Axsia HTL Case Study: How a collaborative approach can lead to improved market positioning and financial benefits

Contact

Axsia HTL Case Study: How a collaborative approach can lead to improved market positioning and financial benefits

This case study by Axsia HTL demonstrates how success can be achieved when owners, brands (HMCs) and employees collaborate with a strong strategic asset management team.

This case study demonstrates how success can be achieved when owners, brands (HMCs) and employees collaborate with a strong strategic asset management team. Results are successfully driven which lead to financial benefits for the owner, increased fees, and brand recognition for the brand (HMC) and enormous pride and sense of achievement for employees. Employee satisfaction translates to greater guest engagement which translates to improved market positioning and subsequently financial benefits to all.

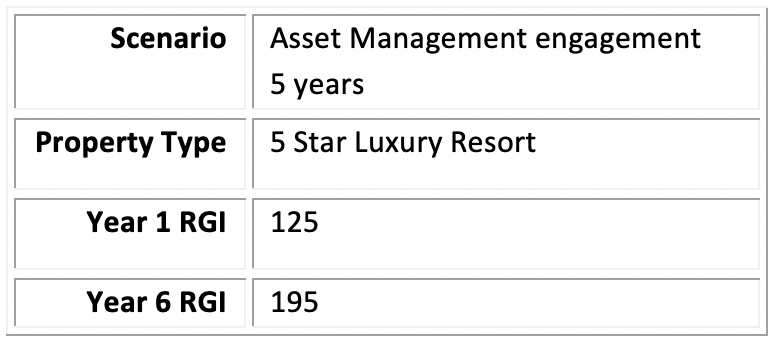

AXSIA HTL has been engaged as the Asset Manager for a period of 5 years at this particular property, when we saw great opportunity to turbo charge the results for the owners.

COVID-19 severely impacted any growth or strategic improvement in years 3 and 4, as it did the entire tourism and hospitality sector around the country.

However, 5 years ago (2017) the hotel had just completed a near full refurbishment of rooms, public spaces and restaurants and bars. The hotel was managed under contract to a major brand and was being promoted by the owners and the HMC as a successful turnaround following the refurbishment. They boasted that the hotel was achieving a revenue market share index (RGI) of 25% over 100 (a standard benchmark) and had returned to profitable business operation.

Once the refurbishment was nearing a conclusion, AXSIA HTL performed a full review of the hotel and its competitor set of hotels. It became clear that there was a lot more potential to drive performance at the property.

When compared with the competitor set AXSIA HTL estimated the hotel should be trading at a minimum premium of 40%, possibly 50% above natural RGI (100). In achieving this additional premium, added market share profits would also increase.

When undertaking such an extensive refurbishment investment, after years of nothing, it is important to revisit your Vision, Positioning, Target Markets and most importantly correlating service offerings to match the new product. Over years of underinvestment your customer base changes with your declining room rates and declining service offerings and it is important to overhaul this to ensure you are capturing a more premium customer to match the new offerings.

The Management team and HMC had not undertaken these activities and were continuing to drive many of the original strategies prior to renovation and obtain better results by simply marketing a refurbished product, thereby increasing occupancies, and lifting RGI.

AXSIA HTL set out a plan (Vision) to challenge the above. The plan had to be all inclusive and required the owners, HMC and the Management Team to “buy-in”. All three stakeholders needed to be participants in the delivery of the plan.

The plan required:

- The owners provide capital and accept some short-term operating expense adjustments.

- The HMC accepted that some of the current hotel executives were not necessarily capable of the change needed to deliver the plan. And its corporate support could be upgraded.

- The hotel management team had to “really” focus on service standards, guest engagement, luxury operational standards and most importantly new positioning was needed to target a new set of customers and implement strategic marketing to match this.

The plan was implemented prior to COVID-19 and had really started to achieve results in 2019. With market share achieving a 90% (RGI 1.90) premium to market and importantly the EBITDA grew by 26%. This was achieved predominately through a RevPAR increase of 20%, by room rate growth, the most profitable revenue growth opportunity.

The estimated capital growth/valuation for the owner, at a 6.5% cap rate, increased by over $12million in that 3-year period.

Now as we enter 2023, the hotel is achieving a market share premium of 95% (RGI 1.95). Again, by driving RevPAR through average room rates rather than major occupancy gains. As stated above occupancy experienced minor uplift however the demographic of the consumer/guests was elevated and resulted in the room rate uplift.

This premium has resulted in an improvement of EBITDA of 70% or capital value growth, estimated at over $30million. This collaborative approach required the owners to invest another $3million in capital expenditure, the HMC to invest additional time focused on the resort with the management team to develop the positioning and marketing plans to achieve the vision set out, however the value gained well exceeds the investment of all parties.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.