowns and border closures.

Data from the Colliers 2022 Hotels Investment Review shows Australia’s hotel market kicked up a gear in 2021 with $2.87 billion worth of assets traded across 60 deals, representing over 7,000 rooms and a 197.5 per cent increase on 2020. This was well above the long-term average of $1.6 billion and was the second highest year on record in terms of total volumes sold.

The year saw a resurgence in cross-border business and consumer confidence as a result of increased vaccination rates, with corporates and investors transitioning to a ‘living with COVID’ mindset, despite the challenges of Omicron.

“Australia’s investment market is expected to ramp up in 2022 with high vaccination rates and an end to extended lockdowns and border closures, underpinned by an availability of stock past the development phase and a weight of capital looking to invest for the right opportunities,” Colliers Head of Hotels Gus Moors said.

“The opportunity to invest in previously tightly held key capitals is also expected to garner significant interest as the sector recovers and Australians start to explore again.”

Excluding those hotels which were bought for conversion, the average price per transaction reflected a 99.5 per cent increase on 2020 at $325,000 per room and is further testament to the increased investor confidence in the Australian hotel sector.

In a marked shift from the past decade, investment capital was predominantly domestic, accounting for 55.8 per cent of total transaction volume. Offshore capital, where prevalent, was able to channel through domestic funds management groups as they look to satisfy the heightened appetite of cashed up global capital partners with a growing tilt towards the Asia Pacific region.

It is expected that while the emergence of Omicron has dented performance in the first quarter of the year, confidence and hotel bookings should trend upwards as high vaccinaction rates and the roll out of boosters underpins the market in the second half of the 2022.

Domestic tourism should return to positive figures in the third quarter of 2022, with investors expecting a return to overall growth in 2023 with sentiment weighted 29.5 per cent in favour of positive trading by comparison to quarter four in 2019.

“We expect a similar level of deal flow in 2022 as seen in 2021. The emergence of the Omicron variant will just bring forward case numbers and drive increased triple vaccination levels, so while there is short term pain expected in Q1, it should help confidence to build in Q2 and beyond,” National Director of Hotels Karen Wales said.

“A tsunami of pent-up demand for corporate and leisure travel has the potential to drive above average near term returns before growth normalises to the levels which were evident pre-pandemic, but with a greater proportion of global travel pushed to perceived ‘safe’ destinations like Australia.”

Deal flow was diverse with eight transactions above $100 million, together totalling $1.77 billion, and with a depth of smaller deals. Regional Australia and development deals both played a prominent role each accounting for more than half-a-billion dollars’ worth of trades.