Stay Home No More: A breakthrough for Singapore’s Hotels

Contact

Stay Home No More: A breakthrough for Singapore’s Hotels

By Julien Naouri, Vice President, Investment Sales, JLL Hotels & Hospitality Group, Asia.

A shift is occurring in Singapore. The hotel landscape in Singapore is facing imminent change that resembles what was previously considered normality. In simplest terms, the COVID-19 pandemic upended the industry but didn’t decimate it. There are several reasons that the Singapore hotel industry we knew will exist once more and why industry distress is now being written off as speculation.

Hotels in Singapore have managed to stay afloat over the past two years despite the collapse of international visitor arrivals. Why is this? Simply put, due to the generous support from the government via buyout contracts for hotels to serve as various types of quarantine facilities, the industry has avoided the hardships found in many other markets. In July 2020 at the peak of Singapore’s battle with Covid-19, Singapore Tourism Board chief executive Keith Tan told the media that more than half of Singapore’s hotel room inventory was being used as isolation facilities . This is significant but was never banked on as the long-term solution for an ailing industry.

Let’s fast forward almost two years. As Singapore emerges from the pandemic and the government adopts an endemic stance towards Covid-19, government contracts have tapered off. For example, in its 2021 full-year results, Far East Hospitality Trust revealed that only 3 out of its 9 hotels were still under government contracts, a decline from 6 out of 9 hotels in the previous quarter. While the decline in government contracts represents green shoots in the recovery of the tourism industry, in the near to mid-term, traditional sources of demand are unlikely to return to pre-pandemic levels as various organizations such as the Singapore Tourism Board and the UN World Tourism Organization have only forecasted a full recovery as early as 2024 .

Asset enhancements to refresh and reposition

As hotels emerge from government contracts, owners have realized that a certain amount of capital expenditure is required to bring the hotels back up to standard to welcome traditional guests or even to reposition their product to capture new demand. Guest’s expectations in terms of safety and hygiene have certainly changed over the past two years, and only those hotels that will meet certain local and international standards will be able to tap on the recovery of business travel and corporate contracts for the next 6 months. The Hilton Singapore Orchard reopened in Q1 2022 after a S$150 million renovation , which was aimed at improving the hotel’s ability to cater to more MICE events and to enhance its competitive positioning. Not to be outdone, the Grand Hyatt Singapore announced a 2-year renovation in late-2021, which seeks to put wellness at the core of its new design.

Sellers were not shortchanged during the pandemic

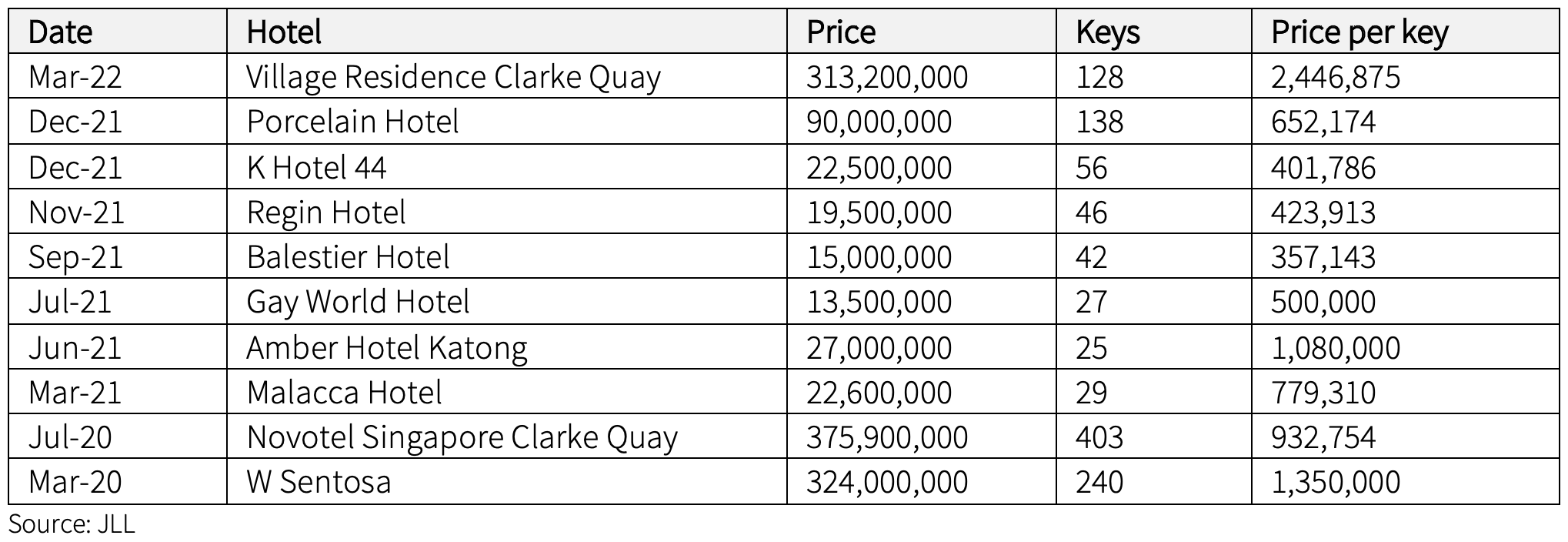

Hotel owners shying away from the financial commitments of a major repositioning have found land-hungry developers and investors seeking to ride the boom in the rental market ready buyers. In December 2021, Far East Hospitality Trust announced the sale of Village Residence Clarke Quay for S$313.2 million to City Developments Limited; the sale price represented a 57.9% premium to its last annual valuation in December 2020. City Developments Limited executed the acquisition with a view to redevelop the property into a mixed-use development.

Given the current profile of guests who stay longer in Singapore rather than just a short trip, the resilience of serviced apartments during the pandemic and the cloudy near-term outlook of the short-stay market has led to several hotels pivoting to targeting long-stay guests in a bid to improve cashflow visibility. In September 2021, Balestier Hotel was sold to a joint venture of LHN Group and Four Star for conversion into a co-living space under LHN Group’s Coliwoo brand.

Dry powder ready for deployment

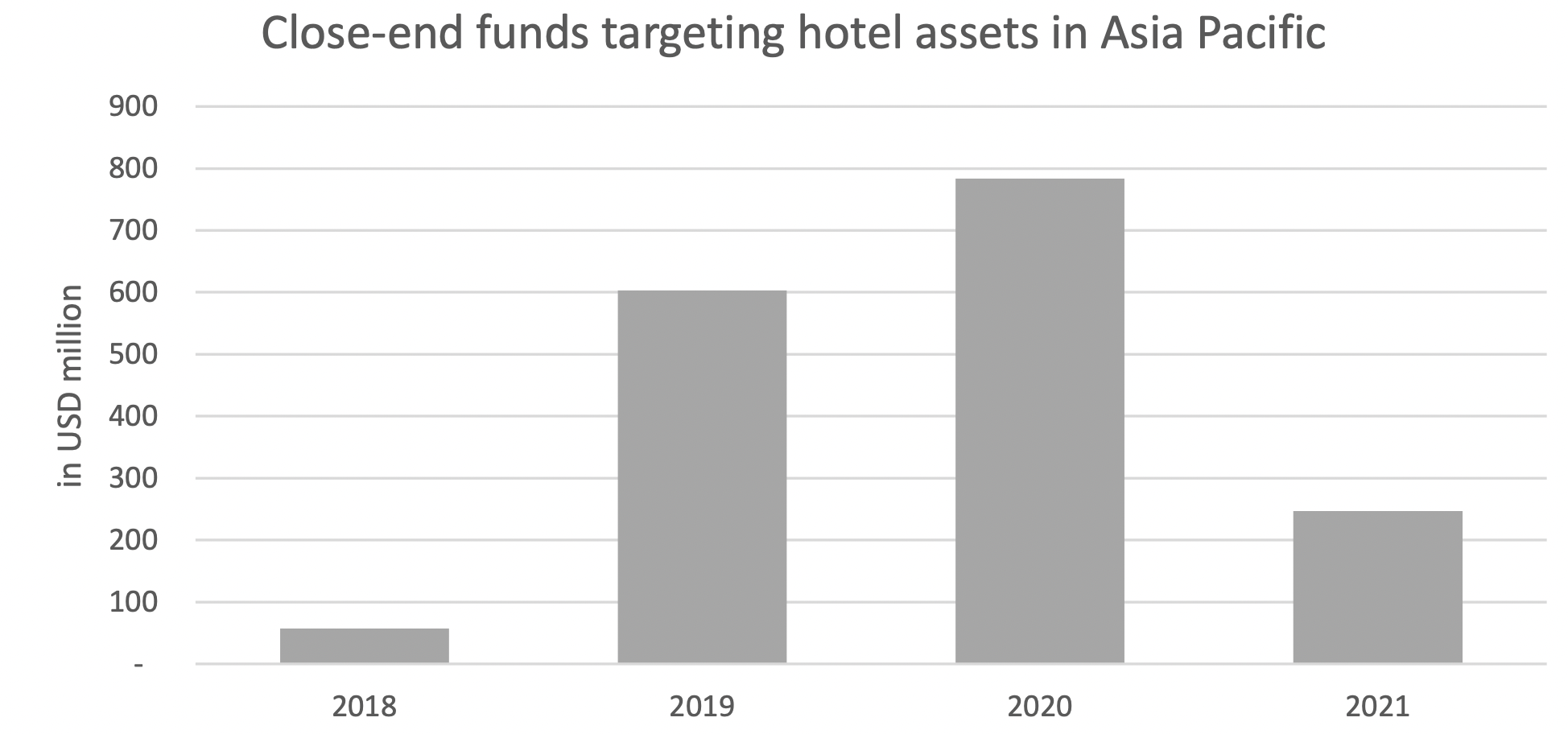

Whilst hotel operations have been pummeled by the pandemic, investors remain keen to deploy capital into hospitality assets. Closed-end funds targeting hotel assets in Asia-Pacific have raised US$1.63 billion over 2019-2021, far exceeding hotel transactions completed in Singapore over the same period. Hotel owners looking at options can take comfort that hospitality assets in Singapore remain attractive to undeployed capital due to its robust regulatory environment and strong government support. Despite the near-term challenges of Covid-19, the Singapore Tourism Board continued to commit to the rejuvenation of Singapore’s tourism infrastructure with projects such as the expansion of the Integrated Resorts and new tourist attractions. The positive outlook in the tourism and hotel sectors should raise even more interest from foreign and domestic buyers eager to invest in safe-haven places like Singapore. As such, we expect hotel investment volume in the city-state to reach SGD 270 million (USD 200 million) for the full year 2022.

Graph 1: Close-end funds targeting hotel assets in Asia Pacific

Note: Pertains to closed-end funds raised in Asia Pacific which invest in hotels

Source: Preqin

Hotel owners are not short of options

Are we going to start seeing distress assets hit the Singapore market?

Based on annual valuations of Singapore portfolios of listed hospitality real estate investment trusts (“REITs”), hotel valuations have held steady with declines of less than 10% despite significantly larger declines in underlying cashflows. With continued yield compression and the lack of cashflow visibility from an uncertain recovery at the forefront, hotel owners with the means have sought to undertake asset enhancement works, others have decided that a sale was a more palatable option. Some more motivated sellers in Singapore may emerge after all, but that remains to be seen.

Table 1: Latest hotel transactions

https://www.straitstimes.com/singapore/more-than-half-of-singapores-hote...

https://www.hindustantimes.com/lifestyle/travel/world-tourism-won-t-retu...

https://www.todayonline.com/8days/theres-new-hotel-town-familiar-spot-an...

https://cnaluxury.channelnewsasia.com/experiences/grand-hyatt-singapore-...

https://www.edgeprop.sg/property-news/balestier-hotel-sold-15-mil