Depreciation deductions: owners vs tenants

Contact

Depreciation deductions: owners vs tenants

Navigating commercial property depreciation can be complex, BMT Tax Depreciation outlines what owners and tenants of hotels can claim.

Navigating commercial property depreciation can be complex even for experienced investors, therefore BMT Tax Depreciation has outlined what owners and tenants of hotels can claim.

First, what does depreciation look like in a hotel?

The Australian Taxation Office (ATO) defines traveller accommodation as construction where the building is intended to be used on completion to provide short term accommodation to travellers, such as:

- Apartment buildings in which at least ten apartments, units or flats are owned or leased

- Guest Houses with at least ten bedrooms

- Hotels

- Motels

Depreciation is the natural wear and tear of a property and the assets within it over time. Capital works deductions (Division 43) are claimable on the building’s structure and assets permanently fixed to the property. Plant and equipment depreciation (Division 40) is claimable on the easily removable or mechanical assets. Hotels generally qualify for capital works deductions if construction started after 21 August 1979.

Hotels hold thousands, and sometimes millions, of dollars in depreciation deductions annually. Regardless of size or age most commercial properties will have depreciation deductions available, but this is particularly the case in hotels as they’re frequently renovated and fit-outs upgraded

Examples of common capital works items in hotels include windows, bricks and mortar, driveways, staircases and roofs.

Some examples of plant and equipment assets commonly found in hotels include air conditioners, carpets, furniture, bedding, ceiling fans, televisions, crockery and cutlery, safes, hot water systems, kitchen appliances, tennis court nets, swimming pool accessories, spa bath pumps, fire extinguishers, and many more.

Depending on how the ownership and tenancy agreements are structured, some or all of the above assets could be owned by the hotel business, or they could be the property of the building owner.

What deductions can commercial property owners claim?

Owners can claim depreciation for the building’s structure and any assets they own within the property. Assets left behind by a previous tenant may be available to be claimed by the property owner for the remaining un-deducted value.

Owners will often renovate their commercial properties for a variety of reasons such as to secure a new lease, increase rental payments, increase tenant appeal and to increase overall capital growth. Renovations result in further depreciation tax deductions.

Click here to find out more about the deductions available to commercial property owners.

What deductions can commercial tenants claim?

Tenants of commercial properties can claim deductions for assets they purchase and install during a fit-out. Within a hotel these items might include beds, furniture, linen, and crockery.

Depending on lease conditions, a tenant may be required to remove assets prior to vacating. In this instance, scrapping may be applied in which the tenant can claim any remaining depreciable value.

Click here to find out more about the deductions available to commercial property tenants.

Capital works depreciation rates for commercial properties

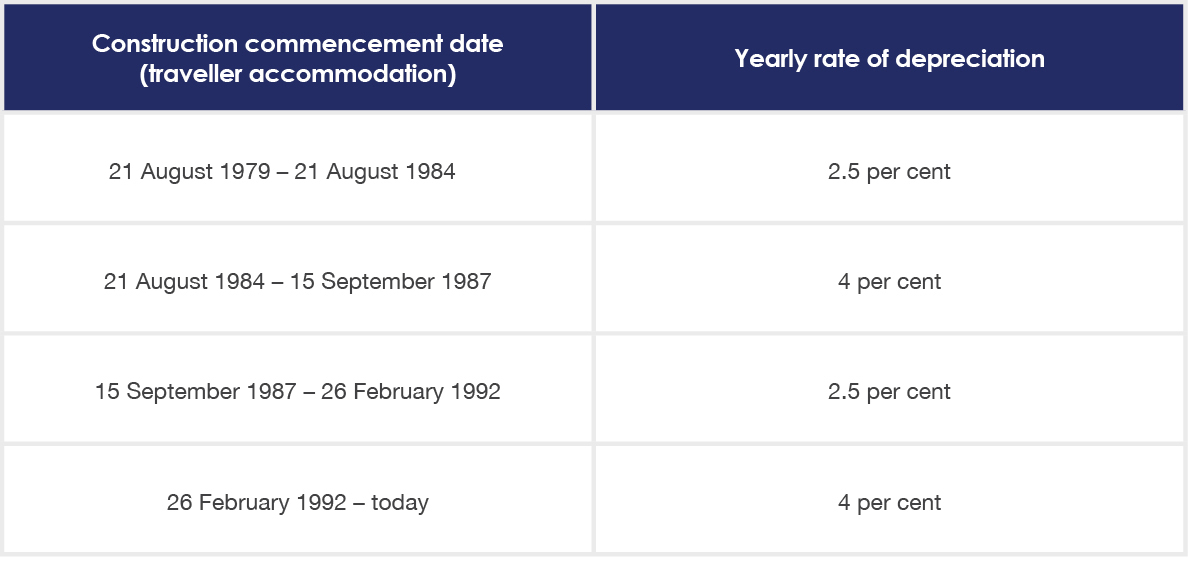

Capital works in commercial properties can be claimed at a rate of either 2.5 per cent or 4 per cent per year depending on the construction commencement date and the type of commercial building.

The table below demonstrates at which rate capital works in traveller accommodation is depreciated.

It’s important to note that capital works deductions begin on the construction completion date and not all commercial buildings are depreciated at the same rate.

The depreciation rate of plant and equipment assets on the other hand is more complex. Assets are depreciated based on their effective life set by the Tax Commissioner. The same asset can often have a different effective life in different industries or even for different purposes within the same industry.

For instance, carpet in hotels have an effective life of seven years whereas carpet in sports and physical recreation venues have an effective life of four years. This is because each industry has a different type and degree of use.

The effective life and depreciation rates for commercial and residential assets can be found on BMT Tax Depreciation’s Rate Finder tool.

Why is claiming depreciation important?

Whether you’re an owner or tenant it’s important to know which depreciation deductions you’re entitled to. Claiming depreciation reduces tax liabilities and boosts cash flow, and with improved cash flow comes more opportunity to complete renovations, upgrades and expand businesses and property portfolios.

A BMT Tax Depreciation Schedule outlines every available depreciation deduction, making it essential for maximising cash flow.

To learn more about the deductions within commercial properties for owners and tenants contact BMT on 1300 728 726 or Request a Quote.

The information provided in this article is of general use only and should not be used as a quote or advice. BMT recommend consulting an accountant before making financial decisions. Contact BMT for a specialised tax depreciation schedule.