Typical deductions in a hotel room - BMT

Contact

Typical deductions in a hotel room - BMT

BMT Tax Depreciation explores how assets are depreciated and how common hotel room items can yield significant deductions.

Hotels are brimming with assets available for depreciation deductions. Lounges in foyers, carpets in elevators and glassware in guest rooms are all qualify for deductions.

The assets in one room alone can generate thousands of dollars in deductions for their owners each year.

BMT Tax Depreciation explores how assets are depreciated and how common hotel room items can yield significant deductions.

What is property depreciation?

Depreciation is a tax deduction available for the wear and tear of an income-producing property over time. Depreciation is claimed under two categories. Capital works (Division 43) deductions are claimable for the structural component and assets permanently fixed to the property, and plant and equipment (Division 40) depreciation is claimable on the easily removable or mechanical assets.

Owners and tenants of commercial properties can claim depreciation deductions:

- Commercial property owners are eligible to claim the assets they own or paid for, typically the base plus fixed assets.

- Commercial tenants are eligible to claim the assets they own and paid for, typically the loose fit out.

- Commercial operators who own the property as well as occupy it are entitled to claim all available depreciation deductions.

How are plant and equipment assets depreciated?

Unlike capital works deductions which depreciate at a rate of either 2.5 or four per cent per year depending on the construction completion date and industry, plant and equipment assets are depreciated differently.

Each asset has an effective life set by the Australian Taxation Office and is depreciated at a set rate. The same type of asset can have a different effective life based on the industry it’s used in, for instance, the carpet within a retail store doesn’t have the same effective life as carpet in a hotel. This is because the same asset will typically have different intensities of use between industries resulting in a slower or quicker rate of wear and tear. The rate of depreciation is based on the method selected, methods include the diminishing value, prime cost (straight line) method and the low-value pool for assets costing $300 or less.

Both methods will claim the same amount over the life of the property, however, they use different rules to achieve either upfront claims or more consistent claims each year, putting commercial owners and tenants in different short and long-term cash flow positions.

There are government incentives available until the end of the 2022/23 financial year for eligible entities which accelerate depreciation deductions such as the instant asset write-off and temporary full expensing. The loss carry back tax offset is also available which allows eligible entities to carry back losses to earlier years in which there were income tax liabilities.

Case study: typical deductions within a hotel suite

Star Hotel is a luxury hotel with over 250 suite-style rooms in addition to a foyer, fitness centre, pool, outdoor area, parking garage and restaurant and bar.

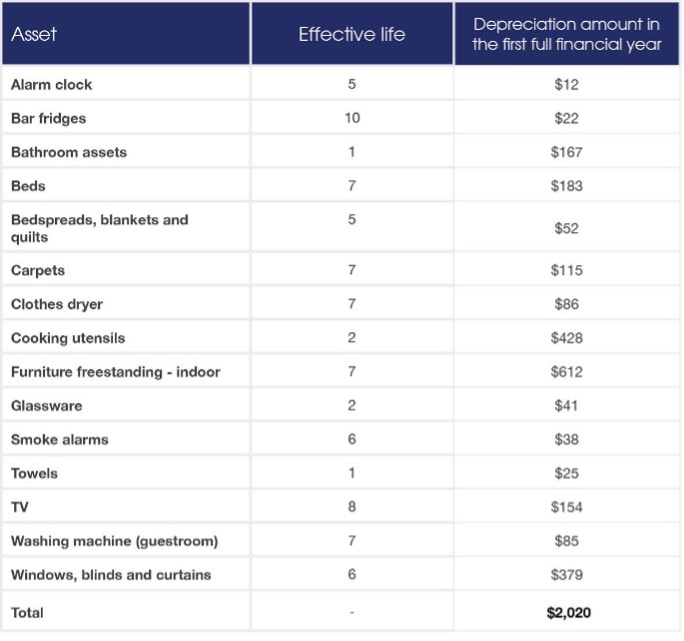

The table below represents some typical assets found within a hotel room, their effective lives and how much they generated in claims in the first full financial year.

In a single suite, the owners claimed $2,020 in the first full financial year for the listed plant and equipment assets.

While $2,020 may not seem like a significant claim on its own, once the remaining assets and capital works deductions are calculated hotel-wide, the total amounts to a lucrative yearly deduction.

An essential step to maximising claims is organising a site inspection through a specialised quantity surveyor. Site inspections are necessary for identifying all available deductions and ensuring claims are accurate.

BMT Tax Depreciation conduct site inspections so clients can claim maximised deductions while maintaining full ATO compliance. A BMT report also takes all business incentives into account and applies them to qualifying assets when applicable.

To learn more about depreciation in your hotel or commercial property call BMT on 1300 728 726 or Request a Quote.

Disclaimer: The example used within this article is based on a specific business entity, location and size. This information is not to be used as a quote.